Fed Cut Rates & Hint at QE4

News

|

Posted 19/09/2019

|

9455

Last night saw the latest US Fed meeting deliver an expected 0.25% cut in their interest rates to 1.75%. Whilst that wasn’t a surprise there were a couple beyond the headline that saw markets whipsawing.

The backdrop of the Repo drama this week which saw another intervention by the Fed last night to bring things back under control was largely ignored or at least downplayed with Fed chair mentioning that “funding pressures in money markets elevated this week” and that “we will over time provide sufficient reserves supply” and “we have tools on funding pressures, will use as needed”.

Back in May we explained the IOER (interest rate on excess reserves) and in addition to the 25bp drop in the Fed Funds Rate they also lowered the IOER by 30bp to try and stabilise the liquidity issue. That we saw that huge spike in Repos this week and the Fed having to inject money into that market for the first time since the GFC, it hardly seems enough, but only time will tell.

The meeting was also notable for the level of dissent in the committee. There were 3 dissents with 2 not wanting to cut and 1 wanting 50bp not the 25bp. There was also plenty of difference in opinion in the guidance with nearly half split on a further cut this year or not.

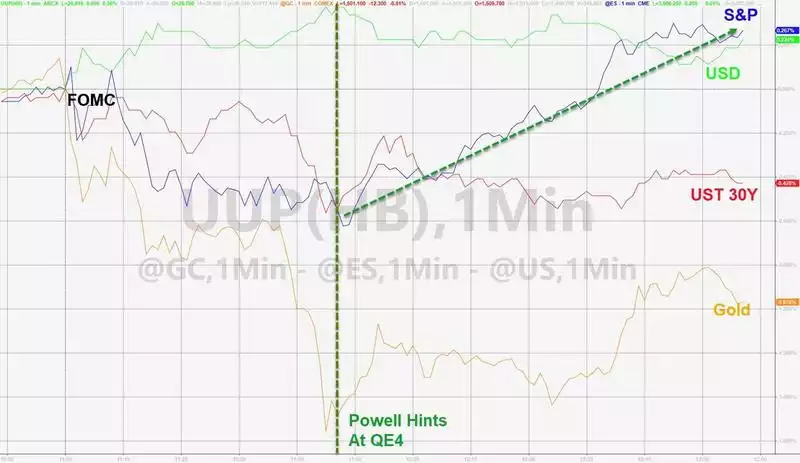

The disappointment with the result saw shares tank. But then in the press conference afterwards we heard this little gem:

“It is certainly possible that we’ll need to resume the organic growth of the balance sheet sooner than we thought.”

And right on cue he is putting QE back on the table and with the inevitable reaction from markets:

More broadly the news saw the USD higher and whilst bonds and bullion bounced on “QE4” it was muted compared to shares.

The fall in the AUD buffered most of that small net fall in gold out for us but the additional pressure it now puts on the RBA can’t be ignored.

Finally, Trump was clearly stoked at the mild actions of the Fed and playing down of the repo market turmoil…