Did the Crypto Market Price in The Worst?

News

|

Posted 01/03/2022

|

6702

Global markets have faced a very sobering week, as armed conflict breaks out between Russia and Ukraine. As a global macro asset, and with markets that never close, the price of Bitcoin was quite volatile in response. This week the market traded down to a low of $34,474, before rapidly recovering to a high of $44,200 this morning.

Having now been in a drawdown from the November ATH for 138-days, the conviction of many Bitcoin investors, mostly those who bought near the top, has been significantly challenged this week. In this edition, we will analyse what looks like a flush out of top buyers, and draw comparisons between the current market structure and the May-July 2021 period.

What we will observe is that top buyers have almost completely capitulated now. However, the remaining distribution of holders appears to be of a far higher resolution, arguably reflecting the unwavering conviction of the buyers of last resort: Bitcoin HODLers.

Starting with the May-July period, the coin distribution was skewed to be very top-heavy, with a large proportion of the coin supply held between $54k and $60k. Whilst this showed a degree of demand at higher prices, it also made for a fragile market with many 'top buyers' who would be sensitive to any major price correction.

What eventuated was a major market capitulation. Both spot and derivative markets were flushed of all hype, the on-chain activity on the Bitcoin network collapsed, and it can be reasonably argued that this was the start of the present bear market.

During this 2.5 months-long period of consolidation, a great deal of supply was transferred by top buyers into exchanges for sale. This supply was then gradually soaked up by higher conviction buyers, with the cost basis of these coins becoming more heavily weighted between in the $29k to $40k price range. This behaviour describes a broad scale weak hand to strong hand redistribution event.

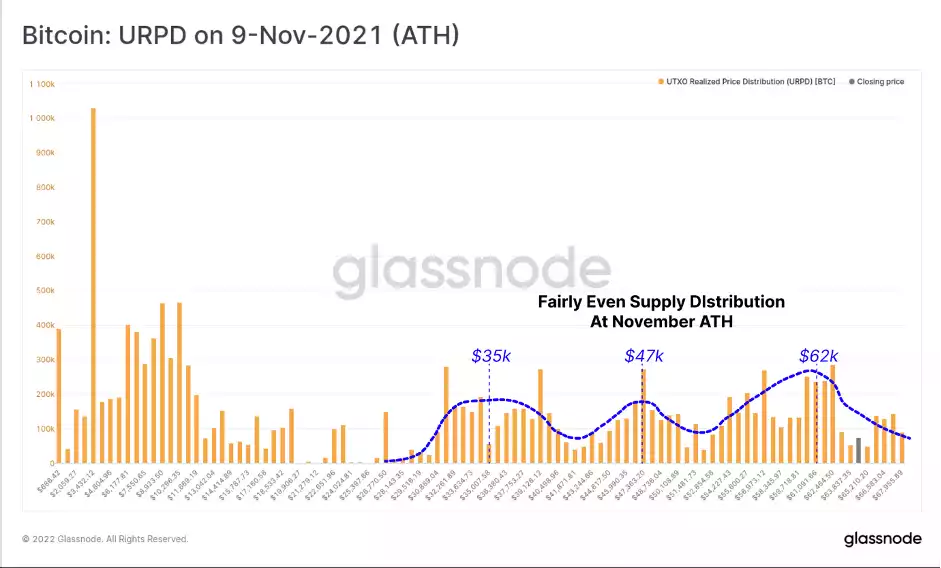

Moving to the present market correction, we can see a remarkably even distribution of the coin supply was established during the rally from July 2021, into the Nov ATH. This distribution indicates the following:

- Many investors who accumulated in the May-July correction took profits on the way back up. This created volume nodes around $35k, $47k and $62k.

- Buyers saw value and entered the market throughout the August to November rally. This is despite on-chain activity indicating that the majority of 'market tourists' had left, and only the HODLers remained.

Top buyers may have already capitulated. The news events of this week are world-changing. If there was to be a time that Bitcoin investors would capitulate, especially those who see it as a risk-on asset, the break out of war would be a likely catalyst.

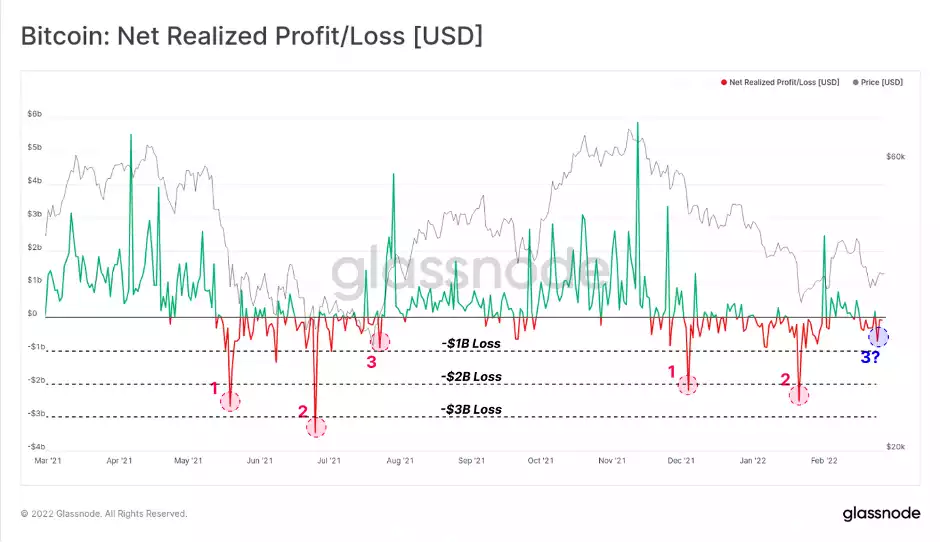

However, the degree of on-chain capitulation that occurred during this week's sell-off was lacklustre, to say the least. It exhibits similar characteristics to the 20-July-2021 sell-off to $29k (Point 3 below) which simply didn't have the bearish follow-through to break prices down to new lows.

This week saw a net realised loss of $713M which is significantly less than the $2.0B+ capitulation events experienced earlier in the correction.

With top buyers largely flushed out of the network, and evidence it is a HODLer dominated market, we will close out with three charts that help describe what this long-time horizon cohort may be doing.

First up is Illiquid Supply, which tracks the volume of coins held in wallets with little to no history of spending. These often represent cold storage and the wallets of HODLers who withdraw religiously whilst undertaking a dollar-cost average style strategy.

As a proportion of circulating supply, Illiquid Supply has now surpassed the May 2021 peak, reaching 76.3%. This has now returned to the same level as the 2017 market top, reversing a four-year long increase in coin wallet liquidity. Note however that both of these instances preceded major sell-off events, and thus it remains to be seen if these coins are truly in cold storage.

The current market is extremely interesting from both an on-chain, and a macro perspective. Given the enormous magnitude of uncertainty and risk that a kinetic conflict introduces, must be prudent with an expectation of further de-risking, investor panic, and capitulation events. So far, however, we have not seen a widespread capitulation event, with exception of very short-term holders who purchased the ATH or premature dips during this drawdown.

Despite this very uncertain macro and geopolitical backdrop, the behaviour of Bitcoin HODLers maintains a remarkably bullish conviction. Coins continue to be withdrawn from exchanges, are moving into increasingly illiquid wallets, and are maturing into increasingly senior age bands at a high rate. These look like Long-Term Holder coins in the making.

It is now key to watch in case these coherent trends begin to reverse, which may signal broad-scale loss of confidence. However, instead of such a reversal, these observations continue to paint a favourable and constructive future for Bitcoin, somewhere over the horizon.