PM Bull Run Fundamentals “never been better”

News

|

Posted 01/07/2020

|

17432

And so ends another financial year. Likely one we will never forget and unfortunately FY21 is looking to be equally eventful. Over FY20 we saw (in AUD) gold up 30%, silver up 19%, platinum flat, and the ASX200 down 11% by comparison or 1% if you had your cash (nervously) in a term deposit. In crypto, BTC is flat and ETH is down 19%. There are no end of forecasts for where to from here for gold but most are caveated around when it breaks through the key resistance of USD1800. Many a forecast has it off to USD2000 before calendar year end if it does, so all eyes are on it. There are headlines this morning of that happening last night but we’d suggest that might have been a rogue candle wick given ‘officially’ it got to around USD1788. So we wait like an expectant parent…

At the beginning of FY20 the Gold:Silver Ratio was at a near record high of 90 with all aflutter at the prospects. As we know now that rocketed up to a new record high 124. As we sit here on 1 July in the new financial year it’s at a still sky high 98 but trending down from that 124 high. Last night silver broke up through a key technical line prompting Crescat’s Otavio Costa to Tweet “This is it. The silver rush is on. Key breakout from a bullish pennant. Further monetary dilution to fund fiscal stimulus is inevitable. Big day for the precious metals space.” In relation to the chart below.

FY21 may well be silver’s year of GSR reversion (silver outperforming gold) as gold takes off.

Speaking of Crescat Capital, in mid June they released an investor update that prosecutes a very strong argument for going long gold and short equities. Here are the key excerpts, and it’s very well worth the read in terms of what FY21 may have ahead.

“The US stock market should not be trading anywhere close to the multiples it is today given the enormity of the macro events that have already unfolded this year:

- US and Iran being on the brink of war in January with still unresolved problems.

- The virus pandemic that now has an incredibly high probability of a 2nd wave unfolding.

- The steepest economic downturn in US history.

- Front-month crude oil prices turning negative in April.

- 20 million of unemployed Americans enjoying a temporary boon of Federal unemployment benefits under the CARES Act, a program that expires at the end of July.

- The savings rate shot up to 33% in April, the highest monthly level ever. A new trend in consumer savings versus spending will be a major drag on the overly anticipated recovery.

- Government debt outstanding has increased by $2.5 trillion so far this year with the deficit doubling from 5 to 10% while corporate debt issuance is surging. Treasury debt alone has consumed all the money printing by the Fed.

- The days for a US-China trade deal are long gone. Since the virus outbreak, relations have deteriorated yet again. The world’s two largest economies are firmly entrenched not just in a trade war but a new cold war.

- Riots and protests have been breaking out nationwide in the US with race discrimination and wealth inequality at the core.

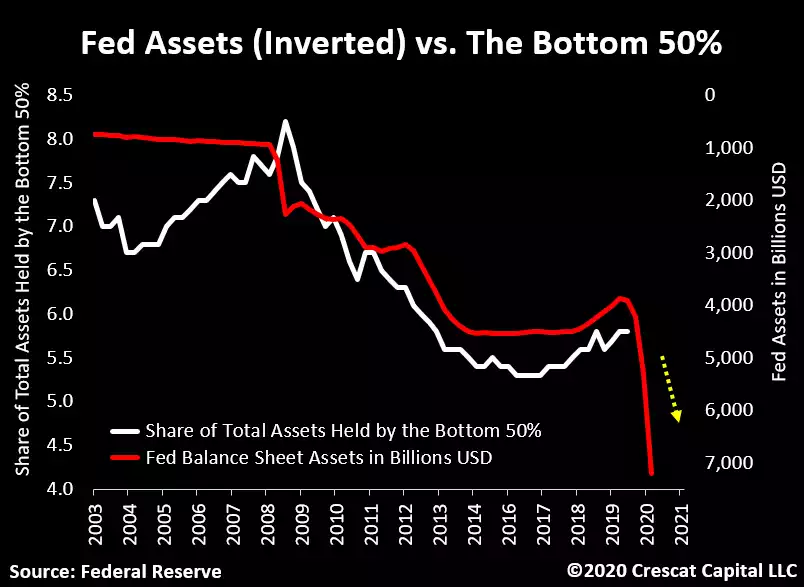

- The latest Fed liquidity injections have divided the rich and poor to the highest levels since the Great Depression creating class warfare and heightened political conflict.

