Why You Should Watch the Yuan & Gold

News

|

Posted 25/10/2018

|

5570

Heavy falls hit Wall Street again last night taking both the Dow and S&P500 into the red for the year. There was no one clear catalyst but a few more indications the strength of the US economy is not all it appeared with further losses in the property market and mediocre earnings results.

We were however reminded of an article Jim Rickards penned back in July warning of the consequences of China responding to the Trump Trade War through devaluing its currency (CNY).

“But China could use a real nuclear option to counteract the trade war by fighting a currency war.

If Trump imposes 25% tariffs on Chinese goods, China could simply devalue their currency by 25%. That would make Chinese goods cheaper for U.S. buyers by the same amount as the tariff. The net effect on price would be unchanged and Americans could keep buying Chinese goods at the same price in dollars.

The impact of such a massive devaluation would not be limited to the trade war. A cheaper yuan exports deflation from China to the U.S. and makes it harder for the Fed to meet its inflation target.

Also, the last two times China tried to devalue its currency, August 2015 and December 2015, U.S. stock markets crashed by over 11% in a matter of a few weeks. So, if the trade war escalates as I expect, don’t worry about China dumping Treasuries or imposing tariffs.

Watch the currency. That’s where China will strike back. When they do, U.S. stock markets will be the first victims.”

The CNY/USD chart below shows those 2015 ‘shock’ devaluations circled. Check out what China have done this year in response to the trade wars…

It certainly begs the dual questions of where to from here for the CNY and then of course where to from here for the US financial markets.

Exporting all the inflation to the US forces the Fed’s hand in raising rates into a weakening economy. Just last night Trump again ‘broke the rules’ of Fed independence by declaring:

“To me the Fed is the biggest risk, because I think interest rates are being raised too quickly,”

"Every Time We Do Something Great, He Raises Interest Rates" adding in frustration that Mr. Powell “almost looks like he’s happy raising interest rates.”

Trump understands completely this ‘economic recovery’ is one based completely on free money and the Fed could be ruining his debt fuelled plans, to wit last night:

“I’m just saying this: I’m very unhappy with the Fed because Obama had zero interest rates.”

One potential answer to that question of ‘where to from here’ may lie in the gold price. Jeffrey Snider of Alhambra Investment Partners just released an insightful piece talking to this same topic. He talks of the 3 Stages of Gold – reflation (re-emerging inflation), collateral, and fear.

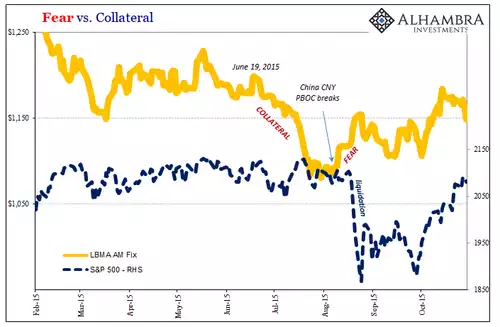

Revisiting the setup of that first big devaluation of the Yuan in August 2015:

“From March on through August, the PBOC had pegged CNY making it seem like all that noise in 2014 had been skillfully handled. But from mid-June 2015 forward, gold markets signaled another deflationary wave, likely originating in stalled collateral flow blocked by restricting balance sheet capacity (swap spreads turning negative was pretty conclusive evidence in that regard”

The CNY had withstood all those 2014/15 USD gains, gold flagged that collateral force was in play, and when it snapped fear arose and gold popped. But that was just a prelude. Gold bottomed in November 2015 and has been up since.

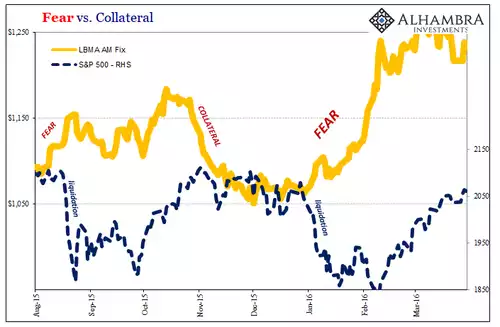

So what are we seeing now?

The above graph was produced before the further losses on Wall St last night. The S&P500 is now on track to have its worst month since that August 2015. There are any number of global “Black Swans” ominously circling at present and the trillion dollar question is what will China do with the yuan? Just last night we had a report that Peoples Bank of China “(PBOC) Sources See Greater Chance Yuan Could Break Below 7.0 Near Term”

Back to what Rickards said in July:

“Currency wars arise in a condition of too much debt and too little growth. Economic powers try to steal growth from their trading partners by devaluing their currencies to promote exports and import inflation.

But China can’t keep going with tariffs.

They only import about $150 billion of U.S. exports. At the rate they’re going, they’ll run out of goods to impose tariffs on. Trump can keep going because the U.S. imports so much more from China than they buy from us.

But the Chinese are obsessed with not losing face. Chinese President Xi has just been named in effect dictator for life. He doesn’t want to start out his new dictatorial regime by backing down from a stare-fest with Donald Trump. So he needs another option.

For China to keep fighting, they need an asymmetric response; they need to fight the trade war with something other than tariffs.”

Finally, if you were a buyer back in that August 2015 storm you will clearly remember the squeeze on gold and particularly silver supply. Bullion dealers and refiners around the world were cleaned out of stock. Only the shorting on the futures (paper) market contained the official spot price but spreads on getting physical metal spiked and buyers were waiting weeks for delivery on back order. It was extraordinary. But it was only a prelude to when this really goes wrong.