Gold Doesn’t Yield & Doesn’t Need To

News

|

Posted 06/08/2020

|

8792

For the big money US Treasuries have always represented their main go-to risk free trade, the safe place to put their money. Whilst essentially buying debt, the fact that it is backed by the US has meant it is still perceived to be risk free. Over the last few years it has been one of the best trades for macro investors.

However even bond bulls are now raising serious doubts as to the merits of bonds when their yields are essentially already zero bound. Remember when you buy a bond note the price you pay is inversely proportional to the yield it returns. As interest rates have headed to zero the price of those bonds has risen. But where to from here is the question on bond traders’ lips.

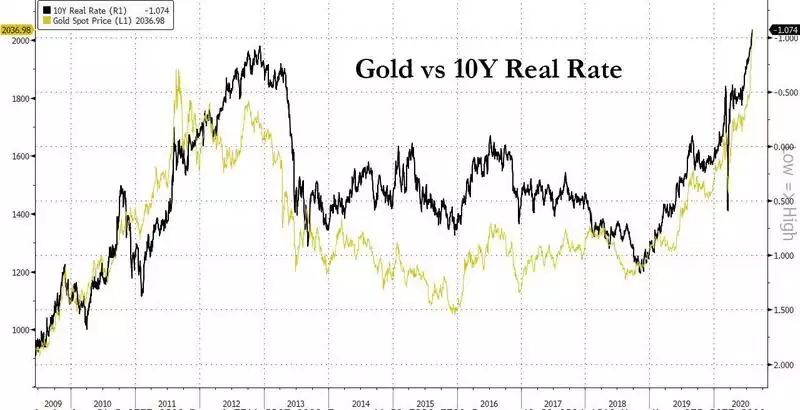

As we’ve shared many a time, the correlation between the gold price and the REAL rate on bonds, i.e. the yield less inflation, has been incredibly tight as you can see in the following chart:

We are now in the space where real rates on the benchmark 10 yr Treasury is negative 1%. That of course is bullish for the competitor gold which pays no yield. When faced with two choices for safe haven, Wall St types and probably your financial advisor have said ‘gold is not an investment as it doesn’t yield’ and have favoured bonds over that ‘pet rock’ they like to call it (pet rocks don’t pay trailing commissions etc like managed funds…). The difference of course is that one is a debt instrument piece of paper with counterparty risk, and the other has intrinsic value and no paper promise, and now has an even playing field with real rates on bonds now negative. Moreover, the background has changed with the level of central bank and government intervention. From Bloomberg:

“Spurred on by real yields at record lows and monetary dangers ahead, asset allocators are primed to start ditching some of their government debt holdings, the theory goes. Given the size of the fixed-income universe, it wouldn’t take much to power the gold price to fresh and dizzying highs.

Managers like Plurimi Wealth LLP’s Chief Investment Officer Patrick Armstrong are a case in point. Armstrong has cut back on bonds and now holds 7.5% of the firm’s balanced portfolios in gold -- the most ever. He also started buying gold-mining equities in March. The allocation shift is an about-turn for the investor who was shorting bullion five years ago when prices languished near $1,100 an ounce compared with $2,040 today.

“The reason I want to hold gold is because the future is just going to be a continuation of what’s happening now: more money printing,” he said.”

As we reported earlier this week, even after this rally and the record amounts flowing into ETF’s, the proportion of gold in portfolios is still below 2011 & 2012 highs. Bloomberg also notes:

“Gold positions in ETFs and the Comex represent about 0.6% of the $40 trillion that’s invested in funds globally, according to data from UBS Group AG. That’s less than the highs from the last gold market peak in 2012 and 2013. Just returning to the peak would mean purchases of more than 81 million ounces.

“Positions could easily double without the allocation looking extreme,” Joni Teves, a strategist at the bank, wrote in a report. She cautioned that her analysis isn’t an estimate for future gold allocation, but illustrates how a small increase among a wide pool of investors could have a major impact.

There’s even more reason for managers to consider gold with U.S. 10-year real yields, which strip out inflation, plumbing new lows near minus 1% this week.

“We see gold as providing better risk-reward characteristics than Treasuries in such inflationary environments,” said Guillermo Felices, head of research and strategy at BNP Paribas Asset Management’s Multi-Asset, Quantitative and Solutions team.”