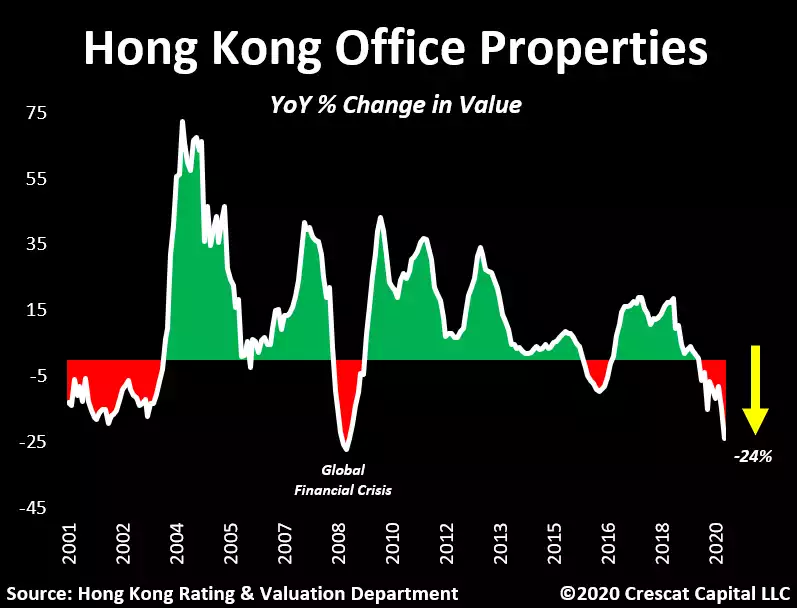

- Conflicts between Beijing and Hong Kong, and even Taiwan, are heating up again with wealth inequality in China and Hong Kong even greater than the US.

- Similar to China, Hong Kong suffers from a credit bubble of its own. Poor living standards for the bulk of Hong Kong’s younger population fuels its willingness to protest against the recent interventions by the China Communist Party. Hong Kong’s role as a global banking and trade hub is severely threatened by CCP interventions.

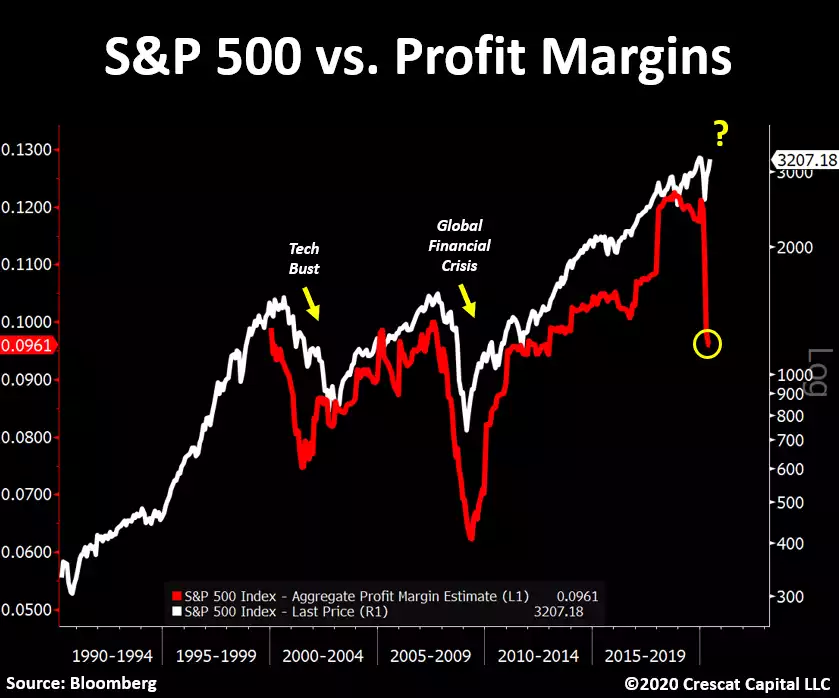

The chart below is a great illustration of how insanely disconnected equity prices are from their underlying fundamentals. S&P 500 profit margin estimates are plunging! “Buy the dip” investors are not paying attention and have simply been too eager to call the bottom.

