Interim Silver Figures 2019

News

|

Posted 22/11/2019

|

12673

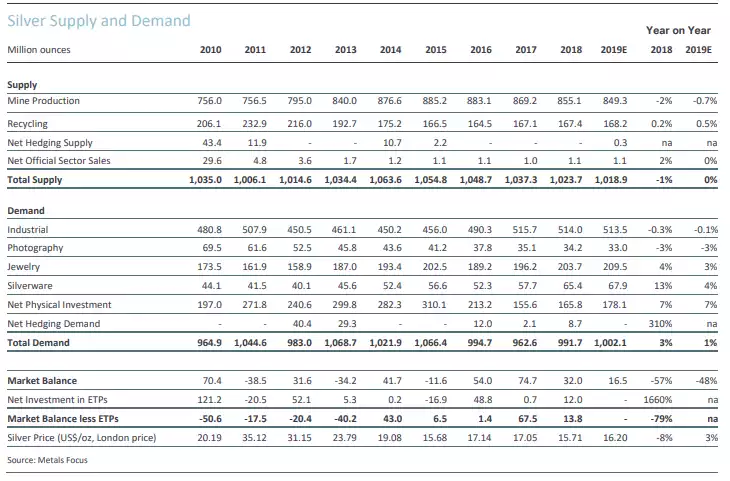

The Metals Focus / Silver Institute Interim Silver Market Review for 2019 was presented this week and below are the key findings:

Production

At the start 2019 several key producers were forecasting higher output which, following three years of losses, had the potential to deliver a return to growth for silver mine supply. However, community protests and strikes across South America, a blockade at Peñasquito and lower than expected grades at the Uchucchacua, Fresnillo and Saucito mines have weighed on the total. Production remains finely balanced and is expected to fall by 0.7% in 2019 to 849.3Moz. However, uncertainties remain for Q4 and the direction global supply takes will be dictated by the restart of disrupted operations and key mines achieving grade targets.

Industrial Demand

For the second year in a row, silver industrial fabrication will hold at a record high. Even so, in the wake of the escalating US-China trade war, several areas of electrical and electronic end-uses have struggled, broadly in line with an global economic downturn. However, their negative impact on silver demand, has been mitigated by higher silver loadings, especially in the all-important automotive sector (as vehicles become more sophisticated). In addition, silver consumption in the photovoltaics sector has also grown as more countries push ahead with renewable energy projects in 2019.

Jewellery Demand

Global silver jewellery and silverware demand is projected to grow by 3% and 4% respectively in 2019. For both, this year’s increases are almost entirely led by India, where gains have been assisted by increasing awareness of sterling silver, growth in organized retailing, along with the benefits from restrained silver prices in the first half of 2019. By contrast, US jewellery consumption, the world’s second largest single-country market, has remained relatively soft due to such factors as competition from gold and company-specific retailing problems. Finally, structural factors have led to further losses in China.

Investment Demand

Healthy gains are also expected for physical investment in 2019, with sales of silver bars and coins projected to rise by 7% to a three-year high. In the US, investment is on track to record its first annual increase in four years, thanks to improving price expectations and rising price volatility, although levels remain historically low. In India, the partial recovery that started in 2017 has continued this year, although the sharp rally in the rupee price has seen sales ease recently, particularly in rural areas.

Below is a chart showing the extent of total silver investment holdings:

Balance

Overall, the silver market is expected to record a small surplus in 2019. That said, this metal should be easily absorbed by investors as rising macroeconomic uncertainties and fresh monetary easing by major central banks rejuvenated the appeal of safe haven assets from mid-2019 onwards which, looking ahead, should continue to benefit precious metal prices.