ECB to go QE3? – To Infinite & Beyond!

News

|

Posted 07/09/2016

|

4913

Gold and silver had a cracker of a night last night, silver in particular up 2%. Whether it was the poor economic and employment data released last night (which as usual we will report in the Weekly Wrap on Friday), news of Trump hitting the lead in a number of polls, or the heightening tensions over the South China Sea, it’s hard to know.

What is not hard to know is that this insane world of central bank stimulus artificially inflating assets must end badly and its feeling soon. History is littered with examples of economic collapse occuring when debt reaches levels beyond what can be repaid.

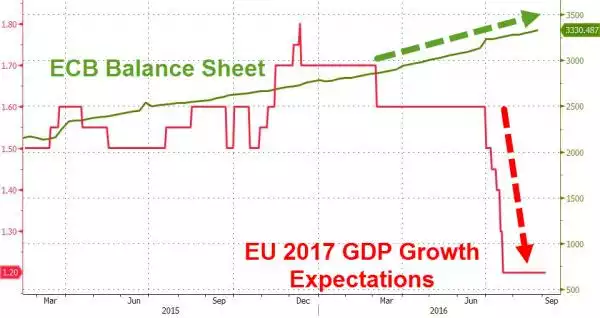

So it beggars belief that, when you look at the graph below of the ECB’s balance sheet (and we looked at a few yesterday) and the resulting real growth, that they are now expected to increase it at their meeting this week. The ECB are now well into their current QE program of buying $1.9 trillion of assets using freshly created money. That program is due to finish in March 2017. In a Bloomberg article over the weekend they reported that 80% of surveyed economists expect this to be extended at the ECB meeting this week.

As we’ve reported previously, so rampant is their program that they maxed out on sovereign bonds to buy and are now buying corporate bonds as well. A similar proportion of economists also see them ‘relaxing the rules’ to allow them to broaden their purchasing scope – i.e. increase the risk profile.

The comparison has been made to QE3 in the US when the then Fed chief Bernanke, introduced the 3rd round of QE but that time made it open ended for ‘as long as necessary’. Given the results to date of the ECB QE have seen little success with inflation in the EU running at just 0.2% in August & July (per the graph below), the IHS Markit economic growth index at a 19 month low, and GDP (as can be seen above) heading down not up, that could be for quite a while before they maybe learn that it just doesn’t work (take a look at Japan and US) and racks up enormous amounts of debt.

So again the missing piece in all of these exercises is what happens to that debt and how much money can you print before people lose faith in it?