At Crescat, we are focused on three major macro investing themes in our portfolios today:

1. Record Overvalued US Stock Market

The US stock market is absurdly overvalued. In our analysis, the gap between current prices and discounted present value of likely future cash flows is the highest ever. Speculation is rampant and being championed by a bold new breed of Millennial day-traders. The mania is based on a widespread hope in Fed money printing. The catalysts for reckoning are numerous as a major cyclical economic downturn has only just begun. With too many afraid to tread there, the potential reward-to-risk tradeoff from shorting stocks is worthy of a significant allocation today. It is perhaps one of the best macro set-ups in US history to rotate out of overvalued stocks and into undervalued precious metals.

2. New Precious Metals Bull Market

We believe we are in the early innings of a major new bull market for precious metals as a non-correlated macro asset class. There is good reason why gold and silver have served as hard money around the world for thousands of years. It is the same reason gold remains the most ubiquitous global central bank reserve asset on the planet. We expect the world’s sovereign treasury departments acting in their national interests to provide strong demand for gold in the current global economic downturn. Treasury departments must consider the value of owning government obligations of highly indebted economies with fiat money printing presses compared to the value of gold today.

3. China Currency Bubble

With even greater non-performing domestic debt than the US and even greater poverty and wealth inequality, China is run by a totalitarian government responsible for running what in Crescat’s view is the largest banking and currency Ponzi scheme in world history. The inevitable if not imminent implosion of China’s financial system and economy only adds to our globally contagious economic downturn thesis and case for precious metals.

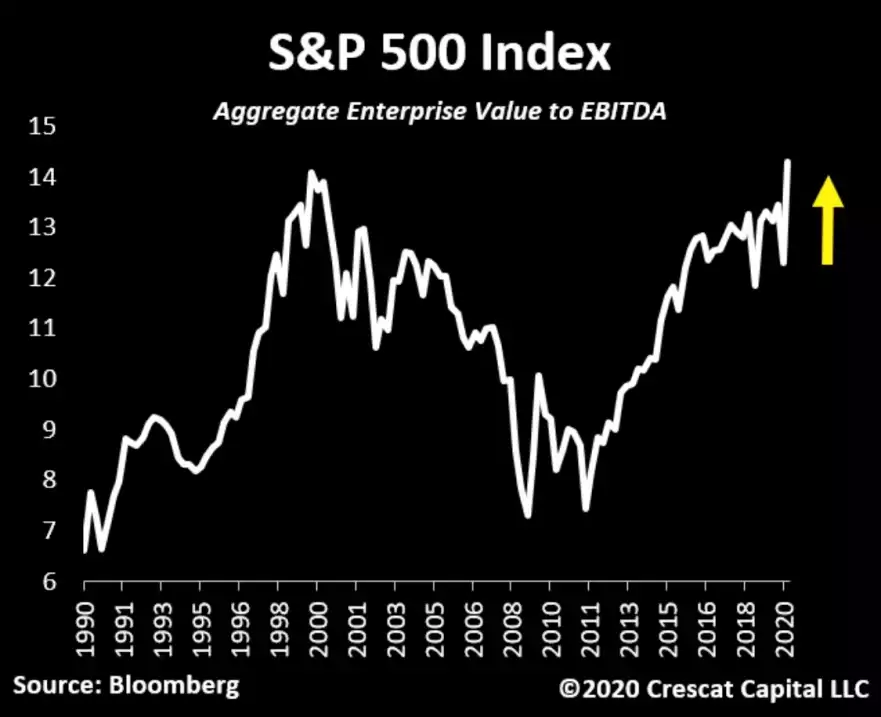

US Imbalances

Aggregate enterprise value to EBITDA for the S&P 500 has never been higher. The set-up reminds us of early February when stocks were also grossly misaligned with economic reality. We think we are about to see another reckoning moment which will mark the second leg of the bear market.

