Flight to Safe Havens

News

|

Posted 06/07/2016

|

5079

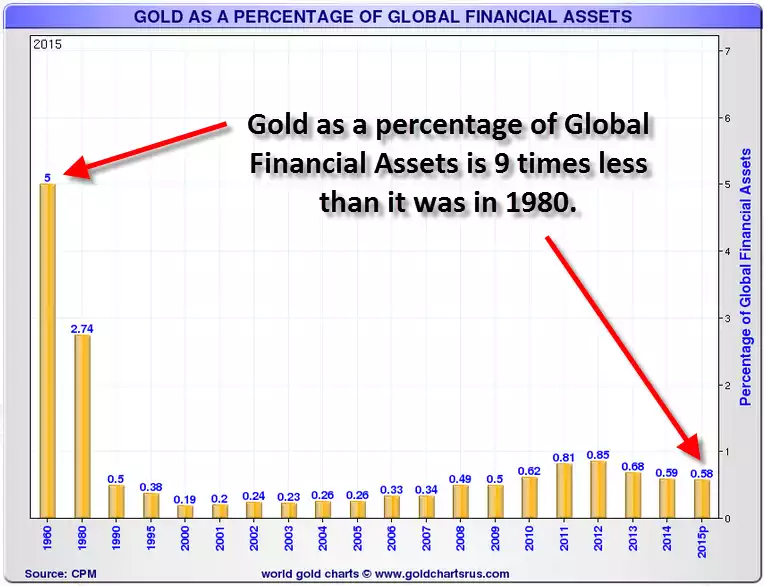

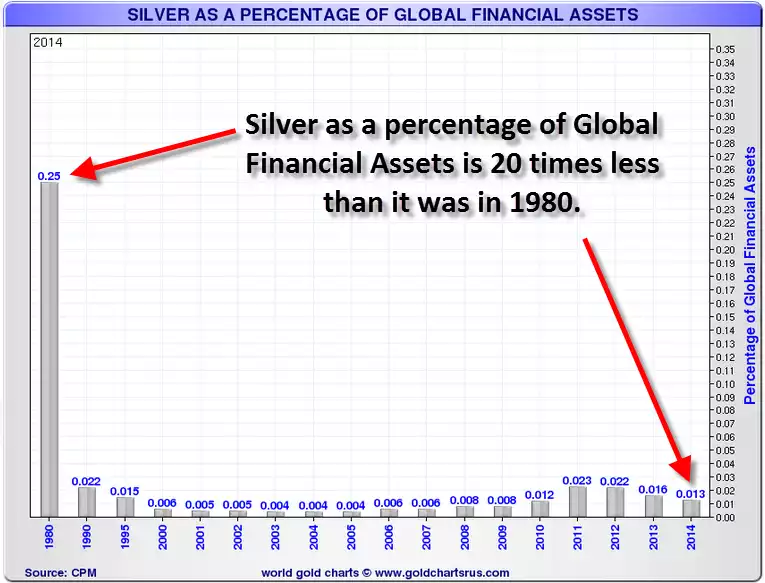

As a follow on from yesterday’s article about the size of the ‘paper’ gold and silver markets we expand the discussion to the total gold and silver market as a reminder of the sheer scale of the difference. We’ve reported before that gold accounts for about 0.58% of global financial assets. What we haven’t seen before is the amount silver equates to. Sharelynx.com have recently produced the two charts below which show that currently silver only accounts for 0.013% of global financial assets.

The last estimate of the total of global financial assets was around $295 trillion. That includes shares, bonds, etc. We discuss this in our new Why Buy Bullion download. If you haven’t already, it’s worth a look (even for old timers).

As we’ve seen in 2016 to a comparatively very small degree, when financial markets get spooked they go to safe havens like gold and silver. Whilst gold and silver are up 25% and 41% at the time of writing for the year, they are small gains to what has historically happened before when there is a flight to safety.

The other safe havens of bonds and the US dollar have their own challenges at present. Firstly, over a third of global government debt (bonds) is now yielding negative returns. Apart from the nonsensical prospect of paying for the privilege of holding government debt, with the fragile nature of the global economy (principally because of that same debt burden) maybe bonds aren’t as safe as they seem. That leaves the USD. There is already plenty of expectation that the US Fed will unleash QE4 and even talk of negative rates (NIRP) for the US in one final fling to try and save the system. Any such move would see the USD plummet, so again, not a great prospect. That leaves gold and silver, and probably why they have performed this role time and time again over thousands of years.

So, again, ask yourself what happens to the price and availability when that $295 trillion tries to get into the 0.58% and 0.013% spaces…. To paint a clearer picture for the gold case with the ‘flight’ analogy… an Airbus A380 with 850 passengers catches fire. Everyone tries to get on the adjacent 5 seater Cessna. What will tickets cost? With silver there is only one seat in the Cessna….