COMEX smashes record

News

|

Posted 28/01/2016

|

6154

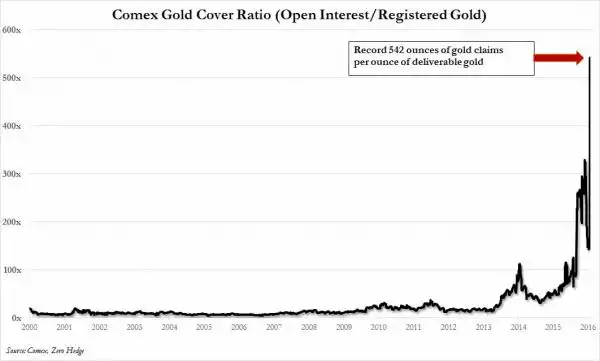

Just when you thought the COMEX gold (futures market) situation couldn’t get more absurd we learned yesterday that the registered gold stocks dropped over 200,000 oz in one day taking the total registered gold (that available for delivery) to just 74,000 oz. If you are new to this space and that still sounds a lot, well consider that open interest (contractual claims) stands at around 40 MILLION oz. The graph below tells the story as the ratio of Open interest to registered gold just shot up to 542 ounce claims to ounces of gold registered for delivery!

We reported back in December last year when the record was 294. Registered gold is only part of the picture, there is also Eligible gold which is lodged but not available. The question many are asking is why are the big bullion banks removing gold from Registered in such epic amounts? Many speculate they can see the possibility (inevitability?) of the big squeeze coming and want to keep what physical gold they do have closer to hand.

Whilst financial analysts don’t get too concerned by this situation (because contracts could always be settled with cash) the reality of the setup remains, that if just one big player demands gold not cash or another contract, the whole thing snaps. Any graph like the one above in the financial world simply must be taken notice of.

Tomorrow we will bring you an intriguing set up in silver on Comex too…