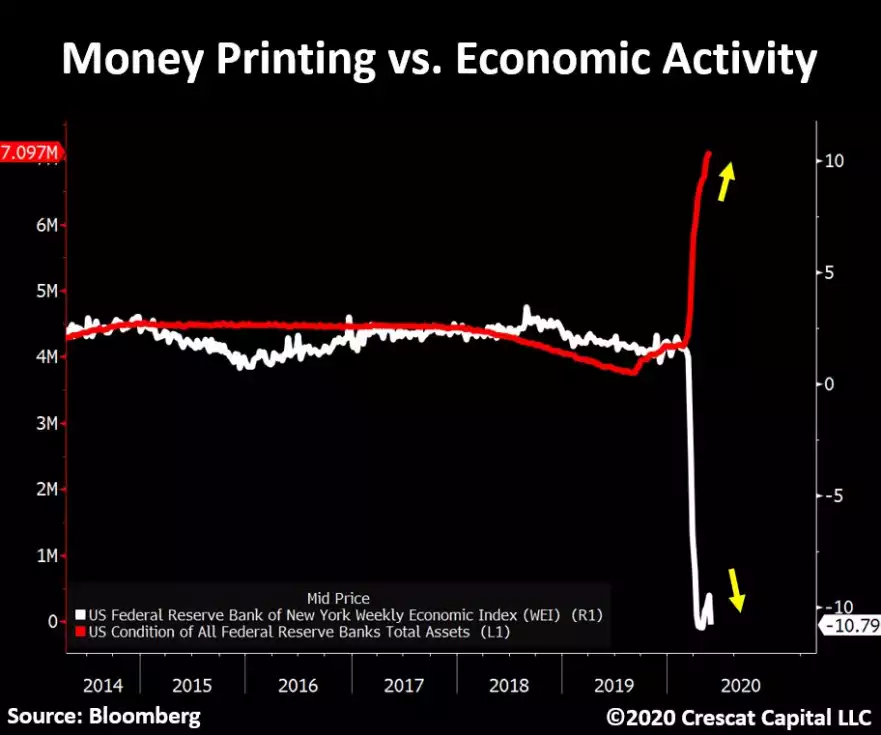

Markets driven by euphoria never end well. The US stock market today is in la-la land. It is discounting a new expansion phase of the economy at the same time as a major recession has only just begun. Since the March lows, investors have turned overwhelmingly bullish. They are trusting that central banks’ liquidity will miraculously create economic growth rather than just temporarily ease the pain of declining gross domestic incomes and crushing debt burdens. This delusional thinking is induced by the intense but short acting dopamine response to Fed money printing but completely ignores how business cycles work. Government money printing has failed miserably, repeatedly, throughout history at eliminating recessions and frequently coincides with some of the worst downturns. Today, it is a major symptom of a severe recession if not a depression.

Ongoing government fiscal and monetary stimulus does not prevent economic downturns. To the contrary, such past actions are the moral hazard that is chiefly responsible for the imbalances that have built up over time already, the set-up for today’s recessionary environment in the first place. Brutal bear markets and recessions begin from record asset valuation bubbles and debt imbalances, and that is the case again this time. In our analysis, the current downturn has only just started and has much further to play out. Economic downturns are rarely halted and reversed by government intervention so early in the process. They must play out to bring the necessary creative destruction that sets the stage for a new economic expansion and bull market. That is how the business cycle works. We have not seen anything yet in terms of such a necessary downturn in equity valuations. We only had a brief taste of it in March, the first tremor. It has been followed by a massive, but overzealous relief rally.

Money printing does not fix the economy. It is visually astonishing how divergent the Fed’s balance sheet assets and the Weekly Economic Index (WEI) has been. Developed by the Federal Reserve of New York, WEI measures activity by combining a series of other baseline indices such as same-store retail sales, consumer sentiment, initial jobless claims, temporary and contract employment, steel production, fuel sales, and even electricity consumption. The chart below shows clearly that this index hasn’t experienced any level of improvement since the March lows, a drastic comparison to the recent vertical growth in Fed’s assets.

