Epic Set Up in Silver

News

|

Posted 15/05/2017

|

9499

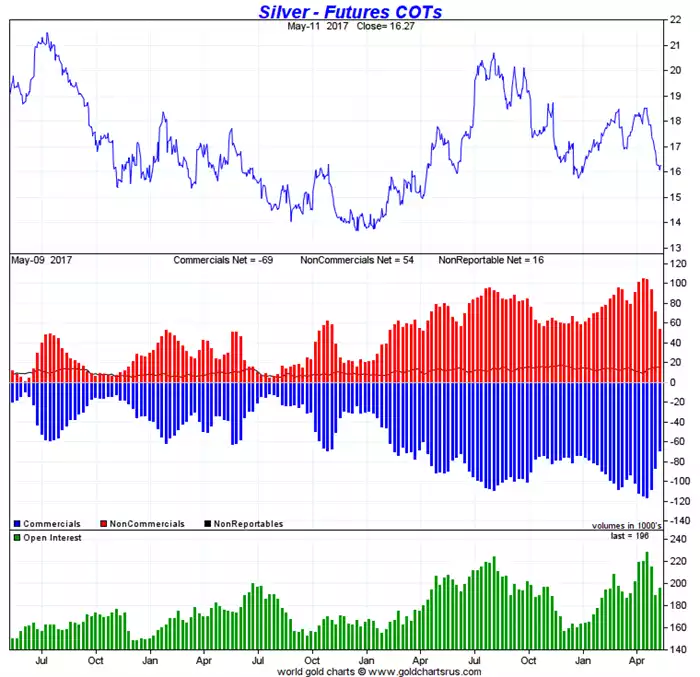

Friday night’s COMEX Commitment of Traders report for silver in particular was nothing short of breathtaking and one investors simply must take note of.

As a reminder, COMEX is where gold and silver futures are traded and at volumes far exceeding physical supply and with contractual claims many many times over the physical metal available for delivery. Like it or not this paper market has a large bearing on the spot price… for now. The main players are the Commercials, dominated by the big bullion banks, and the Non Commercials dominated by Managed Money (speculating hedge funds etc). Up to last week the Commercials had amassed an all time record short position in silver (sell contracts assuming/betting on lower prices) and Managed Money conversely on the long side (buy contracts assuming/betting on a price rise). We wrote recently that we expected a big reduction in those Managed Money longs as they capitulated on the recent drops in the silver price. Well oh boy, did they!

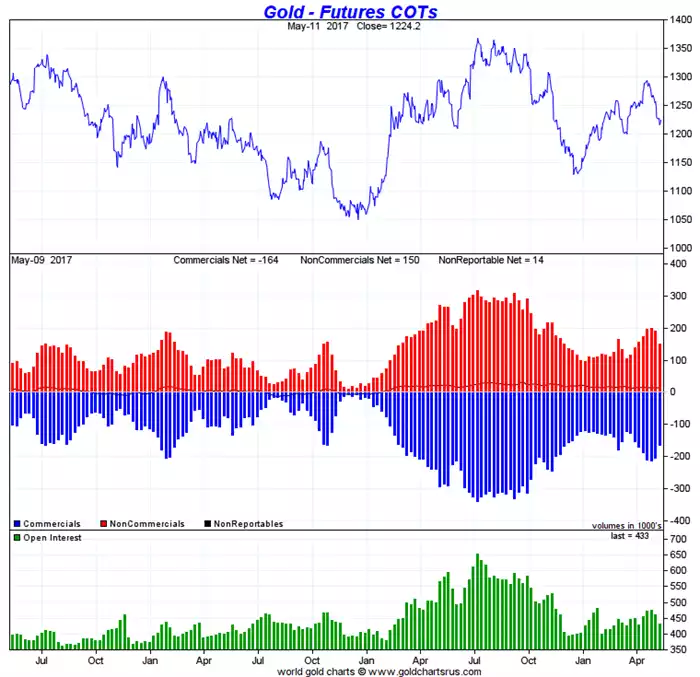

The COT report published Friday takes data up to Tuesday of last week. In the week to last Tuesday we saw the Commercials reduce their short positions by a staggering 19.4% in gold and 20% in silver. Conversely the hedge funds decreased their long positions by 20.9% in gold and (wait for it) an eye watering 24.8% in silver. What does that mean? Long time COMEX analyst Ted Butler had this to say over the weekend:

“I am convinced that silver will soon explode in price in a manner of unprecedented proportions, both in terms of previous silver rallies and relative to all other commodities. By unprecedented, I mean that the price of silver will move suddenly and shockingly higher in a manner never witnessed previously, including the great price run ups in 1980 and 2011. The highest prior price level of $50 will quickly be exceeded.

By “soon”, I mean that the move can commence at any time, but more likely before many weeks or months have gone by. I know that the price of silver has been declining on a daily basis nonstop for three weeks now, itself an unprecedented move, but I also know the reason for the decline and how the sharply improved COMEX market structure has always guaranteed a rally in a reasonable period of time.”

How?

“At the heart of the unprecedented move higher in the price of silver is the manner in which it will occur. It will be a price move like no other. It will be the greatest short covering rally in history. That’s guaranteed because the COMEX silver short position is the largest and most concentrated short position in history. There is no buying force in the financial markets more powerful than panicky buying by those forced to cover short positions. The largest short position ever holds the potential for the greatest short covering rally ever.”

Now Ted Butler is one analyst and others may put forward an alternative view but the graph’s below show very clearly what normally happens after such a move (a price rally), especially a move setting up such a ‘small’ net short position.

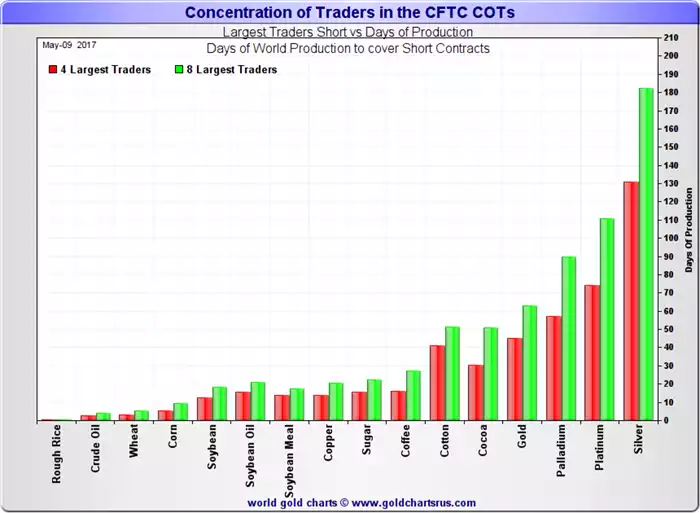

When looking at these too, keep in mind the incredible concentration of these short in silver between just 2 banks, Canada’s Scotiabank and J P Morgan, the latter of which Butler reports has in excess of 500m oz of physical silver on the other side of its paper short position. Between the 2 of them they are short the equivalent of 86 days of silver production, or about 2/3 of the red bar in the graph below. This is not a ‘market wide’ position, this is a concentrated short like no other, in the most shorted commodity on earth. Just think about what that means….(Hunt Bros?)