Fed “No News” Statement Fuels Gold Bulls & Dollar Bears

News

|

Posted 27/07/2017

|

7177

The Federal Reserve’s overnight statement which, as was widely expected, left rates untouched was remarkable in terms of how unremarkable it was.

The concept of “balance sheet normalisation” which first featured in the Central Bank’s vernacular only 2 months ago or so, again made an appearance and was again accompanied with imprecise timing guidance such as “this year” and “relatively soon”.

We addressed the topic of balance sheet reduction on the 6th of this month when covering the release of the June Fed minutes and again exactly one week later on the 13th of this month when covering the conflicting messages being transmitted by Janet Yellen during her House of Representatives testimony. It is noteworthy that the gold price at that time was $1220.30 compared with the $1260.30 printed this morning; a rise of exactly $40 US in exactly 2 weeks.

The Fed’s overnight statement communicated that “the Committee expects to begin implementing its balance sheet normalization program relatively soon, provided that the economy evolves broadly as anticipated; this program is described in the June 2017 Addendum to the Committee’s Policy Normalization Principles and Plans”.

Again, this is nothing new and the fact that the statement was conditional upon a “broad evolution” of the economy leaves wiggle room for changes in future policy direction.

The unremarkable nature of the Fed’s statement is supported by CIBC Capital Markets senior economist Avery Shenfeld who described the release as the “no news statement” and by Brown Brothers Harriman (BBH) who said that “the FOMC statement reads very much like the June statement.”

Avery Shenfeld elaborated by saying “of course interest rates were left unchanged, and they weren't quite ready to start the clock on letting bonds roll off their balance sheet, but saying it’s coming "relative soon" is in line with our view that it’s on tap for the September decision”.

BHH analysts also elaborated by saying that the lack of surprises in the Fed’s statement “freed up the market to keep doing what it was doing prior to the Fed decision”.

But what exactly was the market doing prior to the Fed decision? The answer may lay in the following two charts and the fact that the US dollar is now in a bear market.

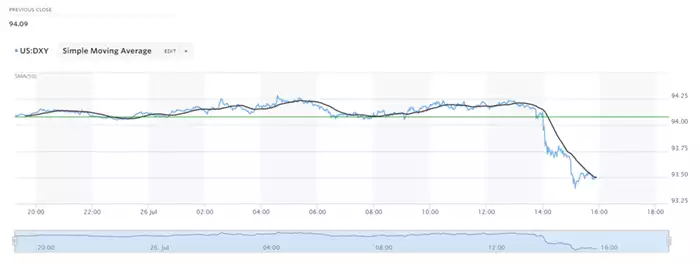

Below is a plot of the US Dollar Index produced this morning for our readers with the post-Fed drop along with its notable impact on the current gold price (pictured above) being an obvious feature.

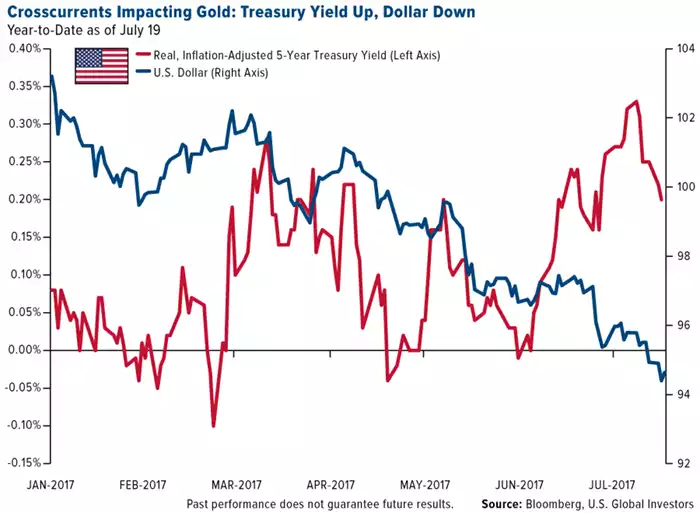

Frank Holmes, US Global Investors CEO discussed the longer term picture of the USD this week. On Monday, Frank wrote about the interesting scenario surrounding the 2017 five-year Treasury debt yield trend and the gold performance resulting from the Dollar’s continued slide. Adjusting for inflation, Frank notes that this year has seen an approximate 150% rise in the yield offered by the five-year instrument which would typically see significant downward pressure on gold given the opportunity-cost inherent in holding the latter in such a scenario. The USD bear market however (which saw a 13 month low in the USD:EUR pair just last week) has seen a greater than 8% YTD rise in gold which is atypical in such a bond yield environment. The scenario is pictured below courtesy of data from Bloomberg.

To succinctly articulate a conclusion, we delegate the remainder of this article to Frank Holmes himself.

“That gold is still holding at its current level—despite rising rates, despite a stock market that continues to rally—is ‘encouraging.’

All of what I’ve said so far pertains to the near-term. Gold’s medium- to long-term investment case, I believe, looks even brighter. Many unsettling risks loom on the horizon—not least of which is a record amount of global debt—that could potentially spell trouble for the investor who hasn’t adequately prepared with some allocation in a safe haven.”