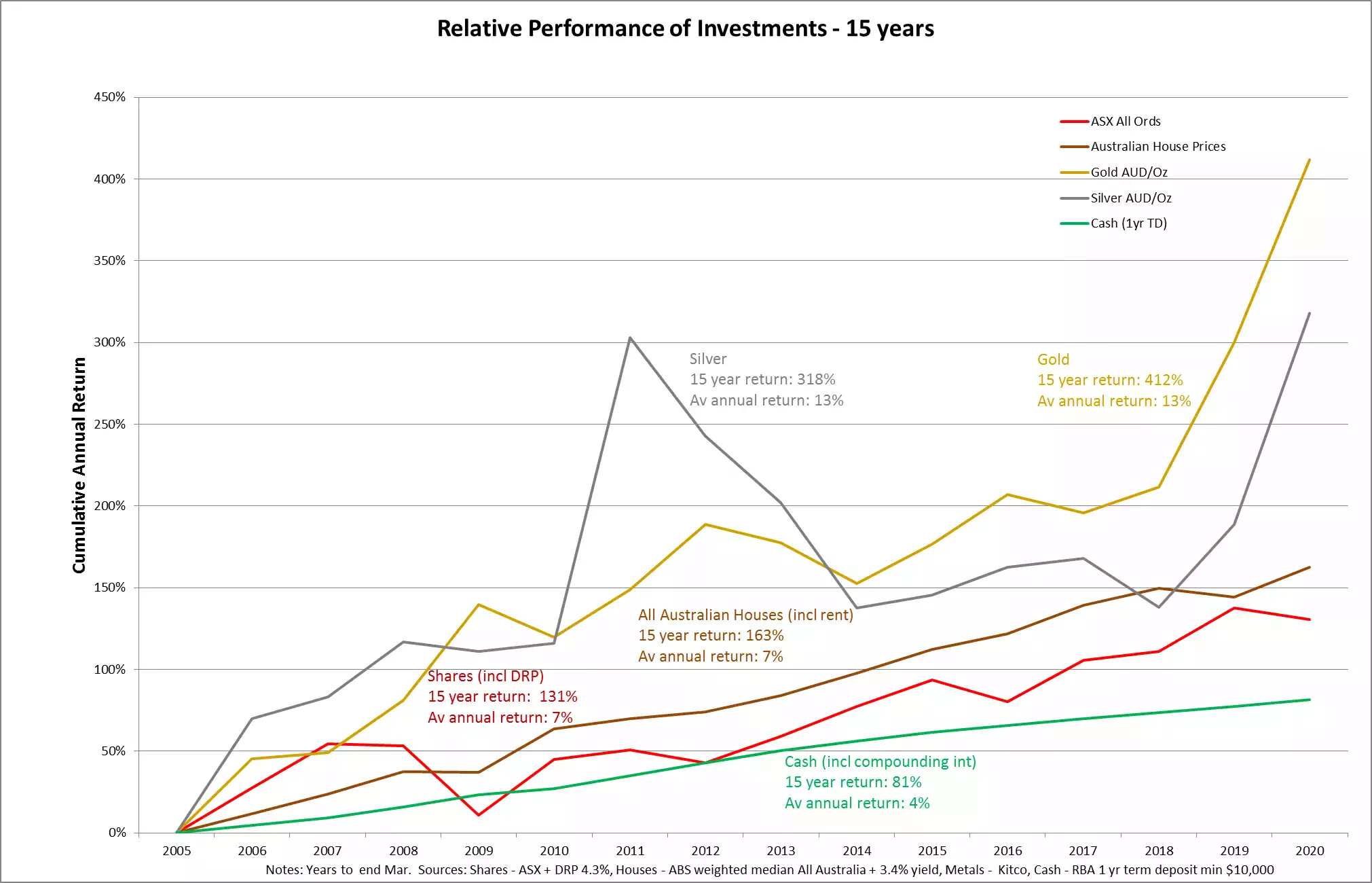

The lack of yield ‘problem’ for gold can very easily be stripped out by levelling the playing field. The chart below shows the performance for the main Aussie asset classes over the last 15 years. It builds in dividend reinvestment plans for shares to include yield, it includes rental yield on property, and it include interest on a term deposit for cash, all compounding. Gold and silver of course have no yield so their growth is just capital growth. As you can see, the ‘pet rocks’ of gold and silver have very easily outperformed every investment over the last 15 years. You can see that it does particularly well when those brown and red lines dip, housing and shares. The big question is now, how big will the next dip of house prices and shares be and what will happen to gold and silver when it does…