US Corporate ‘Hospital Pass’ New Record

News

|

Posted 04/10/2019

|

9597

After plenty of headlines about the Aussie sharemarket losing $74b in just 2 days as we feel the effects of the growing global economic concerns (discussed here and here), today looks like we will get a reprieve after Wall Street stabilised last night.

So everything is awesome again and there’s nothing to fear as the ‘market’ became net buyers of shares last night and the price went up. That’s how it works right?

But what if the ‘market’ was the very companies themselves? We have written before about the corporate share buyback phenomenon over the last few years that sees US companies using cheap debt and undistributed dividends to buy back their own shares rather than invest in capital expenditure or put that money back into the economy via dividends. This has the desired effect of creating ‘demand’ for the shares, supporting/lifting their price, and allowing CEO’s and executives to achieve their bonus metrics.

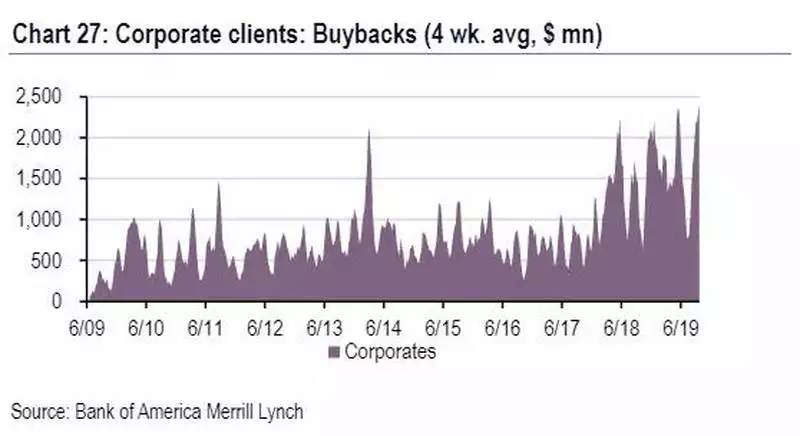

Amid all the growing concerns of a pending recession you may not then be surprised that they have upped their game a little. Indeed the latest figures from Bank of America Merrill Lynch see a record (since they started mapping this in 2009) in weekly corporate buy backs.

2019 has taken the already record year of 2018 further with cumulative year-to-date buybacks up 25% compared to the same period last year and zooming in, (US) Q3 to date is up 39% compared to last year.

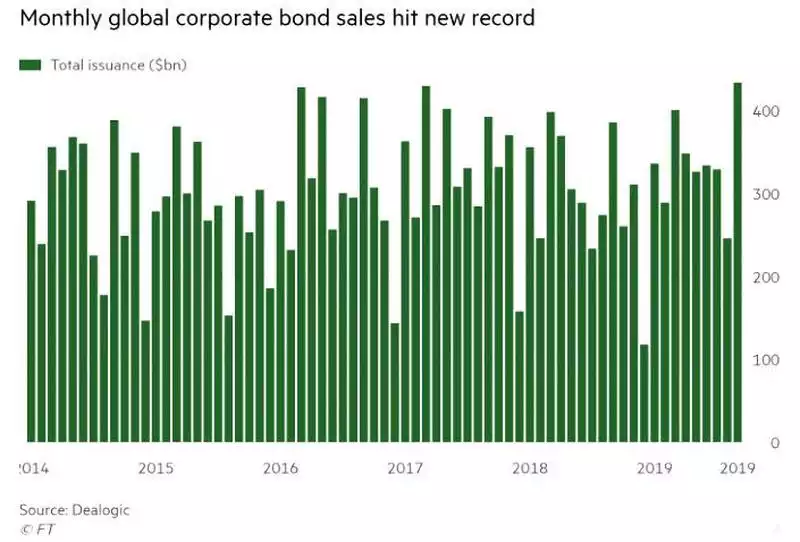

As mentioned earlier, the funding for this is predominately debt. As we’ve written many times, corporate debt in the form of corporate bonds stands up the top of many lists, alongside China, as the pick of the catalysts for a crash scenario. Indeed last time (here) we reported:

“There is now $7.7 trillion of US denominated corporate debt averaging a yield of just 2.93% with all the risk that represents. That completely dwarfs the $1.5 trillion of subprime debt that catalysed the GFC.”

Logically, if you’ve just seen the biggest spike in corporate buybacks you might expect a whole lot of new debt to pay for it. Yup. The biggest monthly corporate debt issuance on record… $434b in one month.

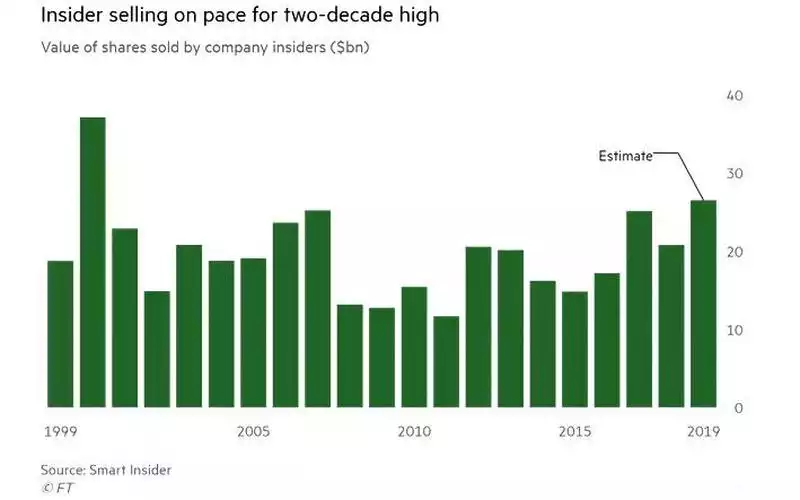

The Financial Times last week ran an article reporting that ‘insider selling’ was on pace to hit a two-decade high. ‘Insiders’ are those with intimate knowledge such as CEO’s, CFO’s, Executives and Board members together with venture capital and similar seed capital investors. To mid September they had collectively offloaded $19b which when annualised (in the US fiscal year) would equate to $26b. That’s more than what happened in 2006 and 2007 before the GFC (they knew that was coming too) and during Euro debt crisis. Only the massive insider offload before the dot.com bubble popped surpasses it.

If ever you want a classic example of the ‘smart money’ selling to the clueless masses this is it. Not only are they selling them their shares, they are getting them to fund it by issuing them junk bonds at low yields as well! What could possibly go wrong…

Speaking of what could go wrong, tonight we get the monthly official US jobs report, the US Non Farm Payrolls print. Part of the concern (somehow forgotten last night) was the possible insight as to what is coming via the jobs component of the ISM survey released this week. As you can see below (red line), it dipped below 50. That’s a contraction. The green line is the NFP which as you can see has been on a declining trend this year anyway (and hence a large contributor to the Fed cutting rates, as has our RBA on a similar trend), but the ISM is foreshadowing a potentially much larger fall tonight. The monthly correlation is by no means tight, but the trend most certainly is.

The US market is already now pricing in a 90% chance of another US rate cut next meeting. Where a big miss on the NFP tonight takes us is anyone’s guess. Don’t discount a return to the ‘bad news is good news’ days where the prospect of even cheaper debt (because things are so bad they need to cut rates deeply again) sees shares actually rally. The spring on the trap however is most certainly tightening and gold usually sees through the short term ‘irrational exuberance’…