The Three Pillars of Inflation

News

|

Posted 27/05/2021

|

9665

A longer one today but an excellent piece from Crescat Capital on what we might expect to see from here in the US which both portends similar outcomes here in Australia but also will directly affect Australia via the effects on the US regardless.

“We strongly believe investors will want to get positioned now for the Great Rotation which is being catalyzed by the three macro drivers of inflation all firing in sync today:

- Demand Pull

- Cost Push

- Monetary Debasement

Let us explain why we think inflation is real and what investors should be doing about it.

The Demand Side

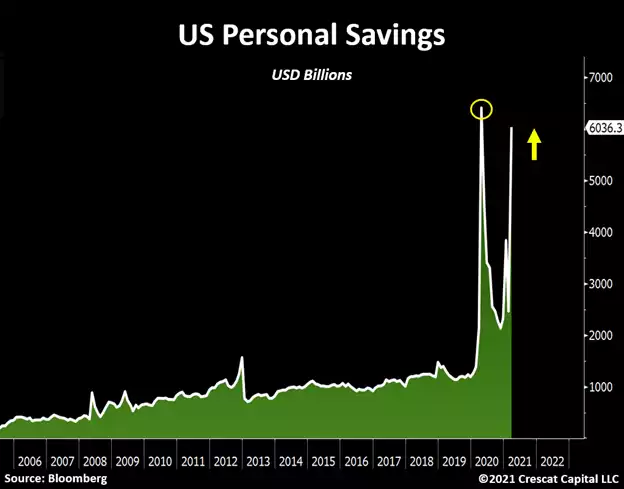

In April 2020, household savings peaked at $6.4 trillion. Subsequently, $3.6 trillion of consumer spending was unleashed over the next twelve months. That is equivalent to 7.5 times the historical average annual spending adjusted for inflation. This is relevant because household savings came out recently, and the number shot up to $6 trillion again. With the economy re-opening, we estimate that consumer spending could surge to as high as $4.5 trillion in the next 12 months.

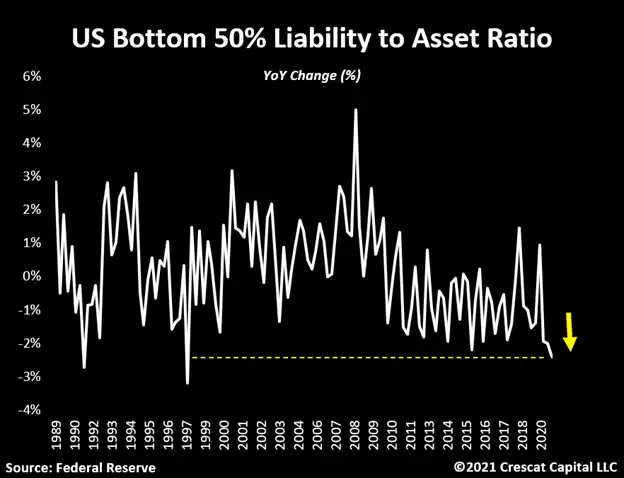

It is also important to consider the fact that the balance sheet of US households, especially those in the bottom 50% of net worth, also looks significantly stronger. The total liability to asset ratio for the lower class is not only in a long-term downward trend, but it is now at its best condition in almost two decades.

Supply Shortages

Additionally, historic amounts of savings are likely to create a wave of consumption that the supply chain is ill-equipped to handle.

Back in December, we wrote about the economic ramifications the US suffered during the Spanish Flu of 1919 and how that period should serve as a roadmap for the current macro environment. As the economy shut down then, industrial capacity was drastically reduced, and with that a major gridlock in the production of raw materials was created, particularly within the natural resources sector of the economy. In a very similar fashion to today, this bottleneck resulted in severe upward pricing pressure in consumer goods. We now believe a second wave of these developments is underway. In our view, the economy is at the early stages of an upsurge in labor-management conflict. As the general supply shortages escalate and consumers start noticing the inflationary burden in their daily expenses, pressure to increase wages is sure to follow.

To provide some context, we experienced this problem across all industries of the economy during the Spanish Flu. Back then, workers revolted against their employers by demanding materially higher wages and salaries. In fact, one out of five people in the US labor force was engaged in a strike. We believe a similar trend is brewing in the US today. Large restaurant chains such as McDonalds and Chipotle are already experiencing pressure from employees to increase pay and provide more appropriate work conditions. We think it is a matter of time until further protests emerge in other parts of the economy. However, another important factor today that is significantly more inflationary than in Spanish Flu times, is that government policies are magnifying the labor shortage problem by discouraging folks to return the labor force. See below some shocking comments from executives as part of the Fed manufacturing report:

“Our human resources department reports that even at a starting pay for non-skilled-level workers of $14 per hour, we cannot fill our 20-plus open positions. People don’t want to go to work when they can stay home and collect $400 or more per week in unemployment.”

