IMF - “Precarious” Global “Synchronised Slowdown”

News

|

Posted 16/10/2019

|

12109

After softening us up last week the IMF yesterday released its latest Global Economic Outlook and as expected it was not good.

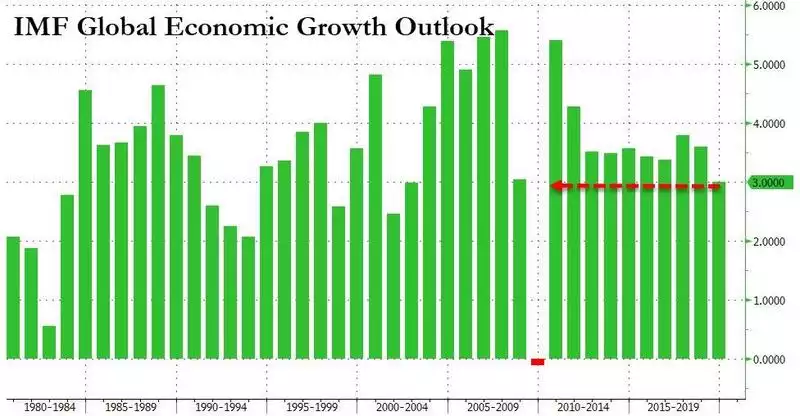

With the worst growth estimate since the GFC the IMF warn of the structural fragility in the market that, just like their woefully high pre GFC call, could see a far worse outcome. This is the 5th downgrade for the 2019 forecast since the high of 3.9% amid the ‘everything’s awesome’ mid 2018 when the Fed were tightening and everyone believed markets were not completely reliant on central bank stimulus… They’ve now reduced that by nearly 25% to the latest call of 3%. You can see from the chart below just how wrong their similar 3% call was just before the GFC. As we said yesterday, recessions don’t come with an accurate start date…

From Bloomberg:

““With a synchronized slowdown and uncertain recovery, the global outlook remains precarious,” IMF Chief Economist Gita Gopinath wrote in the report. “There is no room for policy mistakes and an urgent need for policy makers to cooperatively de-escalate trade and geopolitical tensions.””, and

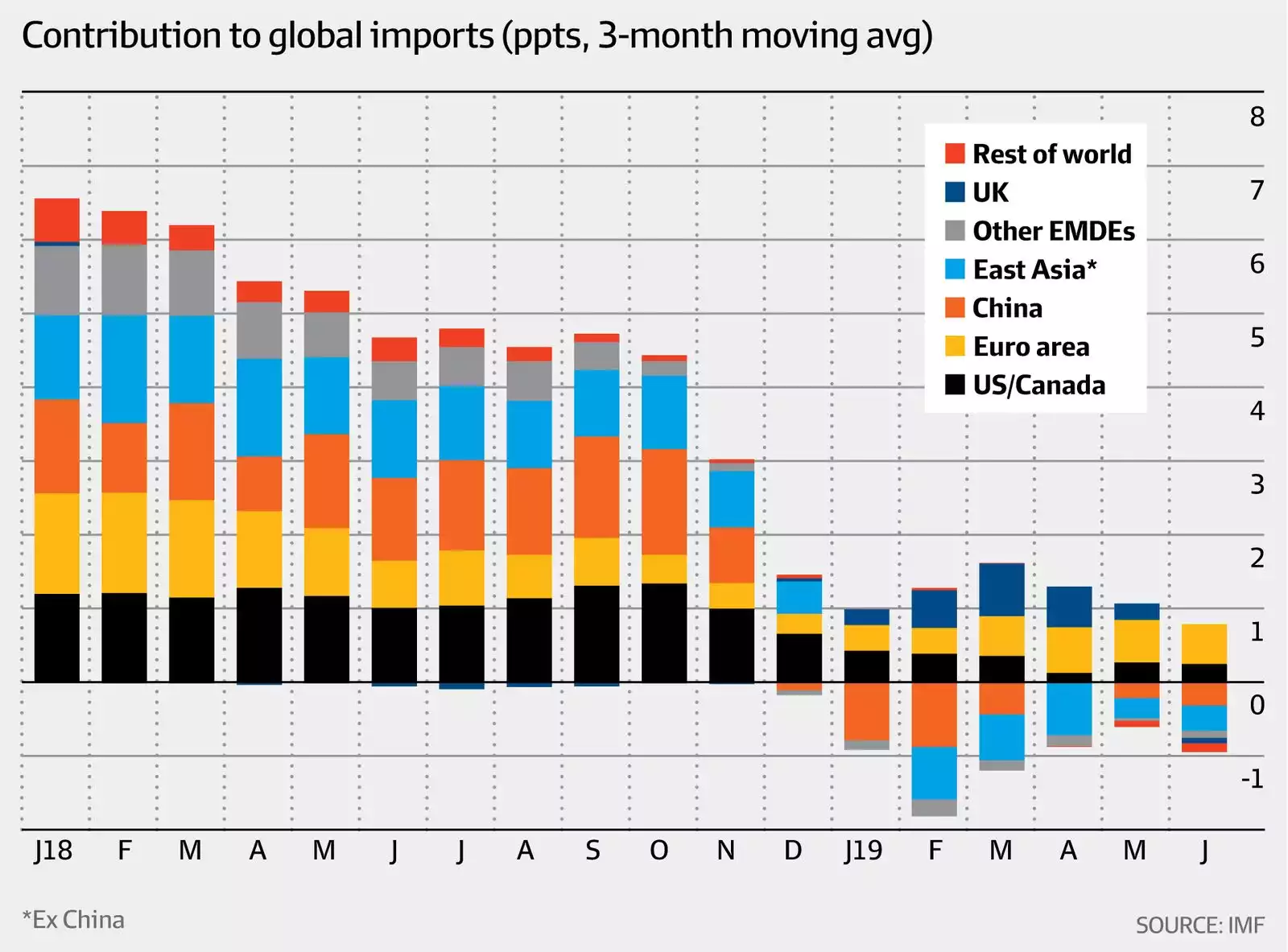

““The world economy faces difficult headwinds,” the outlook said. “Despite the recent decline in long-term interest rates creating more fiscal room, the global environment is expected to be characterized by relatively limited macroeconomic policy space to combat downturns and weaker trade flows, in part reflecting the increase in trade barriers and anticipated protracted trade policy uncertainty.””

For Australia the news is actually worse with the IMF slashing their 2019 forecast by over a third from 2018’s 2.7% to just 1.7%. With the RBA widely expected to lower rates more to counteract this the IMF, whilst applied generally, warned this will not be enough, saying:

"Monetary policy cannot be the only game in town and it should be coupled with fiscal support where fiscal space is available,"

As one of the only countries in the world with a surplus (and hence “fiscal space”) that puts the Morrison government further in the firing line to start spending to add to the rate cuts. But they won’t have a bar of it, with the PM adamant when tested on this in question time:

"It is a clear choice, as we have continued to demonstrate, and that is the sound, stable and certain policies ... not getting riled up, not getting spooked by the international conditions we are faced with, but ensuring we protect budget resilience that enables us to meet the challenges ahead.”

Morrison cites that we have the 2nd strongest growth of the G7 countries as justification which seems to miss the point that our export centric economy, particularly with a faltering property market, is beholden to ‘the rest’.

Moreover the IMF’s track record of over estimating growth should be firmly in people’s minds as they read the various commentary today over this latest report.