Hedge Fund Moguls Mobius and Paulson Recommend Gold

News

|

Posted 08/09/2021

|

6600

Famed Fund Manager Mark Mobius has advocated for the Golden Rule: “10% should be put into Physical Gold”. The Mobius Capital Partners founder argued, “Currency devaluation globally is going to be quite significant next year given the incredible amount of money supply that has been printed.” With US$86.6 Million AUM, it’s not the biggest fish in the sea, but is a part of a growing chorus of market participants seeking a safe haven.

Similarly intentions have been signalled by John Paulson, founder of Paulson & Co, famous for using credit default swaps to bet against the US subprime mortgage lending market to the tune of $4.9 billion. Speaking with Bloomberg last week, he cited gold’s propensity to perform well during high-inflation periods - “as inflation picks up … the logical place to go is gold… because the amount of money trying to move out of cash and fixed income dwarfs the amount of investable gold, the supply and demand imbalance causes gold to rise.” These statements aren’t news to our readers, but that the major money managers on Wall Street are the ones making them is significant.

In comparison to the vast majority of fund managers, Mobius and Paulson are still early movers into the fray, they are way behind Ray Dalio. The Bridgewater Associates founder has been making the case to the mainstream since 2017. Moreover, he has put his “gold” where his mouth is, by maintaining a total allocation of 2.63% of Bridgewater’s $15.59 billion fund to gold as per 13F Filings Q2 2021. We’ve previously covered his warnings of government debt monetisation - so to say he is ahead of the curve is an understatement. Along with Palantir’s $50 million physical gold holdings covered in last month’s news, there are growing indications that fund managers are looking to diversify their positions with gold.

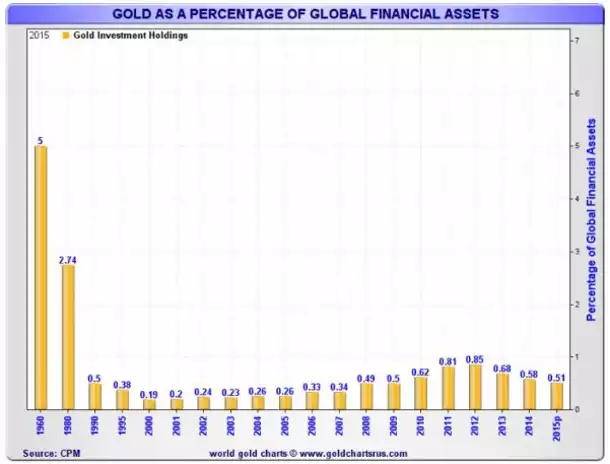

Modern Portfolio Theory, pioneered by Harry Markowitz, was a staple of graduate courses for finance majors and the industry alike from the mid 1950s. It recommended a 5-10% gold weighting in a balanced portfolio. This reflected a much longer tradition of money managers hedging against adversity with gold, with the “Golden Rule” of a 10% hedge position. Even in the 1960s this was reflected in Portfolios as per the Gold as Percentage of Global Financial Assets.

Following the closing of the gold window in the 1970s, this gold to financial asset ratio almost halved to approximately 2.74%, before crashing in the 90s and staying down below 1% ever since. Watch out if this percentage rises back up towards 1980s let alone 1960s levels.