Yet another new Comex record

News

|

Posted 01/12/2015

|

7189

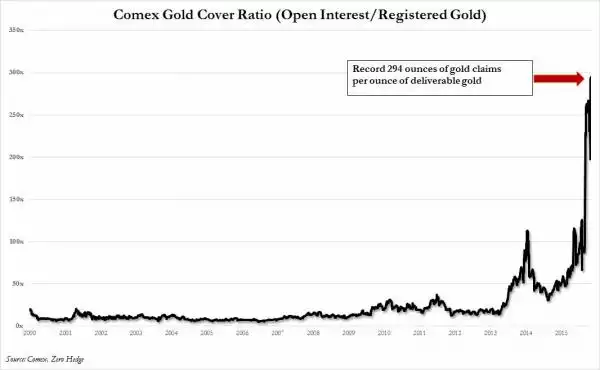

About a month ago we reported the new record of COMEX futures contracts per ounce of registered gold available for delivery hitting 293oz paper to 1oz of physical gold with a measly 151,000oz available. Well that just got worse (or potentially better if you own the real stuff) with registered gold inventories dropping again to just 134,877oz. That is just over 4 tonne and hence less than a 10% of the weekly Chinese consumption figures we report each week in the Weekly Wrap podcast. The last week actually saw over 50t – all real physical gold.

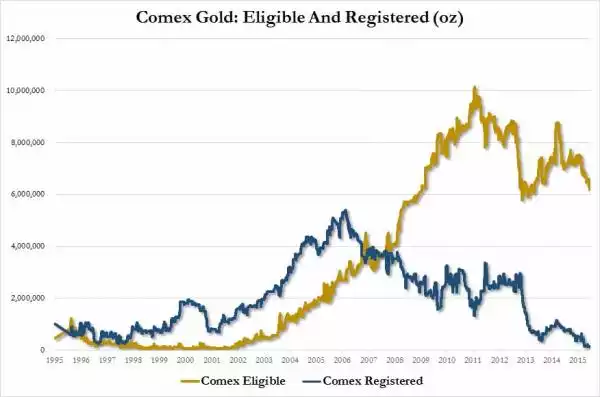

And it’s not just registered gold that’s dropping with eligible inventory on the decline too.

Bill Holter wrote the following over the weekend (before the 150Koz dropped again) after the big sell off on Comex Friday night and puts it into context:

“Yesterday's post-Thanksgiving and illiquid trading day saw some 18,000 contracts sold at the COMEX within a 30-minute time frame.

In fact, there were 4 single minutes, which saw a total 7,000 contracts dumped on the market. For perspective, 18,000 contracts represents 1.8 million ounces of gold ...while COMEX claims to have a grand total of 150,000 ounces [now 134,877oz] available for delivery! 1.8 million ounces of gold is equal to well over one week's production of every gold mine on the planet, 150,000 on the other hand is just over 16 hours! For further perspective, China has been importing over 1.3 million ounces of real physical gold each and every week and amounts to nearly 80% of all gold produced. Why is this important? China is importing each week nearly 10 times the total amount of gold COMEX has for delivery in total. Put another way, COMEX gold "pricing" rests on a foundation 10 times smaller than what China imports each and every week! How is it credible that COMEX can sell 12 times as much "gold" ...in just 30 minutes as they claim to have available for delivery?

COMEX currently has a problem in my opinion. Their registered (dealer deliverable) category has not received any gold over the last two plus months and has done nothing but shrink to a level equal to just 16 hours of global production. First notice day for December gold is this coming Monday. With just one day left there are still 24,000 contracts open. If history is any guide, Monday will see a drop of 12,000 contracts and a 40% bleed down during the month. If this were to occur, we will see over 600,000 ounces standing with only 150,000 ounces available for delivery. We have seen this potential situation several times over the last couple of years but never with an available inventory as feeble as it is now.”