Goldman’s Up Gold & Silver Forecast as Fed Quietly Eases

News

|

Posted 22/06/2020

|

31209

Unless you’ve been under a rock lately you may have gleaned that the US sharemarket surge has been reputedly based on the Fed’s stimulus rather than fundamentals. After all all-time high share prices amidst the worst recession in a lifetime seem just a little incongruous. To be fair some of the support has been a growing feeling we may see a V Shaped recovery, particularly amongst the momentum driven Robinhooders who skipped physics in class and think momentum is perpetual.

Friday’s session on Wall Street caught a glimpse of reality that saw shares down (except the ‘tech stocks are different’ NASDAQ) and gold and silver both up strongly. The V shape hit a snag with the realisation that a second wave appears to be here and the first wave in the US is getting a head of steam in new states.

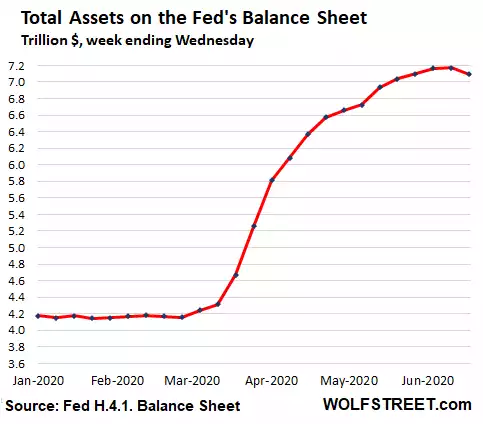

It could also well be that people realised that the Fed have been quietly unwinding their balance sheet, down $74 billion in the week. From Wolf Richter:

“There have been endless announcements by the Fed that they will add this and that to their asset-purchase programs. The media jumped all over these announcements, how the Fed is going to get into the junk bond market and ETFs with hundreds of billions of dollars. Each time, all kinds of hoopla broke out in the markets with stocks soaring and junk-bond ETFs soaring, and everything soaring – despite the worst economy in memory, despite 30 million people on unemployment insurance, and despite shocking earnings reports heading our way.

The Fed has set up an alphabet soup with 10 of these programs so far – and it has been buying some of the assets it said it would buy, but it also has been shedding alphabet-soup assets it had bought in March and April, while whittling down its purchase programs of Treasuries and MBS for the past two months. And repos unwound, and dollar liquidity swaps unwound, and now total assets on the Fed’s balance sheet for the week ended June 17, released this afternoon, actually shrank by $74 billion.

This $74 billion decline in total assets during the week was powered by a plunge in repo balances and foreign central bank liquidity swaps, while some alphabet-soup programs also unwound. And the junk-bond and ETF buying program stalled.

And there is a big shift happening: The Fed has started lending to entities, including states and banks, under programs that channel funds into spending by states, municipalities, and businesses, rather than into the financial markets. These types of programs are propping up consumption – not asset prices. That’s a new thing. I don’t think the hyper-inflated markets, which have soared only because the Fed poured $3 trillion into them, are ready for this shift.

The $74 billion in total assets that the Fed shed during the week brought the Fed’s total assets down to a still breath-taking $7.095 trillion. You can see from the curve that this isn’t an accident, but part of a plan to front-load QE and then back off – rather than let it drag on for years:”

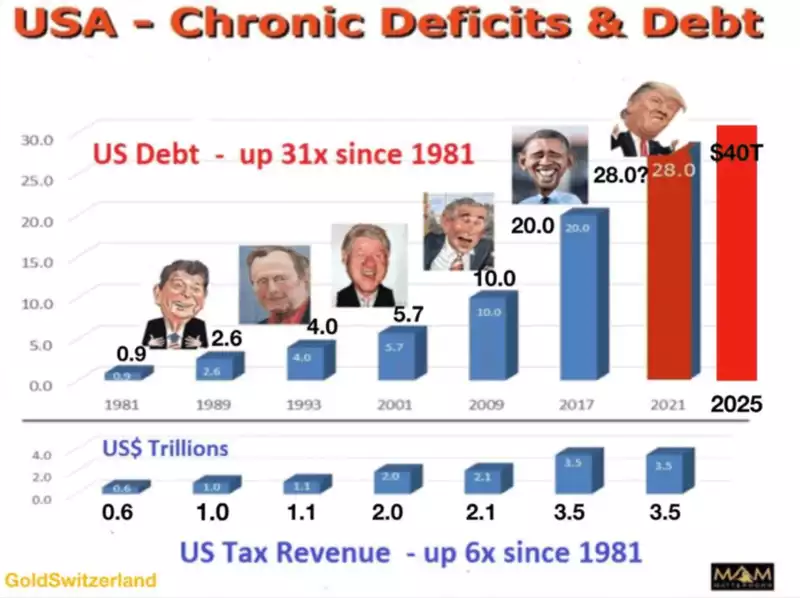

And so we may well now be at a turning point where the US sharemarket has to consider life without this liquidity injection. Critically for gold and silver that change in focus to propping up consumption rather than financial markets adds weight to the inflation trade. This comes at the same time as record fiscal stimulus from the government (again into Main Street not Wall St), and with an election in November, promise of more to come. Trump has taken the US national debt to $26 trillion and will throw the kitchen sink at it leading into the election. Interestingly investment legend Egon von Greyerz predicted almost exactly what has played out when he published the chart below just after Trump was elected. Back then he predicted US public debt would hit $28 trillion, a figure we could easily hit by November.

