Exiting When you Own the Market?

News

|

Posted 25/09/2017

|

7338

Back in June we wrote an article asking what happens “

When Central Banks Turn Off the Tap”. When analysts talk of the danger of excess central bank intervention they often hold Japan up as an ‘exemplar’. Japan has suffered literally decades of deflation or near zero inflation and moribund growth. They, in many ways more than most, exemplify the demographic challenge the world is facing in an aging population, diminished natural population growth, indebted Governments having to support more and more people on pensions and social welfare on a (relatively) reducing tax base. The maths simply doesn’t add up.

Post GFC, the US lead the world with ‘QE’ or Quantitative Easing where their central bank bought US Treasuries with freshly printed money. To the tune of $4.5 trillion no less….

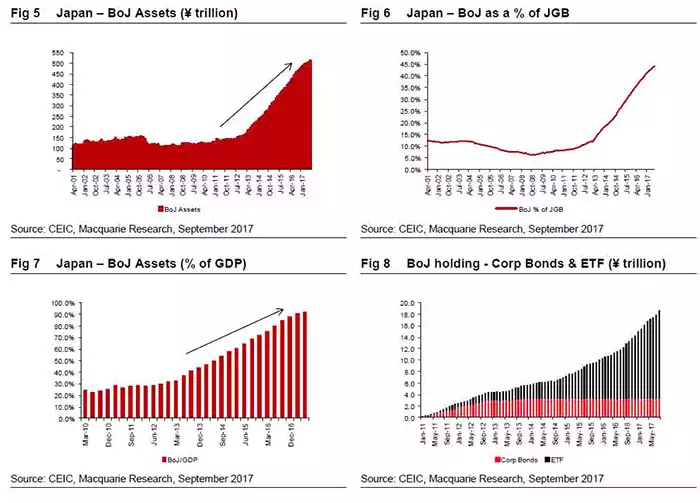

Japan joined that money printing party late but, per head of population, Bank of Japan outdid every other central bank hands down and is still going. Has it worked? Absolutely not. Like elsewhere it propped up the sharemarket nicely (as will happen when you are the biggest buyer of ETF’s on the market!), held down the Yen but achieved pathetic real growth and penalised savers.

Macquarie Bank just published the following self explanatory charts and rightly state “State-controlled capitalism is becoming the preferred business model”

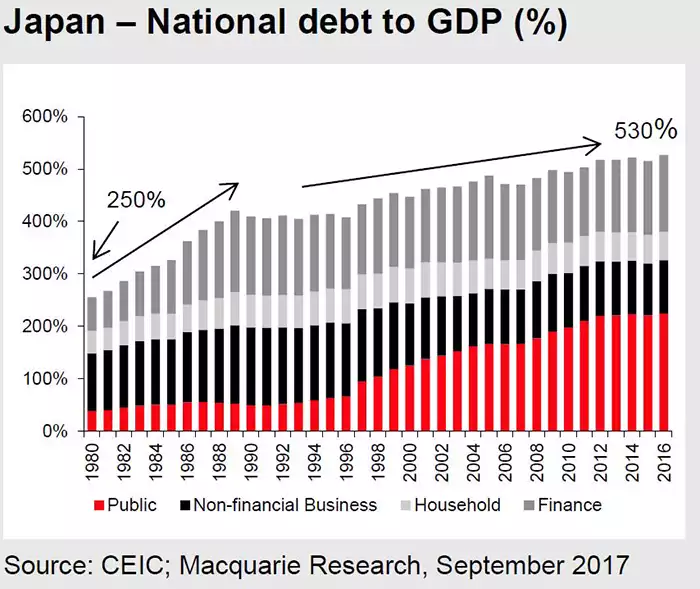

The following graph shows not only the eye watering debt to GDP in Japan but the explosion of public debt since the turn of the century.

Again this begs the question…. What happens when it stops? What happens when the holder of Y16 trillion in ETF’s and nearly 50% of all Japanese bonds stops buying? This is no Venezuela or Zimbabwe, this is the 3rd biggest economy in the world.