Is Recession now here?

News

|

Posted 26/05/2022

|

9160

Last night saw even more poor economic data and Fed minutes confirming they have no intention of backing off at least for 3 more rounds of 50bps hikes. Clearly fuel for more sharemarket falls one would think… However the market seemed to somehow latch on to the hope the Fed will stop in September? The question is will that be too late?

Last week saw consumer bellwethers Target and Walmart reporting dramatically lower earnings despite higher than expected revenue. Target reported a 4% increase in total revenue, but taking out their expenses, income fell from $2.4bn to $1.3bn (-43.3%). Walmart also faced headwinds from higher fuel prices, and inventory levels piling up. CEO Doug McMillon said the discounter’s bottom line results “were unexpected and reflect the unusual environment,” as inflation in the U.S. is at a nearly four-decade high. Customers are paying more for less, and the costs to supply those goods are squeezing margins. Target has dropped 30% on the missed earnings and Walmart is now down 16%.

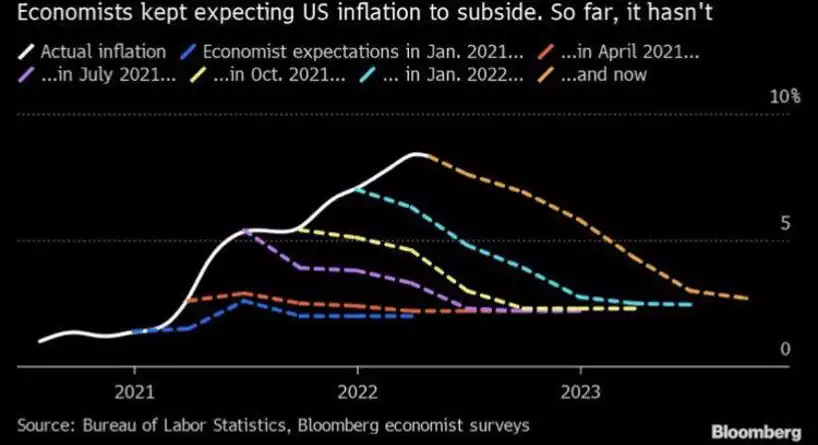

Both are suffering from increased inflation and consumers tightening up on their discretionary spending. Head of the world’s largest hedge fund, Bridgewater Associates’ Ray Dalio, argues that the US is on the cusp of stagflation and markets are yet to fully realise. For the last year and a half, inflation predictions have consistently been proven wrong.

Nasdaq deep in bear market territory - 31% below all time highs. Lockdown “stay-at-home stocks” like Zoom (-83%), DocuSign (-76%) and Peloton (-92%) are all now on life support. Fangs are down heavily as well: Facebook (-51%), Google (-28%), Amazon (-44%) and Netflix (-73%) are all deep in the red.

April New Home Sales in the US only came in at 591k annualised behind expectations of 749k. The previous month March was at 763k sales, so the bottom has dropped out of the housing market. Are we now well and truly in recession?

In Aussie Dollar terms, Gold is up 4.5% year to date, while Silver has shed a dollar this year. The safe haven status of precious metals is holding the line as risk assets continue to descend.

In an interview with CNBC Dalio, who has been rubbished before by saying ‘cash is trash’ when, apart from gold, it was the best place to be over this market correction, doubled down but with explanation and clarifying "equities are trashier"…

“Of course cash is still trash... Do you know how fast you’re losing buying power in cash?

So when I say cash is trash, what I mean is all currencies in relationship to the euro, in relationship to the yen, all of those currencies like in the 1930’s will be currencies that will go down in relationship to goods and services."

For many, US bonds are a cash equivalent safe haven however as we’ve discussed before, we have seen huge outflows and the Fed is about to start QT. Dalio agrees:

"The federal reserve is going to sell, individuals are selling, foreigners are selling, and the U.S. government is selling because it has to fund its deficit. So there’s going to be a supply/demand problem, that means that it produces a squeeze."

In other words, if the Fed are raising rates and bonds are falling with yields then rising in unison with a weak and weakening economy, that spells stagflation. The CNBC asked Dalio "Can the Fed reduce demand without breaking the back of the economy?"

“The answer is no,” Dalio replied.

He then went on to say he owns gold and some bitcoin….