Market Crash in September – History’s Lesson

News

|

Posted 03/09/2021

|

12659

As we sit here now in September, statistically the worst month of the year for shares and coincidentally with sharemarkets at near all time highs, investors should be taking a step back and objectively assessing the situation. Winston Churchill famously paraphrased philosopher George Santayana when he said “Those who fail to learn from history are condemned to repeat it.”

The last time sharemarkets got to such distorted highs was the dot com bubble in 2000. So what does history tell us? Crescat Capital’s latest investor research letter talks to this in their usual insightful terms.

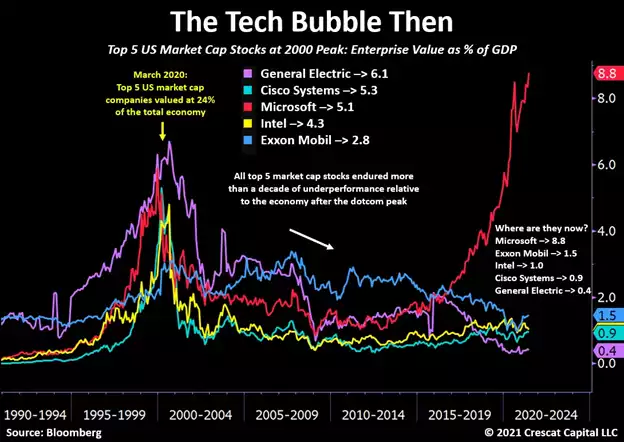

The so called tech bubble actually only had 3 tech companies in the top 5 market cap companies, Microsoft, Cisco and Intel. The other 2 were GE and Exxon Mobile. As you can see from the chart below, only one of these, Microsoft, remains in the top 5 but after it fell 65% and took 16 years to get back to its December 1999 high. One lesson is that companies that have such exponential growth measured against the reality of GDP, usually cannot sustain that indefinitely. Over the two and a half years of the tech bust in 2000-02, the S&P 500 Index declined 49% and the NASDAQ Composite crashed 78%. As a reminder on some basic math, when something falls by 50%, you need to make 100% on what’s left to get back to even…

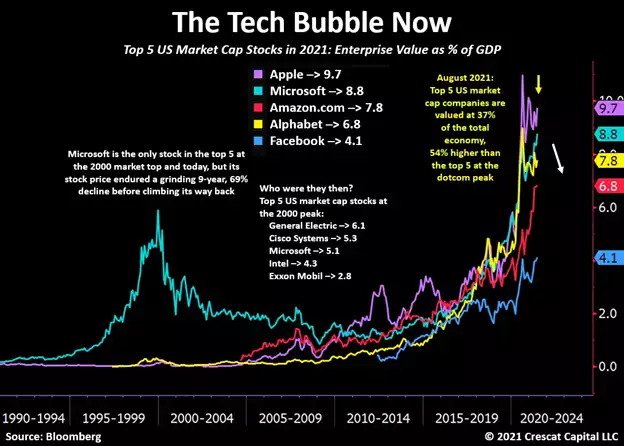

The chart below shows us who make up the top 5 now and how that sits against 2000. As we already know they are the so called FAAMGs of Apple, Microsoft, Amazon, Google, and Facebook. Combined, just 5 companies now account for over a third of the entire US economy, 37% of GDP. For context, that is 54% higher than it was for the top 5 at the 2000 peak!!!

There is a wise saying around not doing as they say, do as they do. Bill Gates resigned as CEO of Microsoft at the very peak in January 2000 and retired the richest man in the world. Just last month, Jeff Bezos retired as CEO of Amazon and is now the richest man in the world….

As Crescat warn:

“Because of the Covid-19 pandemic, in the last year and a half, businesses and individuals were forced to pull forward technology spending and accelerate their move to the cloud to accommodate remote work. The record fiscal and monetary stimulus as a percentage of GDP gave them unprecedented ammo to do so. Naturally, this has unsustainably boosted the revenues, earnings, and free cash flow growth, as well as the profitability, for all five of these already gigantic firms. That is the fundamental problem. The fact that four of these companies are also in the crosshairs of six antitrust bills initiated this year in Congress is yet another eerie parallel to the 2000 era.”

Looking more broadly at the total market, the picture is equally alarming…

“The whole US equity market is insanely overvalued with the total stock market capitalization relative to GDP far into record territory as we show below. Many other broad market valuation measures are also at historic levels. Index investing is also highly popular today offering apparently low volatility and high returns by hopping on the momentum train, but it is high risk and large downside return ahead in our analysis.”

Gradually, we are seeing more and more people realising what is happening. Such statistics as 40% of all the USD ever created being created in the last year are just too big to ignore. Hence too the market’s preoccupation as to whether the Fed will taper or not in the next couple of months.

“For the first time since the 1970s the sense of fiat currency erosion relative to financial assets and consumer prices due to misguided policies has penetrated the mindset of investors in a significant way. Global monetary debasement is now setting the stage for a rude awakening. The inflation genie is out of the bottle and policy makers are unable to sustainably ease off the liquidity pedal. Financial repression has become essential to secure the health of the economy at the current levels of overall debt. Nonetheless, easy and cheap access to capital has also been one of the key reasons for the historical disconnection between asset prices and fundamentals. In fact, the sheer amount of financial assets today that trade at near record multiples is truly concerning. Preventing a collapse in risky assets has become a true policy constraint for monetary authorities. Different than other times in history, the Fed’s ability to allow the cost capital to substantially rise is incredibly limited. Ultimately, policy makers have their hands tied and will be forced to counter deflationary pressures in financial assets with further liquidity. Igniting an inflationary environment is the path of least resistance.

