IMF Warns of “second Great Depression”

News

|

Posted 05/10/2018

|

59387

The International Monetary Fund’s latest Global Financial Stability report is placing the blame firmly on the failure of governments and regulators to learn the lessons of the GFC and install reforms to protect us against the same kind of reckless behaviour that nearly brought the system down then.

Whilst acknowledging work done by the banking system around reserves, they say complacency is evident on the back of long periods of low interest rates and low volatility whilst global debt levels have risen well above those at the onset of the GFC. They said global debt is up 60% since the GFC to an all time high of $182 trillion and much of this new money had not found its way to higher levels of research and development or more general investment in infrastructure. They said it had also left the global economy in a weaker position, especially as it enters a period when a downturn is possible.

In a further warning to the rising levels of inequality within this context, they said much of this money had been hoarded by the wealthy rather than reinvested in the general economy. This speaks directly to the many articles we have written about the use of debt to fund share buy backs to inflate share prices (and executive bonuses) rather than in the companies themselves.

Their concerns extend too to the amplification of the ‘too big to fail’ dynamic with the growth of behemoths like JP Morgan and the Industrial and Commercial Bank of China (ICBC) to scales in excess of that before the GFC. From the IMF:

“The sequence of aftershocks and policy responses that followed the Lehman bankruptcy has led to a world economy in which the median general government debt-GDP ratio stands at 52%, up from 36% before the crisis; central bank balance sheets, particularly in advanced economies, are several multiples of the size they were before the crisis; and emerging market and developing economies now account for 60% of global GDP in purchasing-power-parity terms – which compares with 44% in the decade before the crisis – reflecting, in part, a weak recovery in advanced economies.”

There has been market turmoil the last couple of nights with bonds getting absolutely hammered with yields spiking to the point where UST 30Y is back to 2014 levels and 10Y the highest since 2011. Higher yields means higher cost of servicing all that debt and all that complacency disappears, potentially very quickly. The hawkish statements (hints at more hikes to come) from Fed Chair Powel on Wednesday have precipitated those bond falls and last night very heavy sharemarket falls on Wall St.

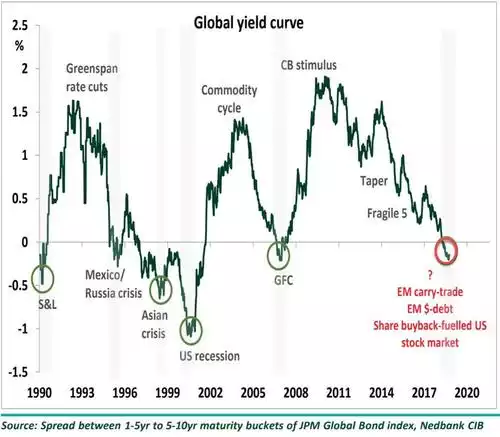

More broadly the Global Yield Curve (explained previously here) has inverted for the first time since the GFC:

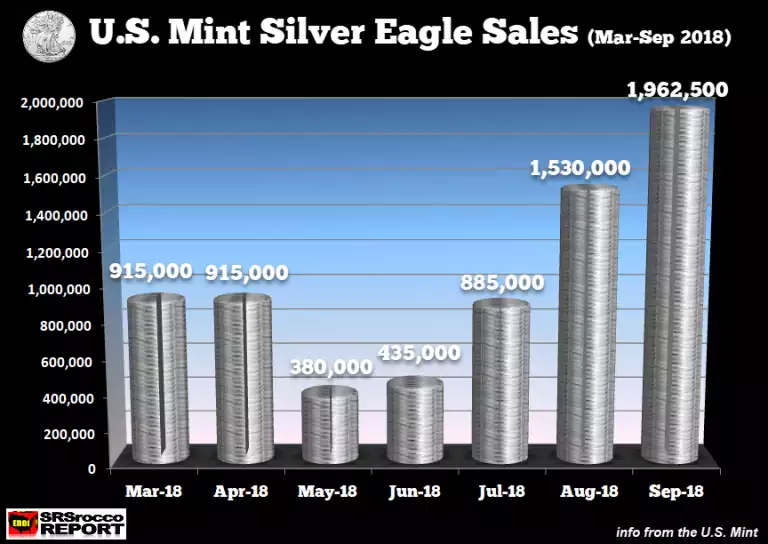

Whilst this is all playing out we are seeing an interesting development in the silver market where the commercials (including the aforementioned TBTF JPMorgan) are now long silver on Comex and that barometer of investor demand, the American Silver Eagle coin has done this:

But for most, everything will remain awesome (until its not, in hindsight) and there is no need for an economic hedge like gold or silver.

Ex UK prime minister Brown summed it up nicely last month when he said the global economy was “sleepwalking into a future financial crisis”.