“Government stimulus money given to individuals has drastically reduced the number of people seeking a job and reduced the incentive to show up and do their job. Labor is becoming a real problem as a direct result of the handouts.”

“We need to hire people, but it’s difficult when people are making $15 per hour to stay at home on unemployment.”

Today’s Inflation is Not Likely Transitory

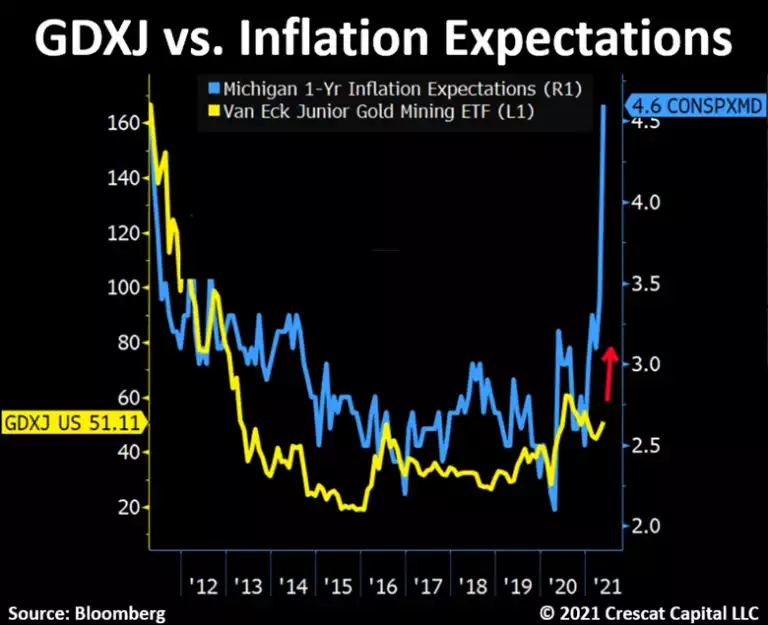

Amid such a macro puzzle one thing is clear, inflation is progressively turning into the prevailing narrative among people. The acuity of the natural resource supply and labor shortage problem is not only leading to higher consumer prices, but it is also creating a reflexivity dynamic that feeds a longer-lasting inflationary story. The idea here is that inflation is no longer transitory when expectations for rising prices become imbedded in consumer and business spending and investment decisions. Such was the wage-price spiral that defined the 1970s macro landscape in the US and is likely to be a main feature of the current decade. Like then, it should be a great decade to own the world’s premier exploration-focused gold and silver mining stocks.

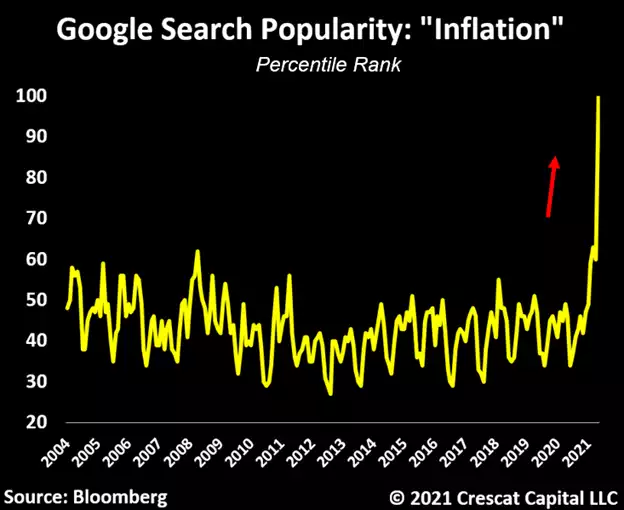

Interestingly, the number of companies that mentioned the word “inflation” on earnings calls is now growing at a pace that we never experienced before. The same is happening with Google trends, see below. Long-term inflationary cycles are often initiated by a general concern of the population in holding cash.