In case you missed it, the chart spells out that since 1981, debt has increased 31 times whilst tax income has increased just 6 times. He goes on to predict the US public debt will hit $40 trillion by 2025, a figure supported by the government’s own Congressional Budget Office (CBO). When we left the gold standard in 1971 there was just $400 billion in debt. Without the discipline of gold that has increased 65 times. Again, if you haven’t read our 2 part article on where this economic empire and credit cycle all ends, please do so here and here.

Stephen Hawking once insightfully noted: "We spend a great deal of time studying history, which, let's face it, is mostly the history of stupidity."

Von Greyerz reminds us again:

“No fiat currency has survived in history. There have been periods when various currencies were backed by gold or silver. This stops governments from spending what they haven’t got. That was the dilemma Nixon had. After many years of the costly Vietnam war in the 1960s, President de Gaulle saw where America was heading and asked the US for payment of their debts to France in gold.

Gold backing of the currency prevents countries from spending money they haven’t got. Every time a nation has dropped the gold or silver standard, it has led to a destruction of the currency.

With deficits and debts rising fast, the US would have run out of gold and Nixon had no intention to balance the budget by cutting expenses. Much easier than to close the gold window and open the printing press which he did on 15 August 1971. And that was the beginning of the end of the US empire and the global currency system.”

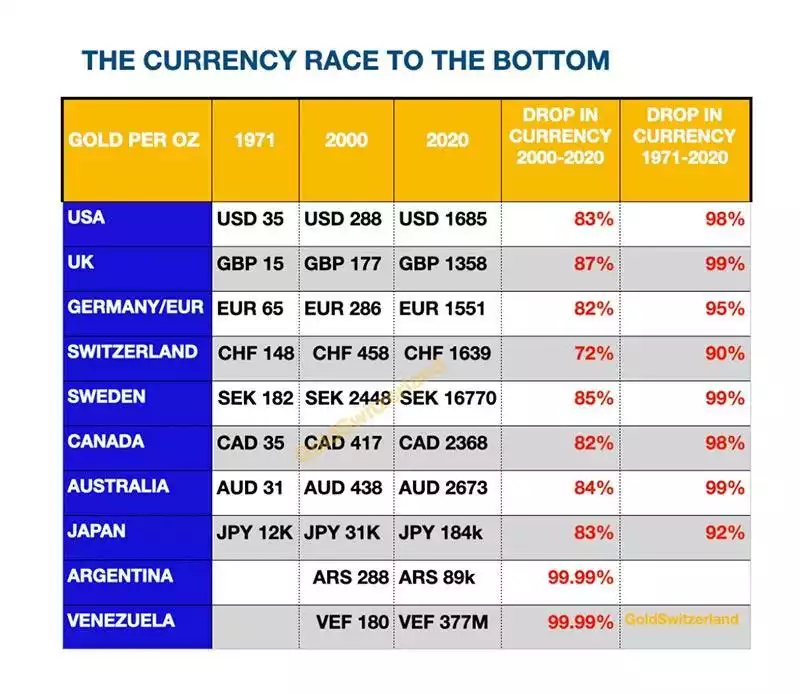

And so the inevitable outcome is inflation. Whilst the common misconception is that inflation represents prices going up, it is in fact simply that the value of the fiat currency buying those goods going down as more and more of it is created out of thin air. The table below illustrates this perfectly when comparing a basket of fiat currencies relative to money in the form of gold, these currencies have dropped in value by 97-99% since 1971 when the printing presses started.

Goldman Sachs are quickly coming to the same conclusion with their latest forecasts for gold and silver increasing on safe haven plays on fears of a second wave of the virus and also inflation from this shift in stimulus away from financial markets to consumption facilitators. They believe the stimulus will ultimately lead to inflation but importantly that the government and Fed will allow inflation to run hotter for longer as they did after WWII to try and inflate away the debts accumulated. (something UBS debunks as we wrote here).

Goldman’s raised their three, six and 12-month gold price estimates to $1,800, $1,900 and $2,000 per ounce from $1,600, $1,650 and 1,800 per ounce, respectively (from $1748 at time of writing). They also materially raised their silver forecast as well up to $US19 in three months, $US21 in six months and $US22 in a year, compared to $US13.50, $US14 and $US15 previously (from $17.74 at time of writing). The more bullish view on silver was explained:

“First, coordinated global stimulus will help generate growth in industrial production and global economic activity……Relative to gold, silver demand is more closely tied to industrial production, accounting for 50% of its demand….Silver also stands to benefit from growing investment in solar power.

Secondly, we have argued in the past that silver is the precious metal of second choice after gold. This means that when interest in precious metals is moderate, investors may still add to gold but silver often gets overlooked.

However, when interest in precious metals is surging (as it is now), a lot of investors historically diversify part of their gold purchases with silver. In this environment, silver can outperform gold because it is a smaller market and moderate relocation into it can lead to a material price spike”.