Safe as A Bank? – Introducing GSIBs…

News

|

Posted 01/07/2016

|

6740

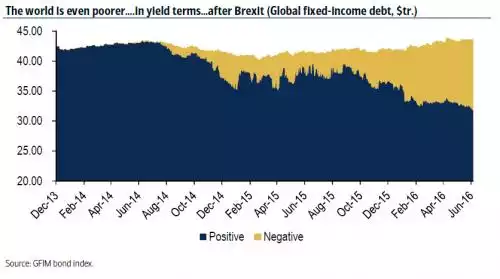

A couple of weeks ago we reminded you of Deutsche Bank’s eye watering $55 trillion derivatives exposure. Somewhat ironically that article reported on them warning of a “broken financial system” evidenced (or caused) by, at that time, negative yielding government debt exceeding $10 trillion. Today’s Weekly Wrap Podcast reports that barely a month after exceeding $10t, negative yielding government debt (post Brexit) now exceeds $11.7 trillion! As the graph below illustrates, the speed this has unravelled and scale are incredible.

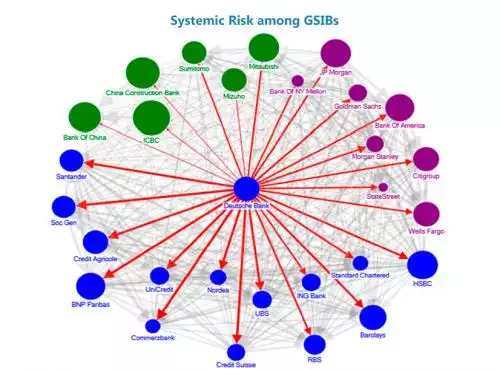

Yesterday the IMF announced that very same Deutsche Bank poses the greatest systemic risk to the global financial system in their Globally Systemic Important Banks (GSIBs) report. This announcement came in the same week that Deutsche Bank failed the US Fed’s annual stress test for the 2nd year in a row and S&P downgraded EU’s credit rating to AA-. When we say ‘systemic risk’ we remind you often in these daily news articles of the interlinked nature of the global financial system now (that includes Australia with over $1 trillion in foreign debt). From the IMF:

“Both Deutsche Bank and Commerzbank are the source of outward spillovers to most other publicly-listed banks and insurers. Given the likelihood of distress spillovers between banks and life insurers, close monitoring and continued systemic risk analysis by authorities is warranted.” Or:

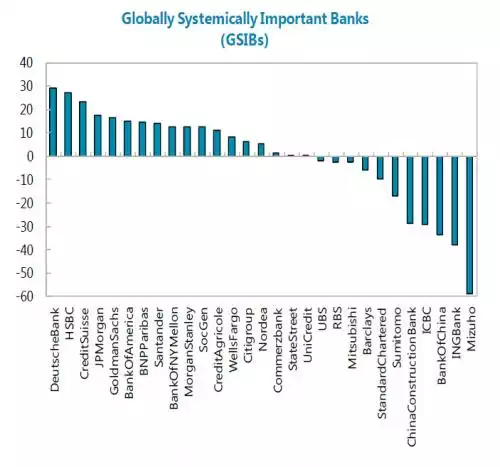

And to highlight that this is not just a Deutsche Bank problem but far reaching, some other ‘big names’ aren’t far behind:

Last night the EC announced a EUR150 billion bank bailout program for Italian banks to try and prevent a run on deposits. GSIB may be an acronym you might hear a little more about going forward…