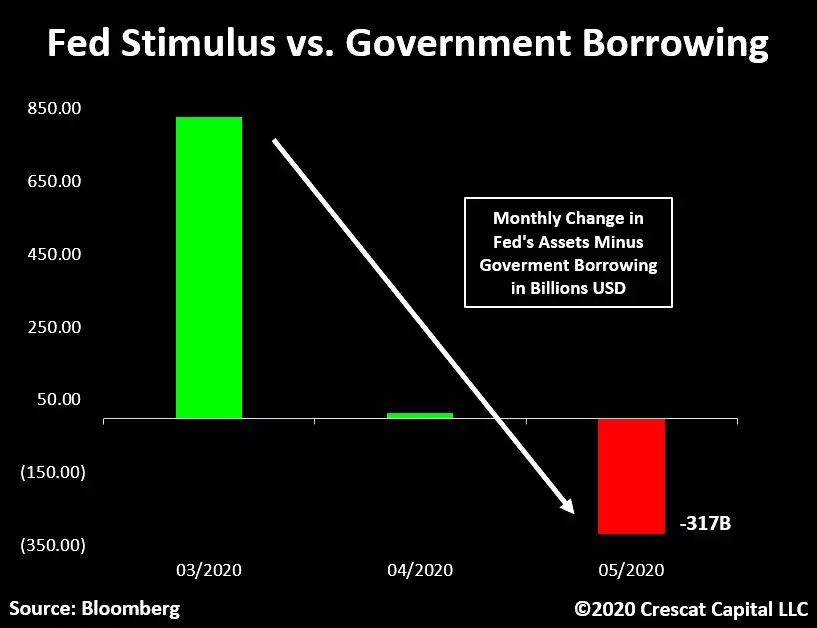

We are also seeing a significant liquidity withdrawal due to the historic debt imbalance today. The Fed’s weekly monetary stimulus has not only been drastically reduced but is also being dwarfed by the amount of government debt growth. We just had the largest monthly net issuance of Treasuries in history, $760B in May alone. This number surpassed the Fed’s quantitative easing by over $300B! It is the largest net decline in Fed assets vs. government debt since the repo crisis started back in September of 2019. The government debt is more than crowding out all the new liquidity.

In our view, the Fed is incapable of injecting enough liquidity to quell the losses in asset values associated with what was $250 trillion in global debt at a record three times global GDP before the Covid-19 crisis even began without also triggering a fiat money crisis. This is what we call a liquidity trap.

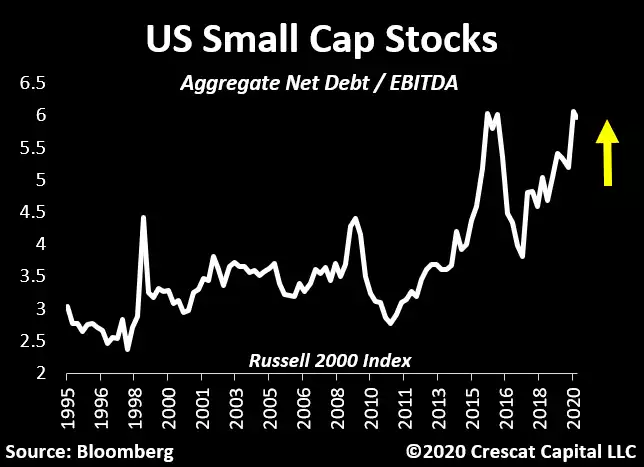

Another part of the market and economy that looks particularly fragile is small cap stocks. These stocks have never been so indebted relative to EBITDA. In terms of valuation, the Russell 2000 stocks now trade at a historic 15x EV to 2020 EBITDA estimates! There is a stunning and totally unwarranted level of optimism still priced into the markets today.

