Why the RBA Will Cut Rates – A Lower AUD

News

|

Posted 08/05/2019

|

8663

The RBA held strong yesterday and kept rates unchanged for a 30th consecutive meeting at 1.5%. The odds of a cut were sitting at around 40%, down from 70% when that poor GDP print surfaced in March (0.2% for the quarter or 2.3% annualised as we reported here) and that zero quarterly inflation print (1.3% annual) late last month. Throw in a persistently weakening property market and Australia is clearly struggling and the analysts saw a rate cut as the inevitable panacea.

However, most of the talk of a rate cuts seems to focus on relief for mortgage holders and stemming the bleed from the property market. The reality is the banks have a record of not necessarily passing on some arbitrary number unilaterally declared by the RBA, rather lead by their ultimate masters of what they are paying globally as Aussie banks now owe over $1 trillion overseas (passed on to you). Conversely a mortgage rate cut may be achieved simply because the banks (as evidenced in recent results announcements) are hurting and losing business post enquiry and amid the property downturn. They are offering deals to bolster their floundering books. i.e. the rate cut may be there for the taking just by shopping around. Finally, the theory of lower interest costs meaning more spending with that ‘free cash’ is dubious in the face of the same huge debt burden against a devaluing asset. It’s unlikely going to unleash a spending spree in that context….

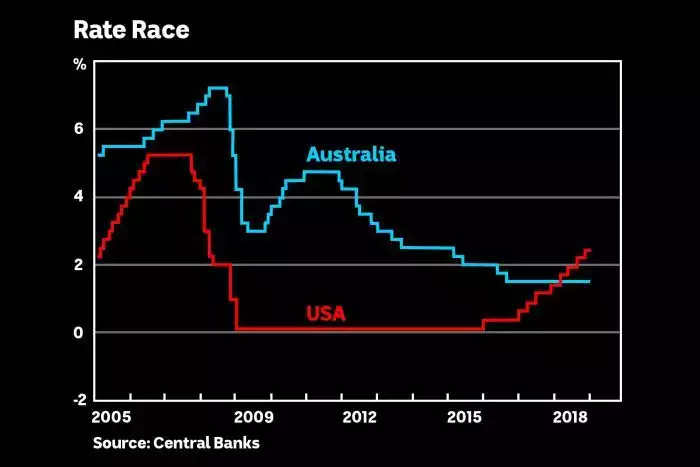

The bigger picture for the rate cut however is our Aussie dollar. A lower AUD fixes many ills. Part of the reason the RBA has held strong for so long is the US has been gifting us a wider spread on the AUD / USD by raising their rates. That spread has made buying USD much more attractive than AUD and has lowered our dollar accordingly as the money follows the yield. The mining boom took our AUD from 50c at the turn of the century to 95c pre GFC, and then the US Fed’s money printing and zero rates took the AUD up to $1.10. The mining boom saved us from the full effects of the GFC and our dollar was a nice yielding place to park your funds.

But that all changed when the mining boom ended and the Fed started raising rates to the point where they now ‘out yield’ us. They were doing all the heavy lifting for the RBA. Remember at 1.5% we are still at the lowest on record and that leaves very little room to cut when things get really bad. They really would rather not cut at that level and leave some bullets in the gun. The problem is the Fed capitulated off the back of the sharemarket correction late last year and now even looking to lower in their next move. It’s back in the RBA’s court…

Lowering rates and hence lowering the AUD bolsters our mining, agriculture, services, education and tourism exports by making them more globally competitive, bolsters local manufacturing by making imports dearer, increases inflation by making all our imported consumables dearer, and, pending a strong job market, increases wages too. On that point, all eyes are now on the unemployment figures due out next week. Dip below 5% and the RBA may hold strong next month. Hold or rise, and the chances of a rate cut jump. Right now the market it pricing a 37% chance of a cut in June, 50% in July and 70% in August. That will all change if next week’s employment figures signal any weakness.

So make no mistake here, the RBA desperately wants a lower AUD over all else. Fundamentally that means less purchasing power for you. The aim of the game is inflation as the only tool left to erode our debt pile. Inflation, by definition, is also and erosion of the purchasing power of your fiat money.

Gold, silver and platinum however are real money. A lower AUD directly increases their value. That’s the currency play. The whole reason for the need to lower that dollar is the threat of a recession. Gold, silver and platinum also historically increase in value in a recession while all else around them fall.

The writing is on the wall. Its just a matter of reading it.