China, Not Greece is the word?

News

|

Posted 02/07/2015

|

4625

There are strong views that the relative lack of market reaction to Greece’s woes are because it was largely expected and already ‘priced in’. Indeed UBS director of floor operations and the New York Stock Exchange legend Art Cashin in an interview yesterday said “I think China may be more important than Greece. Stick with the drill - stay wary, alert and very, very nimble.”

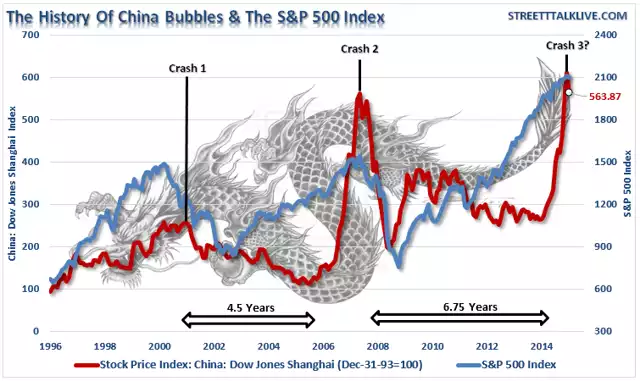

Analyst Lance Roberts agrees and refers to the following chart showing where China’s sharemarket is at relative to previous bubbles/busts and how that relates to US shares. It’s a pretty compelling story.

Whilst Gold held up against the fall in shares on Greek news it hasn’t jumped as some hoped. This is likely largely due to this still being perceived as a Euro problem and hence a flight to the perceptually strong USD which works against gold. A major crash on Wall Street however might bring into question the whole US strength argument and see the money go to gold rather than USD. The graph above suggests that may not be far off… Finally the Greek situation is far from resolved and we are reminded of these comments from legendary Jim Rickards on Bloomberg back in February:

“If Greece left the Euro there would be no end to the catastrophe. Lehman Brothers (one of the triggers of the GFC) is a good example. All the balance sheets are bigger.

‘The whole thing that was too big to fail then is bigger and more complex today…”