Dollar Sinks Further As ADP Report Falls Short

News

|

Posted 03/08/2017

|

5306

Yesterday saw the release of the July 2017 National Employment Report from Automatic Data Processing, better known as ADP. The ADP National Employment Report is a monthly publication which uses real, anonymous payroll data sourced from approximately 400,000 US based businesses in order to quantify monthly changes in private employment within the United States. The report’s sample size approaches 24 million workers according to ADP.

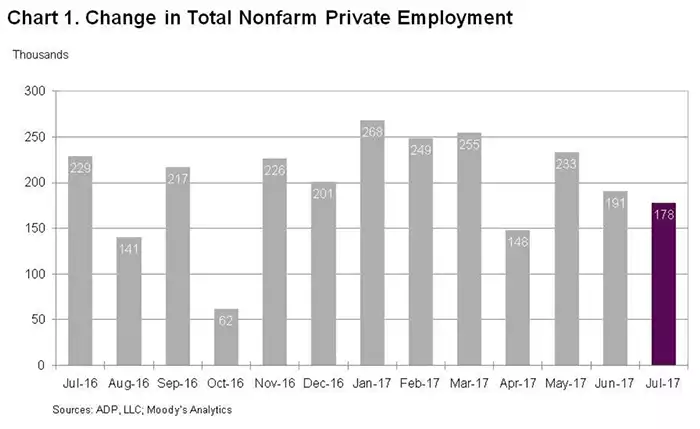

As pictured below from the report available here, the economy in the US managed to add 178,000 jobs for July; a figure that falls shy of the expected 190,000 and of the upper estimate of 225,000 jobs.

The underwhelming private payrolls report comes just two days ahead of government nonfarm payrolls data due for release on Friday and follows disappointing ADP reports in April and June. This is suggestive of a slowdown in the labour market in the United States and adds weight to the idea that the Federal Reserve may need to abandon any plan to hike rates for the rest of the calendar year.

The following chart taken from ADP’s media release illustrates the context of this print and evident is a downward trend that started around the 268,000 print in January this year.

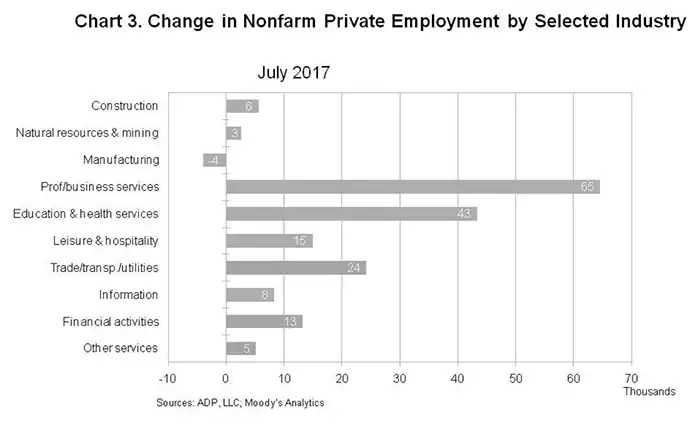

Notable in the chart below is the contraction in manufacturing, an important point given that manufacturing is a sector of the economy that is arduous to re-establish once lost. This is supported by comments from ADP vice president Ahu Yildirmaz who remarked that “as the labour market tightens, employers may find it more difficult to recruit qualified workers.”

Furthermore, CNBC’s Jeff Cox reminds us that the employment numbers are only part of the picture by writing only 7 hours ago that “wages have been the bigger story, with hourly earnings growth stuck at around 2.5 percent.”

The fact that the employment numbers fell short of expectations is significant in terms of its impact on the US currency. A higher than expected print is generally considered bullish for the USD, whereas a lower than expected print is generally considered bearish. Indeed these dynamics did in fact play out.

The ADP release saw an already weak USD fall further with the trade-weighted US Dollar Index falling 0.39% to hit 92.56, the lowest figure seen this year so far.

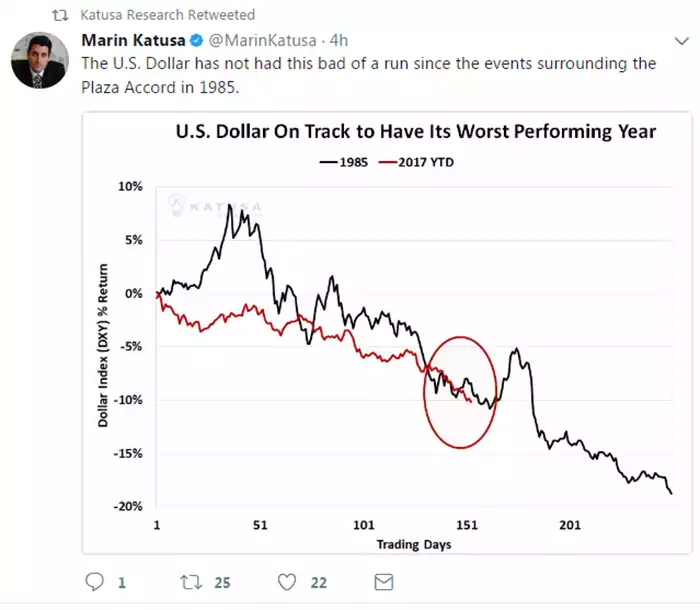

The dollar’s woes are topical at the moment and show no sign of abating. To conclude, we again find this morning’s tween from Katusa Research illustrative of the dynamics currently at play.