Fed Flags June Rate Rise!

News

|

Posted 19/05/2016

|

5059

Markets reacted strongly last night on the release of the US Fed minutes for the April meeting where they held rates steady. The reaction came from the surprise that “most” on the (FOMC) Fed committee expected the next hike to be in June. This took June hike odds from just 4% to 28% before and after the news. September is now running at 60%.

The minutes illustrated a Fed painted into a corner. They acknowledged the growing threat of asset bubbles fuelled by their easy money (note to RBA….), they made it clear any hike in June would be ‘data dependent’ (listeners to our weekly wrap podcast know that is not great), and moreover they continue to be greatly concerned by the global economy and the knock-on effects of a rate rise. Indeed the April meeting minutes mention ‘global’ 15 times. They specifically mentioned the Brexit referendum on 23 June and “unanticipated developments associated with China’s management of its exchange rate”. The latter is the real elephant in the room. Since the market routs caused by the Yuan devaluations in August last year and earlier this year, China have ‘played nice’ and not ventured there again – helped of course by a falling USD. A rate rise, as we saw just on the expectation alone last night, sees a stronger US Dollar. A stronger US Dollar when you are pegged to it like China’s Yuan and you are a major exporter is not a great thing. Add in growing tensions in the South China Sea and China have at their disposal a pretty big stick.

In the short term, as we again saw last night, a stronger USD can see downward pressure on gold. It came off USD20 on the news last night alone as the USD jumped. The key thing investors might want to remind themselves of is the bigger picture of the ‘unintended consequences’ of that rate rise and the higher USD and ask a. Will they actually do it?; and b. What will happen to global markets afterward. It might be timely to look at the market action in January after December’s rate hike…

This is by no means a simple situation. The Fed knows they must at some stage hike or otherwise continue to fuel the biggest debt binge based asset bubble in history. On the other hand there is probably the realisation they have left it too late and any hike could well trigger one of the biggest crashes in history – it is a globally connected system of debt, derivatives and currency wars like never before. A couple of mentions of ‘history’ there…. There is one asset class that has a few thousand years of history of being the safe haven asset of choice….

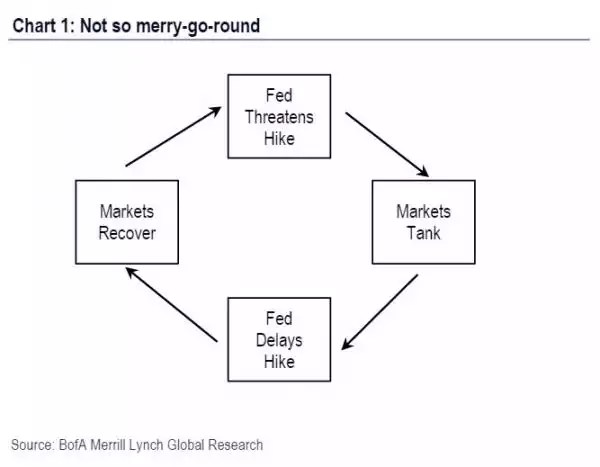

Finally this diagram sums up the other outcome courtesy of Bank of America Merrill Lynch…