Australia’s Headwinds Increase

News

|

Posted 17/05/2019

|

9787

As we warned on Wednesday Australia’s unemployment rate increased yesterday to 5.2% (and March’s number revised up to 5.1%) and the AUD dipped below 69c before settling only just above.

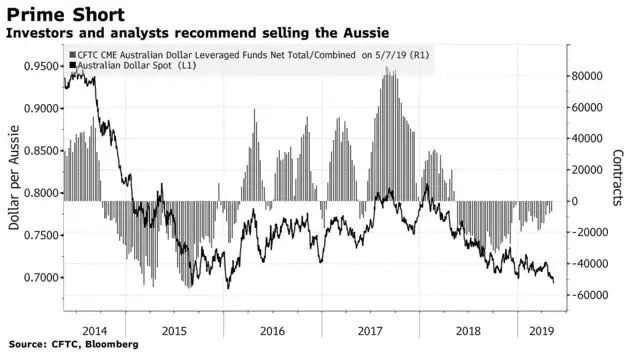

The news had some big names advocating a short position on the AUD, with AMP and GSFM the most bearish calling for a 65c AUD soon. You can see below the futures market is still short even at this 69c level.

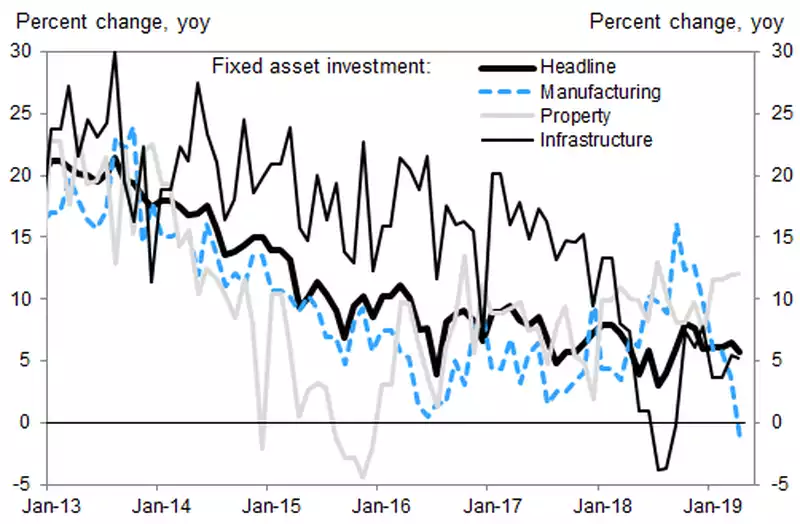

The AUD is often seen as a proxy for betting on the Chinese economy by institutional investors. The Chinese economy continues to slide, exacerbated by the US trade war.

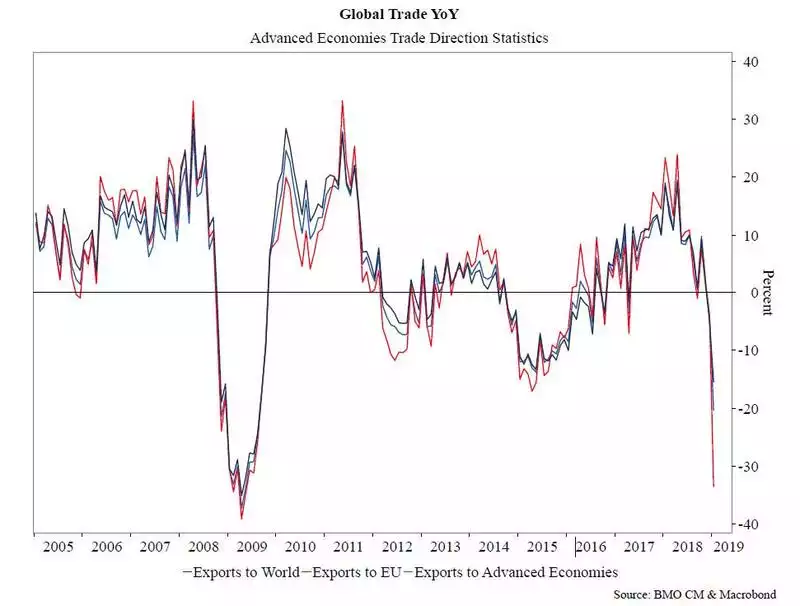

The escalating trade war and deteriorating global economy is seeing a very sharp and deep contraction in global trade where (per the chart below from the IMF), exports across the board are at lows not seen since the GFC.