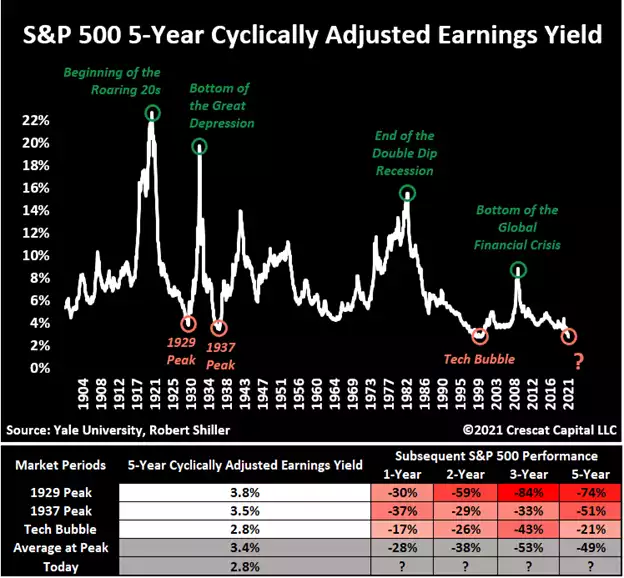

To use the US stock market as an example, the 5-year cyclically adjusted earnings yield is now near all-time lows. In other words, investors are undeservedly paying excessive prices relative to bottom-line fundamentals. Going back over a century of historical data, such depressed earnings’ yields have always led to very significant market meltdowns: the Great Depression, the 1937-8 Recession, and the 2000 Tech Bubble. For every one of these periods, the market unexpectedly reversed from very bullish multi-year trends with an average subsequent 3-year performance of -53%.”

So, apart from the Fed tapering, what could be the catalyst for the impending sell off? Crescat again are pointing to China.

“Among the important exogenous risks to be aware of, it would be China. The recent crackdown by the Chinese Communist Party on domestic companies could easily spill over significant economic deceleration in the rest of the global economy. Asian stocks and the MSCI World index have had a very strong correlation over the years. It amazes us to see the number of folks choosing to ignore these market risks as being independent cases led by the Chinese government. However, what most forget is that the Chinese economy is far from being isolated from the rest of the world. In our view, this major decline in Asian stocks suggests a systemic selloff in global equities ahead.”

We wrote earlier this year of Crescat’s conviction that inflation is not ‘transitory’ as the Fed would have us believe, rather structural. That belief also has them extremely bullish on commodities which normally flourish in higher inflation environments as they outlined here.

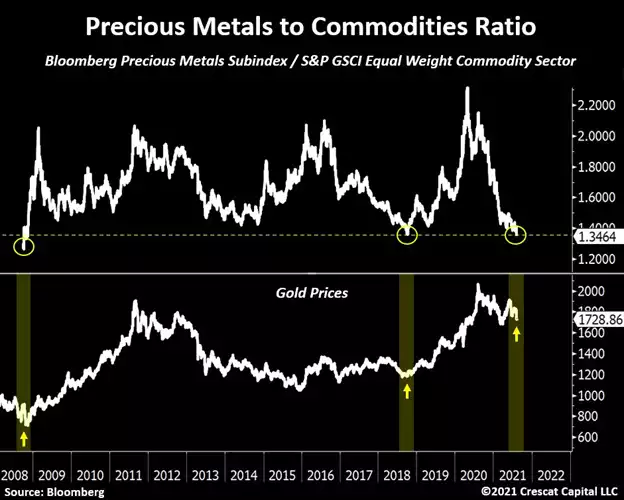

And whilst commodities have had a strong run on the reflation trade since November, we haven’t seen the same performance in precious metals.

“Most commodities have rallied strongly since November 2020 leaving gold and silver behind. However, we not only have an interesting setup for precious metals relative to money supply, but also relative to other resource assets. Gold and silver are now at their cheapest levels relative to other commodities since 2009. This is a very interesting technical, fundamental, and macro setup. Keep in mind that the other two times this ratio reached such depressed levels marked incredible buying opportunities.”

Technically, both gold and silver are looking poised to break out.

“Gold is also forming a very bullish monthly candle after a major reversal”

“The long-term chart of silver continues to look better over time, and we believe it is poised to move much higher in the following months.”

Just to finish off and leave Crescat for a bit. Earlier this week we saw the legendary George Soros warn in the Financial Times of a “Lehman moment” ahead for China. The largest residential property developer in China is Evergrande. Evergrande has over $300 billion (not a typo) of debt and is struggling with plunging revenue and poor longer term demographic trends. This prompted Soros to warn Evergrande "is over-indebted and in danger of default. This could cause a [broader market] crash.". Beijing has also explicitly stated it will not bail them out either. Incredibly overnight even the company itself gave this stark warning to its investors: “The group has risks of defaults on borrowings and cases of litigation outside of its normal course of business…..Shareholders and potential investors are advised to exercise caution when dealing in the securities of the group.”

Bubble meets pin?