Gold & Silver v Bitcoin & Ethereum

News

|

Posted 07/08/2020

|

12136

The nexus between gold & Bitcoin and silver & Ethereum has often been discussed. Tribalists will argue never the 2 or even 4 be discussed in the same breath but the parallels are there and the price performance this year mirrors this too. Gold and Bitcoin are going strong, but silver and Ethereum are going even stronger given their dual purpose.

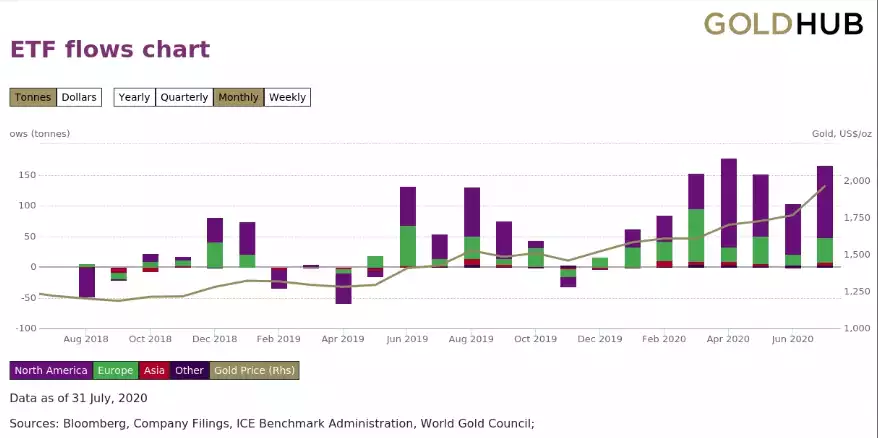

But first, the World Gold Council just released their ETF data for July and it was another spectacular month:

“Gold-backed ETFs and similar products (gold ETFs) recorded their eighth consecutive month of positive flows, adding 166 tonnes (t) in July – equivalent to US$9.7bn or 4.1% of assets under management (AUM). Global holdings have once again reached a new all-time high of 3,785t and the price of gold hit a record high of US$1,976/oz by the July-end, leaving global AUM standing at $239bn. Global net inflows of 899t (US$49.1bn) to date are considerably higher than previous annual highs, and the trend of inflows has continued in the first few trading days of August as the price of gold has breached US$2,000/oz.”

Addressing the question of ‘can this price strength continue’ they outline a few reasons why gold still has plenty of upside that adds to the likes of Bank of America calling for US$3000 gold soon.

“First, while the price of gold reached all-time highs in nominal terms, it remains below the inflation-adjusted record, which is US$2,800 or 42% higher. Additionally, the Commitment of Traders (COT) report for gold COMEX futures often highlights speculative positioning, which can sometimes serve as a contrary indicator at extreme bullish or bearish levels. While bullish sentiment was at extreme levels in February 2020 at 1,209t (US$63bn), it subsided meaningfully to 863t in July (US$55bn).”

Published in July, gold has continued to surge, up nearly another 4%. Year to date it is now up 36% (32% in AUD). Of course August has seen silver finally start its ordinary mean reversion of the Gold Silver Ratio with gusto and is up 21% in 7 days and the GSR now at 70:1. That has taken silver up 62% (57% in AUD) for the year, 126% off the March low and surpassing US$29 (AUD40) whilst writing this. That has it in lockstep with Bitcoin which is up 65% but all pale next to Ethereum’s 207% for the year so far. Ethereum is often compared to silver as in gold being Bitcoin.

Bitcoin like gold has little utility, it is a predominately a store of value through contained supply (compared to fiat currencies being recklessly printed ad infinitum) and very strong stock to flow fundamentals. Ethereum (ETH), like silver, in addition to monetary store of value characteristics, has utility in its various uses. Most recently, and dominating its price action, is its use for DeFi or Decentralised Finance, where more and more uses are coming to the fore that are making banks increasingly redundant. Our very own Gold Standard (AUS) and Silver Standard (AGS) likewise use the Ethereum network to tokenise secured physical gold and silver bullion and allow secure storage and frictionless trading and movement on the blockchain. The take up of these tokens has been strong with a market cap now over $12m and traded not just with Ainslie Wealth but also on CoinSpot, Elbaite and getBamboo. We are only a couple of weeks away announcing the listing on a new open order book exchange for those wanting such a platform. To join the Gold & Silver Standard telegram community for live updates and discussions, click here https://t.me/GoldSilverStandard or visit the website here (https://www.goldsilverstandard.com/) for more information.

Silver’s ‘utility’ was discussed by Bank of America Merrill Lynch in a recent investor update predicting silver could soon go to US$35 and US$50 in the medium term. They site a number of factors but predominately silver’s use in solar panels amid a worldwide push to greener energy and fiscal stimulus directed toward it (you might remember the huge Euro deal targeted it). Jo Biden has set a target of zero emissions by 2050 and specifically emissions from the power generators by 2035. That of course will need a lot of solar panels prompting BofAML to predict “an accelerated de-carbonisation of the US power sector alone could boost annual global silver demand from 2285t in 2020 to an average of 4272t over the next 15 years.”

Silver production has barely kept up with supply over the last few years when investment demand has been mediocre and the global economy tepid. With investment demand surging and now the industrial demand set to as well, the following chart of dwindling supply should put some context behind the surge in silver’s price of late:

You can easily and securely buy gold and silver bullion, gold and silver tokens, and Bitcoin and Ethereum from Ainslie either personally or in your SMSF.