Leaving the 99% Behind

News

|

Posted 28/09/2017

|

6506

The recent German elections that saw a surge in support of the far right leaving Merkel with a slim victory and need to form a coalition, was yet another reminder of the rise in populism. This rise in populism is largely due to the “90%” feeling disenchanted, not only due to the immigration issues in Germany but the less spoken of effects of globalisation – the enrichment of the elite at the cost of the 99%. This same sentiment fuelled Brexit and Trump and now has the anti EU anti establishment party in the lead before the upcoming Italian elections. History is littered with examples of social uprising following years of suppression.

Last night the US Fed released its Survey of Consumer Finances report which again added to the evidence of this social economic dislocation. It was a US Fed document so they tried to play up the wealth creation they had created without dwelling too much on where it went. But the evidence was there and it was damning. By their own words: “The distribution of income and wealth has grown increasingly unequal in recent years”

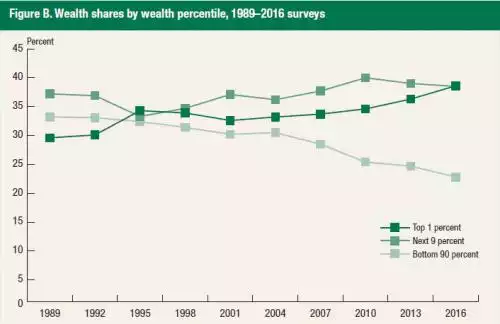

Try this for “unequal” wealth distribution - the top 1% of Americans hold 38.6% of the nation’s wealth, while that held by the bottom 90% is 22.8%, meaning just 1% of the nation are 70% richer than the bottom 90%. The graph tells the story:

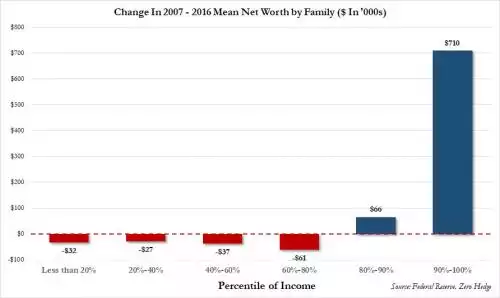

This of course has been amplified since the GFC with central banks easy money policies seeing financial and property asset bubbles ensue, most of which are held by that top 10%. The following graph shows the change across all income percentiles:

So whilst Trump’s election has many scratching their heads, these graphs are a salient reminder why. This phenomenon is certainly not contained to the US, it is a global issue.

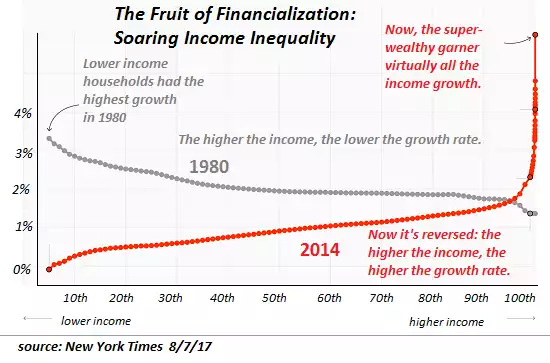

Let us leave you with the following graph and the insightful commentary from Charles Hugh Smith:

“Well-meaning conventional economists have identified a number of structural causes of rising wealth/income inequality, dynamics that I've often discussed here over the past decade:

1. Global wage arbitrage resulting from the commodification of labor, a.k.a. globalization

2. A winner-takes-most power law distribution of the gains reaped from new technologies and markets

3. A widening mismatch between the skills of the workforce and the needs of a rapidly changing economy

4. The concentration of capital gains in assets such as high-end real estate, stocks and bonds that are owned almost exclusively by the top 10% of households

5. The long-term stagnation productivity

6. The secular decline in the percentage of the economy that flows to wages and salaries

While each of these is real, the elephant in the room few are willing to mention much less discuss is financialization, the siphoning off of most of the economy's gains by those few with the power to borrow and leverage vast sums of capital to buy income streams--a dynamic that greatly enriches the rentier class which has unique access to central bank and private-sector bank credit and leverage.”