Jackson Hole – Where Doves Fly

News

|

Posted 30/08/2021

|

6671

The much anticipated and talked about speech from US Fed chair Jerome Powell at the global central bank meeting at Jackson Hole Friday night surprised to the looser or more ‘dovish’ side. Many were anticipating a firm announcement around tapering their $120b/month QE program. And whilst he did talk about tapering it was still very broad, with no set time frames, and dependent on more data. But what was made very clear, is that tapering does not mean raising rates.

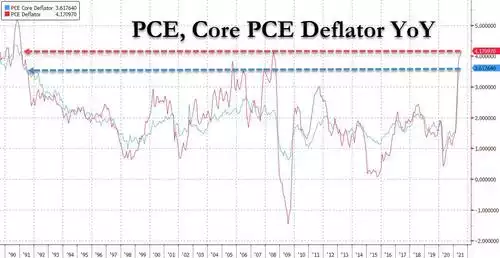

He maintained his transitory inflation stance, indeed it dominated his speech, despite their favourite inflation measure, the PCE Core Deflator coming out that very same day at its highest level since 1991 at 3.6% and likewise the headline PCE Deflator printed a 30 year high of 4.2%, more than twice their 2% ‘target’.

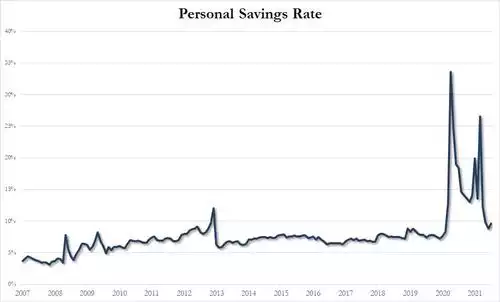

However another bit of data the same day sent mixed messages. The US Personal Savings Rate rose only modestly, remaining down near pre COVID levels. As you can see in the chart below, the rate spikes with uncertainty, particularly around employment. We also saw stronger wage growth finally flow through in the US jobs market potentially giving people confidence to spend again. And so inflation logically follows that huge draw down in savings but the big question is whether it continues on higher wages and higher house prices.

There is a growing view that the answer is yes and that inflation will surprise to the ‘sticky’ side. Higher wages and unlocked ‘money’ in a higher house value can often flow through to spending and hence more inflation.

However, regardless, Powell is maintaining a looser or more accommodative monetary policy and the sharemarkets reacted predictably on bad news…. They went to new all time highs. Indeed it was the 52nd all time high this year which if annualised would be an all time record itself.

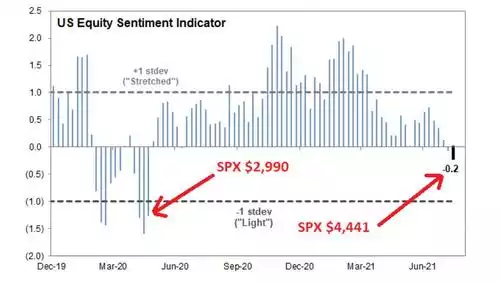

But whilst sharemarkets rallied, the US dollar fell and gold, silver and bonds all rallied too. Also perplexing is that the sharemarket rally happened on ordinary volume. Prior to Powell even speaking there was yet another short squeeze rally. The majority of US hedge funds have a bearish view of this market as even they can see it is based on stimulus not fundamentals and that stimulus must end at some time. They were expecting a more hawkish speech. Indeed the latest Goldman Sachs sentiment indicator, a proprietary gauge combining 9 different positioning and sentiment indicators just went negative for the first time in 63 weeks, or during the depths of the 2020 recession.

So it seems the smart money is short the sharemarket and buying gold, silver and bonds in readiness for the market “shock” of the Fed tapering. The Fed are still clearly set to taper late this year, but just not talking about it definitively yet…. Nothing to see here….