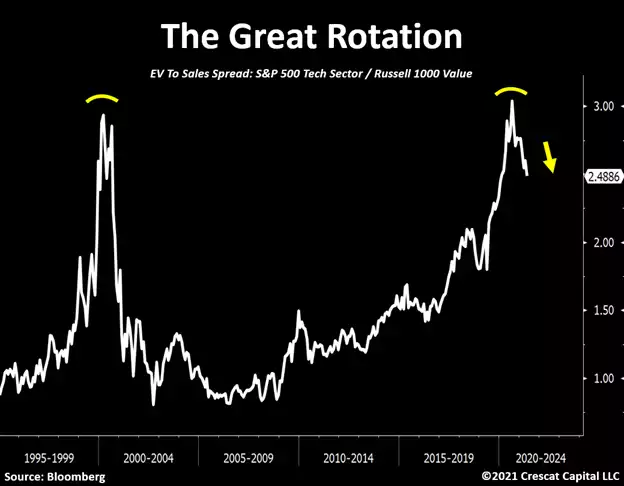

The Great Rotation

Until now, annual increases in wages and salaries had been in a downward trend for 40 years. Over that same time frame, the corporate cost of capital has declined. This macro landscape encouraged companies to favor growth over profitability. More recently, the post GFC years of ongoing accommodative monetary policies have enabled the largest number of money-losing businesses in history. As a byproduct, traditional value-investing principles have become highly out of favor while growth and index style investing have pre-dominated.

But now, with inflationary forces in a new full swing, we believe a major trend reversal is upon us. Analogous to noticeable macro cycles throughout history, the effectiveness of equity fundamental factors also changes over time. We believe near-term growth, profitability, and valuation factors will become priorities again as part of the security selection process. We also believe forward thinking analysts will start applying higher discount rates to incorporate rising inflation, if not yet interest rate risk, into the calculation of the present value of longer-term expected cash flows in their DCF models.

This development has already started to take place. We have been calling it “The Great Rotation”. Our premise continues to hold that capital will flow out of expensive long-duration growth equities and fixed income securities and into a narrow group of tangible commodities in scarce supply and high demand as well as low valuation natural resource stocks that offer high cyclical near-term growth prospects, strong profit visibility, and inflation hedging properties. At historically high broad market valuations for equities, we see downside risk for unprofitable companies with high debt and low pricing power in the current macro environment.

We also see macro risk with respect to what we believe is an insane bubble in an abundance of cryptocurrencies, a new class of highly speculative intangible assets, that are not even securities, rather an unregulated highly speculative new technological asset class of software tokens whose market today resembles a hybrid of the 2000 Dotcom Bubble and the 1637 Dutch Tulip Bulb Mania. Surely, there will be long term winners in crypto. We hope to be able to discern them up as they rise from the ashes after the coming spectacular bust. Afterall, Facebook and Google only emerged after the tech bust, while Amazon was crushed during it, going down 97% within two years before rising from the ashes to become the 3rd largest market cap stock in the US today. [this piece was written before the current crypto correction and hence potentially just happened in a bunch of completely overpriced alt coins]

The chart below shows the enterprise value-to-sales ratio differential between high flying technology and value stocks. Note the comparison between the early stages of the 2001-02 tech bust and today.

Monetary Debasement

The third major driver of inflation is monetary debasement. The current framework of analyzing the state of the labor market and the true levels of inflation in the economy to rationalize the appropriate monetary policy has never been so unfitting. By solely observing the recent macro data, Jerome Powell and the other Fed members had all the right reasons to signal tapering in their last meeting and decided not to.

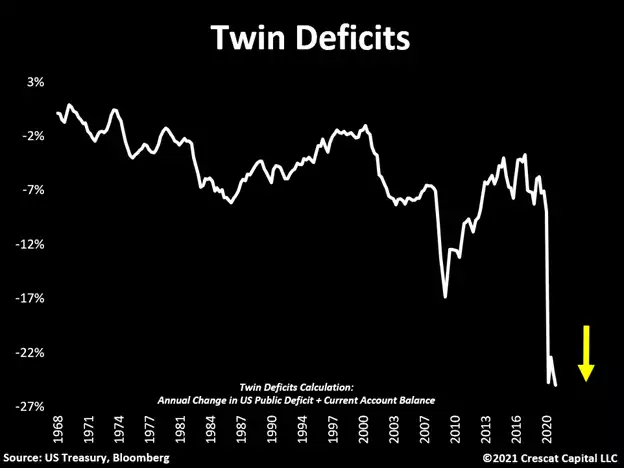

Contrary to what most believe, today’s quantitative easing program and near zero interest rates completely disregard both sides of the central bank’s dual mandate which is supposed to control inflation and maintain full employment. Instead, in our view, monetary policy has only one clear objective: to prevent interest rates from rising so that our government can fund massive fiscal spending. So now we genuinely ask:

How can the Fed reverse its ultra-easy monetary policies with an economy running a twin deficit of 25% of the nominal GDP?