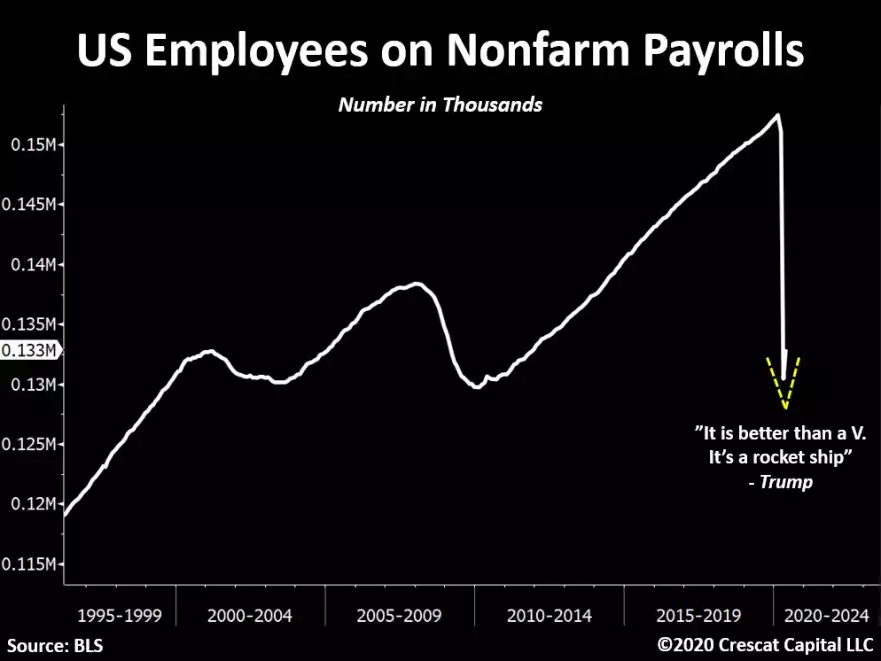

US labor markets unexpectedly improved last month but were not enough to support the bullish narrative of late. To put things into perspective, since the market peak we saw nonfarm payrolls drop by close to 22 million employees. May’s positive number, the best monthly change ever, was an improvement of close to 3 million payrolls, but even the Department of Labor questioned the validity of these numbers. The DOL said it believed the unemployment rate was understated in both April and May while May indeed did register improvement. In any case, we would need 7 months like the prior to regain the same level of strength in labor markets prior to the virus outbreak. The timid “V” shape recovery looks nothing like a “rocket ship” as Trump referred to in one of his recent tweets.

The current monetary stimulus is severely amplifying the wealth gap problem in the US. When inverted, the Fed’s balance sheet asset has followed the share of total assets held by the bottom 50% remarkably close. Logically, this relationship makes sense. As shown in the chart below, since QE 1 started, the less financially privileged parts of the society have suffered from a shrinkage of wealth relative to the overall pie. If the economy continues to prove incapable of growing organically, further monetary stimulus will be necessary and therefore only exacerbating the inequality problem.

China

In our analysis, the Chinese Communist Party is running a $42 trillion banking Ponzi scheme that is ripe to implode in a currency crisis. The US and other highly leveraged democratic developed economies are in bad shape economically today, no doubt, but its peoples need not fall into a Thucydides’ trap, i.e., to be unduly threatened by a perceived rising power. China is a menace to global freedom and democracy, to be sure, but the country has a weak hand economically which will almost certainly be its downfall. It is true and well documented that the CCP runs an unfair technology transfer regime, discriminatory licensing, outbound investment schemes, cyber hacking, and intellectual property theft. As a result, Western democratic advanced economies and their Eastern allies are doing the right thing today by disengaging with the CCP on trade. The Chinese economy is destined to implode on its own, most importantly due to its historic banking imbalances.

We should not forget that US economic prominence in the world is a result of a long-standing Constitution built on core principles that include individual rights and freedoms, rule by the people, freedom from tyranny, checks and balances that prevent abuse of power, and limited government. The grass is most definitely not greener under totalitarian communism which by contrast has a track record of persistent and inevitable economic impoverishment and human rights enslavement. It is important to understand that the imbalances in the Chinese economy are even more extreme than the US which faces its own historic imbalances. As a result, global economic contagion risks remain extremely elevated today. China at the forefront of these risks arguing for a continuation of the serious global financial market downturn and recession that only just began in March.

The Chinese Communist Party takeover of Hong Kong along with the dismantling of its democracy has destroyed the former British colony’s status as an international banking haven and jeopardized its special trade status with both the US and the UK. We believe global capital has been fleeing the country and outflow pressure only continues. Meanwhile, Hong Kong sits on one of the most overvalued property markets in the world that has just started to burst. For instance, Hong Kong office properties are now plunging by 24% YoY, the worst decline since I the Global Financial Crisis. One major difference, however, is that Hong Kong’s under-reserved massive $3.3 trillion banking system was not 9 times the size of its economy back then.

