This Signal Predicted Last 7 Recessions

News

|

Posted 15/10/2019

|

13120

A little known fact is that unemployment usually bottoms just before a recession in the economy. That’s partly because recessions don’t come with a timestamp warning and economies can appear just fine by some numbers just before they are (really) not. But there are always warning signs for those willing to look.

Friday before last we saw the key US employment metrics of the non farm payrolls dish some mixed signals but generally disappoint. The 136,000 new jobs fell short of the 145,000 expected and the all important Average Hourly Earnings growth printed a fat Zero (month on month) against expectations of 0.3%. The numbers consolidated a deteriorating trend. The ‘good news’ was the unemployment rate dropped to 3.5% against the previous and expected 3.7%.

The US Fed’s Claudia Sahm has a forecast thesis that see’s a recession start at a 0.5% increase in the unemployment rate. The signal would have correctly called each of the last seven recessions from 1970. That puts it up there with the yield curve inversion we are already seeing. Whilst the yield curve (explained here and Aussie context here) gives an earlier warning, Sahm’s ‘predictor’ can usually come after the actual recession has started.

On that theory, should we get US unemployment jump to just 4% a recession has started or is immediately imminent. So where are we?

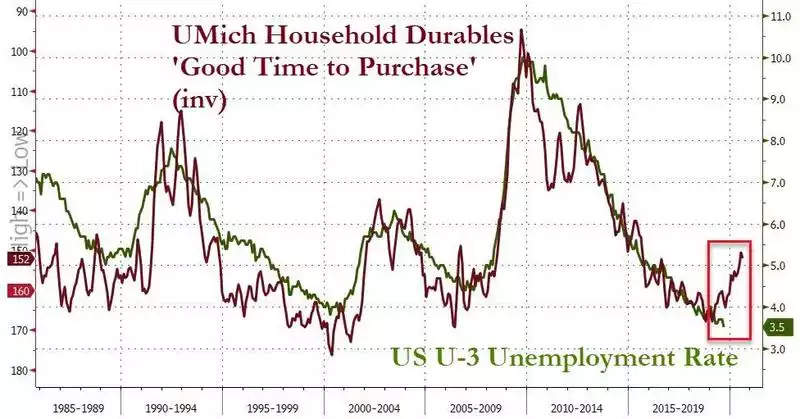

A couple of recent charts indicate we might be there very soon. Firstly, check out the correlation below of the University of Michigan Consumer Confidence Survey response to the question whether it is "a good time to purchase household durables" versus the official U3 unemployment rate. Remember people will often sense beforehand if their employment is getting tenuous and hold off on any meaningful but discretionary purchases, so it makes sense that this could be a good predictor. The correlation is hard to ignore and what it is saying is the US unemployment rate is about to jump to around 5%. That is 1.5% above the current 3.5%, well in excess of Sahm’s 0.5% trigger.

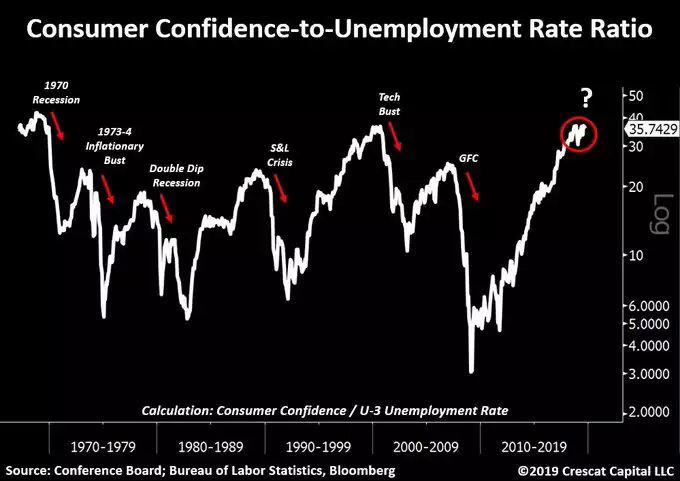

If we look at another predictor, the broader consumer confidence measure over the unemployment rate and you can see we are near all time highs.

The old saying ‘no one sounds a bell at the bottom’ is so true. But recessions tend to catch many unawares which is why they often see huge falls in financial markets. Too often the smart money has offloaded to the ‘mums and dads’ still believing the mainstream media hype that everything is awesome which is why we find the above UMich very pointed question survey response so interesting.

On any account, the signals are there for those willing to look.