Fiscal Spending v QE for Australia – Some US lessons

News

|

Posted 17/10/2019

|

16945

Yesterday we touched on the debate on whether our government should forgo the precious budget surplus and concede to the RBA’s demands for fiscal stimulus. There is then the sub debate on whether such stimulus should be like Rudd’s helicopter money “plasma TV” cheque or instead on investment in infrastructure which should create some jobs and economic return.

Lance Roberts of Real Investment Advice has this week been presenting articles on how Wall St destroyed Capitalism but within that lay some observations relevant to this topic. He quotes Dr. Woody Brock, an economist who holds 5-degrees in math and economics and is the author of “American Gridlock”:

“The word ‘deficit’ has no real meaning.

‘Country A spends $4 Trillion with receipts of $3 Trillion. This leaves Country A with a $1 Trillion deficit. In order to make up the difference between the spending and the income, the Treasury must issue $1 Trillion in new debt. That new debt is used to cover the excess expenditures, but generates no income leaving a future hole that must be filled.

Country B spends $4 Trillion and receives $3 Trillion income. However, the $1 Trillion of excess, which was financed by debt, was invested into projects, infrastructure, that produced a positive rate of return. There is no deficit as the rate of return on the investment funds the ‘deficit’ over time.’

There is no disagreement about the need for government spending. The disagreement is with the abuse, and waste, of it.”

Clearly Country A is the USA as its deficits fund “primarily social welfare, defense, and debt service which has negative rates of return”. Morrison is under pressure to be Country B.

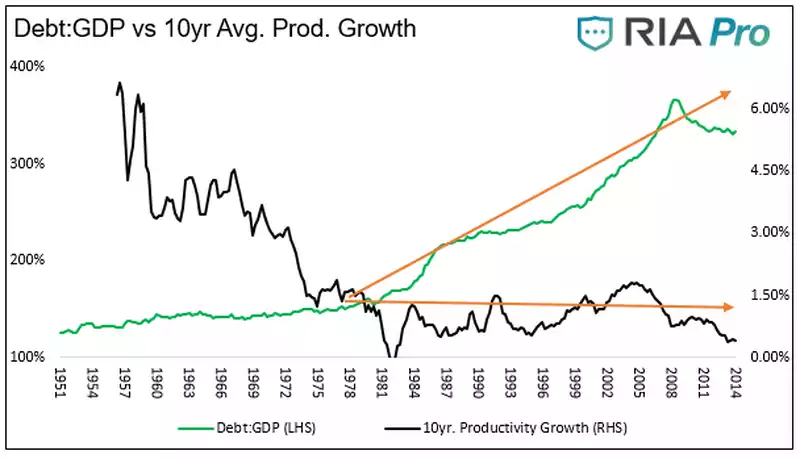

Indeed the growing trend of government’s funds being more and more consumed for social and medical benefits has contributed to an alarming stagnation of productivity. That becomes starkly obvious when mapped against the ratio of debt to GDP.

“This reinforces the message from the other debt related graphs – over the last 30 years the economy has relied more upon debt growth and less on productivity to generate economic activity.”

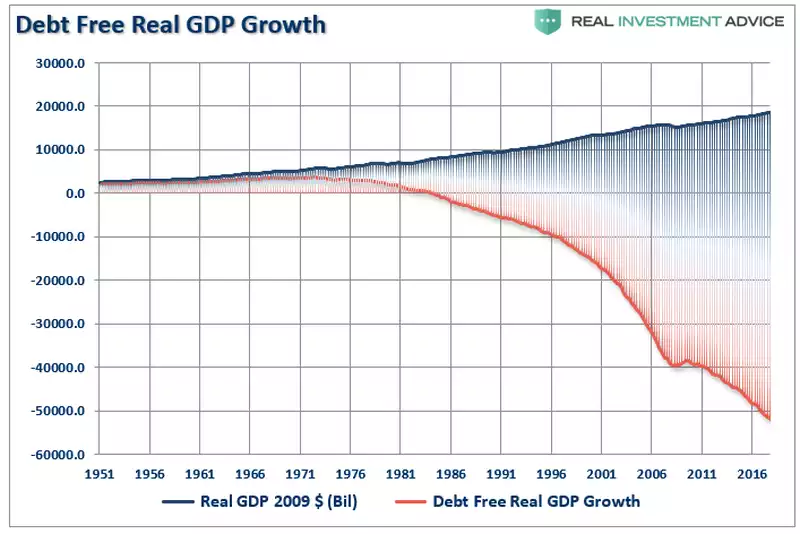

To paint this even more clearly he compares real (in 2009 $ terms) GDP versus what it would be without debt.

“For the 30-years from 1952 to 1982, the economic surplus fostered a rising economic growth rate, which averaged roughly 8% during that period. Today, with the economy expected to grow at just 2% over the long-term, the economic deficit has never been greater, and continues to grow.”

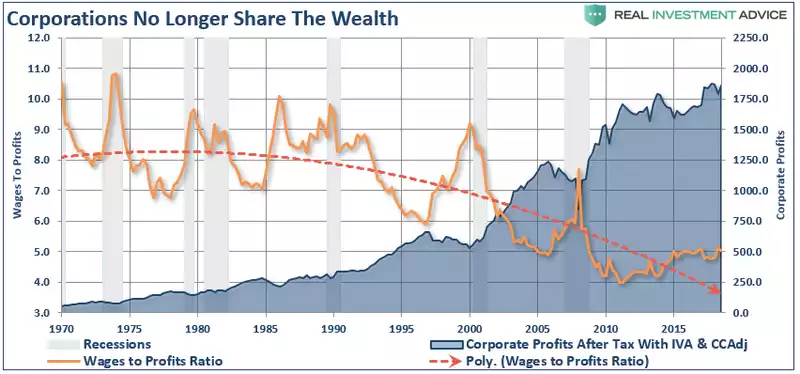

Part of the problem, and hence his blaming “Wall St”, is that US corporations are increasingly not sharing the wealth with the broader economy. This speaks yet again to the growing inequity chasm we often write about which has gone parabolic with the introduction of QE since the GFC. But it’s not a 10 year old thing. Since Clinton tried to cap CEO’s wages in 1993 we have seen a very clear trend of declining wages v profits. With CEO wages capped, boards just rewarded executives with shares and linked everything to that shares price growth. Lo and behold CEO’s were then incentivised to use profits ordinarily distributed to workers and shareholders via dividends to instead buy back shares and reduce costs (and hence increase profitability) by reducing their biggest expense, people. Jesse Fried of the Wall Street Journal spelt it out:

“The real problem is that buybacks, unlike dividends, can be used to systematically transfer value from shareholders to executives. Researchers have shown that executives opportunistically use repurchases to shrink the share count and thereby trigger earnings-per-share-based bonuses.

Executives also use buybacks to create temporary additional demand for shares, nudging up the short-term stock price as executives unload equity.”

“In 1982, according to the Economic Policy Institute, the average CEO earned 50 times the average production worker. Today, the CEO Pay Ratio is 144 times the average worker with most of the gains a result of stock options and awards.”

Apart from the social unrest, more downward pressure on wages also means more social welfare spending and less flow through of wealth throughout an economy.

As discussed yesterday we are at or near the point where lowering rates will provide increasingly diminishing rates of return for our faltering economy. When Australia is then faced with the choice of QE or productive fiscal deficit spending to complement zero interest rates, the answer, taking the US lead and lessons above, appears to favour the latter.