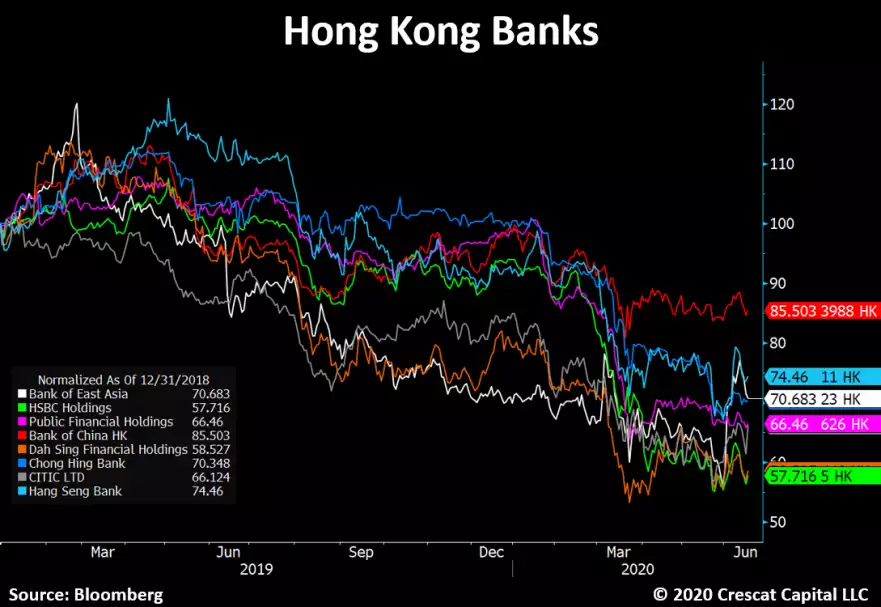

Private non-financial credit in the country is a world beating 300% of GDP. Hong Kong is on the Bank for International Settlements’ crisis watch list for that as well as its record high debt service ratio among all countries. The performance of Hong Kong’s banks over the last two years, as we show below, illustrates the risks to the Hong Kong banking system and the country’s currency peg to the US dollar.

Like with China, the world still believes Hong Kong maintains sufficient foreign reserves to maintain the value of its currency. We believe the reserves supporting both the yuan and Hong Kong dollar are encumbered. Necessarily, these reserves are the collateral in the global interbank FX markets that have been posted in defense of these currencies against years of Chinese capital outflow pressure. We believe China and Hong Kong are not netting the collateral posted for their short FX positions from their FX reserves. A currency crisis is potentially just a margin call away.

Crescat’s Positioning

At Crescat, we remain determined to capitalize on a US equity market downturn via short positions in our hedge fund strategies and believe there is much further downside for stocks at large ahead. Asset bubbles always burst. US stocks prices are way ahead of future fundamentals and poised to disappoint. Equity and credit markets are not immune from a business cycle downturn. They must eventually catch up to the abysmal fundamentals of today’s global economy that is in a severe recession.

With the Covid-19 shutdowns, we just experienced an economic shock likely worse than any single quarter of the Great Depression. It was made worse by the pre-existing imbalances that were threatening to send the economy into a recession of their own accord as had been forewarned by Crescat’s macro model. Yet stock prices are back near record highs and record valuations in response to temporary excitement over massive fiscal and monetary stimulus. It is the same unwarranted speculative mania that was driving the market in 2019 and early 2020, a pumping up of stock prices totally unwarranted by simultaneously deteriorating fundamentals and solely based on the faith in government stimulus.

The macro fundamentals for a new precious metals bull market have never been better as we have outlined herein. We are positioned long gold and silver mining equities across all four Crescat strategies.

Persistent, bi-partisan abuse of Keynesian policies has been a poor substitute for free market capitalism. The lesson is clear. Excessive and ongoing government intervention only creates mounting non-productive debt that stifles future real economic growth. Credit imbalances in the world today are at a historic high relative to global GDP. They are even worse in state-run communist China where historic banking bubbles warn of coming currency crises for both the Chinese yuan and Hong Kong dollar. Crescat Global Macro Fund continues to maintain long US dollar call option positions versus yuan and Hong Kong dollar puts with large US banks counterparties. Our goal is to profit with asymmetric reward-to-risk. While it has yet to play out in the dramatic fashion we envision, we believe it is coming soon.”