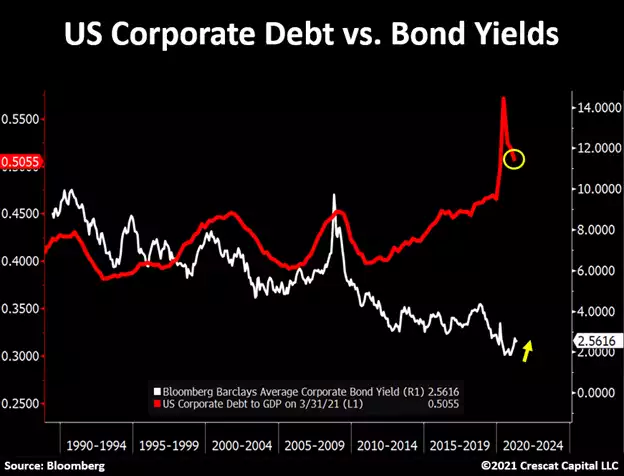

Too Much Debt

Or, on another thought, how does the Fed unwind the alligator mouth below? Corporate debt has grown to near all-time highs while bond yields remain near all-time lows. Again, this is all product of easy money policies.

Ultimately, the Treasury market holds the key for the health of the financial system. With current high debt-to-GDP levels, the economy has an inherent need for loose financial conditions. Correspondingly, the sheer magnitude of the excess liquidity in the markets has created one of the most speculative investment environments of all times. As such, any marginal increase in interest rates would be detrimental for financial assets at near record valuations. [we discussed this yesterday in the context of the similar question in the context of debt to GDP of 130%]

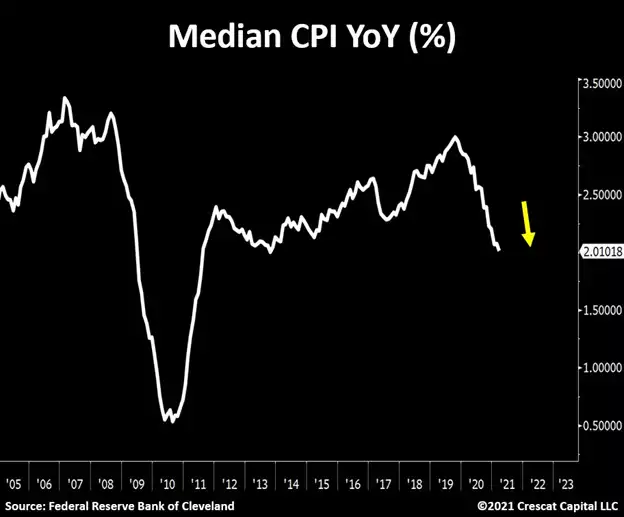

CPI Not Credible

Truth be told, a highly indebted and broken government is at mercy of the Fed. Policy makers have no other options than to continue pumping liquidity into the system while making absurd claims to justify their actions. Most consumer goods and commodities have started to go vertical in prices within the last 1-2 years, and bizarrely, the Fed’s own calculation of inflation just reached a 7-year low. This is what they call a “data-driven” approach?

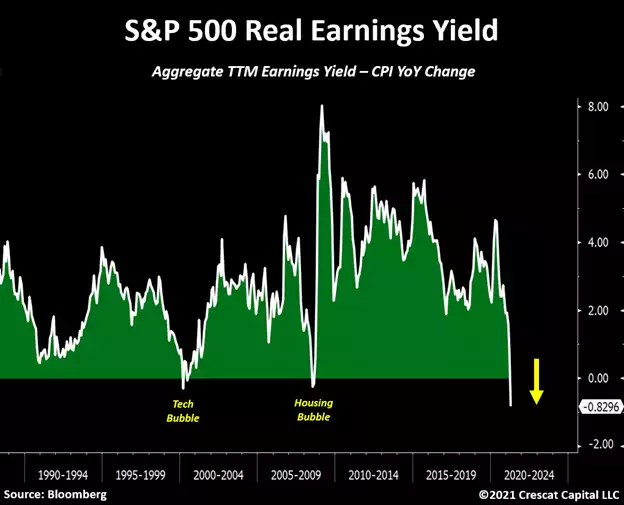

Real Yields Are What Matter

As stimulative packages become exponentially larger in size, the curve of efficacy for monetary policy is peaking. We believe the Fed stimulus is transitioning from a diminishing return phase to a negative one. The scarcity of financial assets yielding anything in real terms is creating a vigorous capital flow dynamic that is incredibly attractive for undervalued tangible assets. With growing concerns of monetary debasement emerging, investors continue to bid up commodity prices, leading to higher consumer prices. This should start becoming an issue for equity markets at excessive valuations yielding less than inflation. For instance, the S&P 500 earnings yield adjusted for CPI is now at its most negative level in 30 years. It is likely much worse, because this is using what we strongly believe is an understated measure of true inflation. Monetary dilution can only lead to higher financial asset prices until inflation begins to develop. At that point, as capital cost rises, Fed’s policies become counterproductive, and a price reset for historically overvalued assets is needed.”

Tomorrow, in the context of the above, we will share why they think “Silver is the single most important asset that we, as a firm, are focused on.”