The implications for Australia on the above news are many and varied and before us as we prepare to elect new leadership of the country with very different approaches. We are inexplicably tied to the Chinese economy and it is clearly struggling as are its ‘customers’. The unemployment figures don’t just portend an interest rate cut (now at odds of 60% in June) and seemingly inevitable erosion of our AUD, they threaten the extension of our record low wage growth environment. That is not just because of the headline increase but the breakup that saw 34,700 of the 28,400 new jobs created being part time. In other words we lost 6,300 full time jobs. That likely indicates uncertainty by employers (and seeking flexibility) and hence uncertainty for employees. That uncertainty by business (as flagged in the NAB survey we shared this week) will likely also see cautious capital expenditure, presenting a further drag to the economy. The uncertainty for employees will likely see constrained spending on the uncertainty of future income. Less consumption again puts a drag on the economy.

A key non-discretionary cost to many of those employees is rent. Without taking sides we feel compelled to share an excellent assessment of the impacts of the ALP’s policies affecting residential property, ironically put forward to reduce rent costs by penalising the oft bandied ‘rich end of town’. Penned by Matthew Gross of National Property Research, it is well worth a read.

“Some food for thought. If the ALP are successful on Saturday, the current tax incentives around established property investment and negative gearing will be removed. Bear in mind this policy was created when the residential market was at the peak of the property cycle. Those conditions have now passed and investors represent significantly less competition in the market place. Vacancy rates in Sydney and Melbourne are at near record highs, rents are falling, markets are oversupplied in many corridors. Prices are falling of their own accord with minimal government intervention...excluding APRA's very effective tightening of credit which was overdue.

However, what has flown under the radar to date is that the ALP will also make any investment property sold see the capital gains tax component increase from 50% to 75%. This is a seismic shift in residential real estate markets that has had very little coverage. If people buy an investment property, what is the incentive to sell it? Also bear in mind that any new property which qualifies for negative gearing when sold, then becomes an established property and no longer as attractive to the investment market.

By reducing the quantum of investors, in the short to medium term, most cities and some major regional centres will find themselves in a shortfall position. The impact will be property prices go up, rents escalate and those who can least afford to pay higher rentals, let alone a mortgage will be forced into...who knows what.

The government will have to provide more housing if it is to avoid the situation where the most vulnerable individuals and families to rental increases can find suitable accommodation. This will take time, an increase in government spending which will translate into higher taxes. If the government is having to provide new housing, that money has to come from somewhere.

The real estate industry is one of the nation's largest employers. Changing housing and taxation policy is fraught with enormous risks to the economy. We know that when the residential market is performing strongly, much of the broader economy benefits. This flows through to new car sales, holidays, discretionary spending etc. A further contraction of the residential market will flow through many aspects of the economy.

A business as usual approach to the market would be far safer in the short to medium term until we see exactly where residential prices settle. As a property economist, I am concerned that the ALP policy, although well intentioned will inevitably hurt those that they are seeking to protect the most. Property (and the economy for that mater) works in cycles, peaks and troughs. Policies need to be capable and flexible of meeting all times in the cycle, not just one aspect thereof.

The changes that are being planned will make residential an almost irrelevant investment asset class, particularly for Mum and Dad investors who predominantly own these houses, townhouses or apartments. It is not the top end of town, but those individuals, families and households who are trying to ensure they can retire without the need of a pension. To penalise middle income Australia, is to institutionalise property ownership into fewer hands and reduce the vibrancy and responsiveness that this sector currently offers. Throw in the Franking Credits issue, low interest rates, a slow stock market and I don't know too many people who would look forward to retirement at the moment.”