USD Plunges – Gold, Silver & Ethereum Surge

News

|

Posted 25/01/2018

|

5812

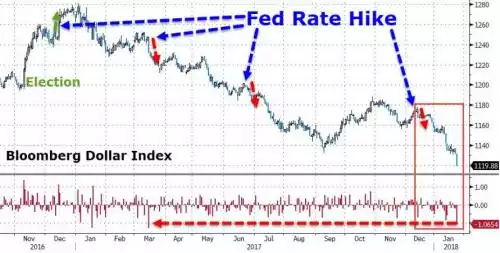

Last week we discussed the falling USD this year and last night we saw it plunge again, making this the worst start to any year in 30 years for the world’s (current) reserve currency. This fall continues a trend that has played out since soon after Trump was elected but at over 1% last night, it was its worst day since March last year.

That fall last night was largely about the US lead trade war provocations at Davos. Firstly US Treasury Secretary Mnuchin said that a weaker dollar would be good for US trade and then US Commerce Secretary Ross fired shots across China’s bow accusing it of talking free trade but acting protectionist, and more broadly saying:

"Trade wars are fought every single day... So a trade war has been in place for quite a little while, the difference is the U.S. troops are now coming to the rampart."

Them’s fightin’ words…

Whilst Mnuchin’s comments in particular may seem ‘just words’, one cannot underplay the gravity of that break from the traditional ‘always defend the mighty (everything’s awesome) US dollar’ role of the US Treasury Secretary.

Add in growing concerns around escalating investigations into the 2016 election and it’s hard yards for the beleaguered USD.

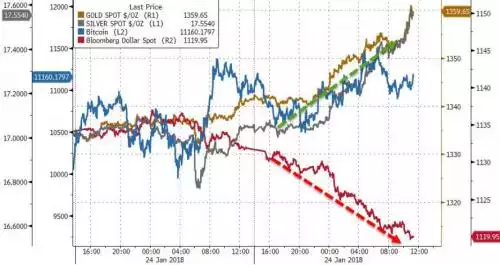

The night was as notable however for the strong gains in gold, bitcoin and in particular silver which was up 50c or nearly 3%. Now normally you’d be waiting for the offsetting news that the weaker USD saw a stronger AUD and washing out some of those gains for Aussies. But not last night. Silver soared by 61c and gold up nearly $20 maintaining nearly identical percentage gains to the US spot price. It was also interesting to see some of that money leaving USD going into the crypto space with the big 2 of Bitcoin (up 1.7%) and Ethereum (up 4.1%) both gaining in lockstep.

It would appear there may be more to come as, for the first time in 18 years, a US President is going to speak at Davos tomorrow. That the President doing so is the one driving this US Protectionist agenda and, well, not exactly known for soft touch tact… There could be fireworks…

Just as a final note… and it’s probably nothing… but that 30 year dollar drop record mentioned earlier was in 1987. Like last night shares largely shrugged it off (the Dow closed 41 points higher) but soon after the crash of 1987 happened…