BTC Hunting For Max Pain

News

|

Posted 21/06/2022

|

8134

The Bitcoin market has reeled from a massive deleveraging event this week, both in on-chain DeFi markets and off-chain as exchanges, lenders and hedge funds being rendered insolvent, illiquid or liquidated. The market sold off below 2017 US$20k ATH on 18-June, reaching a truly remarkable low of $17,708. Prices did, however, recover the $20k level on Sunday.

With Bitcoin and digital assets being the only tradeable instruments over the weekend, macro fears and demand for dollar liquidity appear to have been taken out of the space. As a result of this extreme deleveraging event, we have started to see signals of capitulation across several entities, including miners, Long-term holders, and the aggregate market.

With the market trading below the $20k 2017 ATH, investor conviction and market profitability have been put to an extreme test.

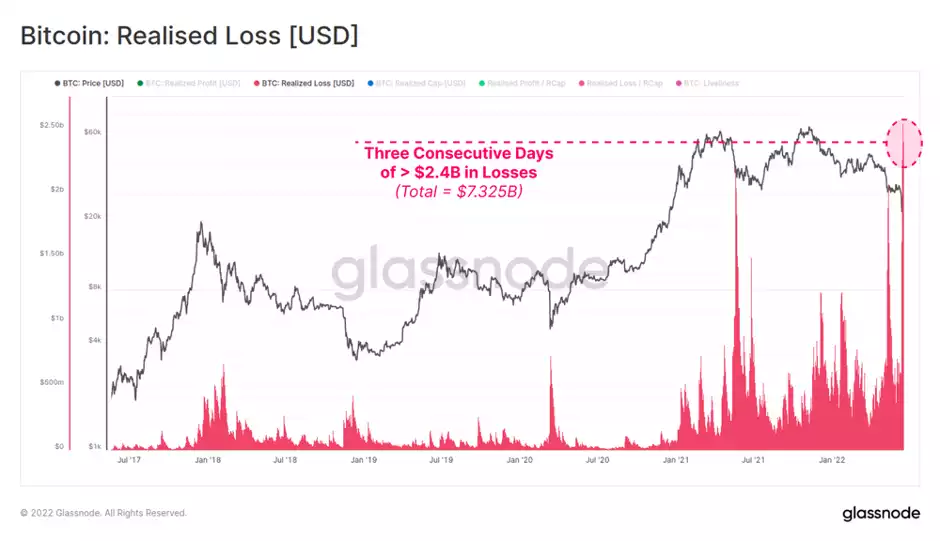

The Realised Loss metric measures the total value difference between coins that were acquired at higher prices and the price when they were subsequently spent on-chain. Realised losses reached a new all-time-high, punctuated by three consecutive days with market-wide realised losses above $2.4B/day, totalling $7.325B.

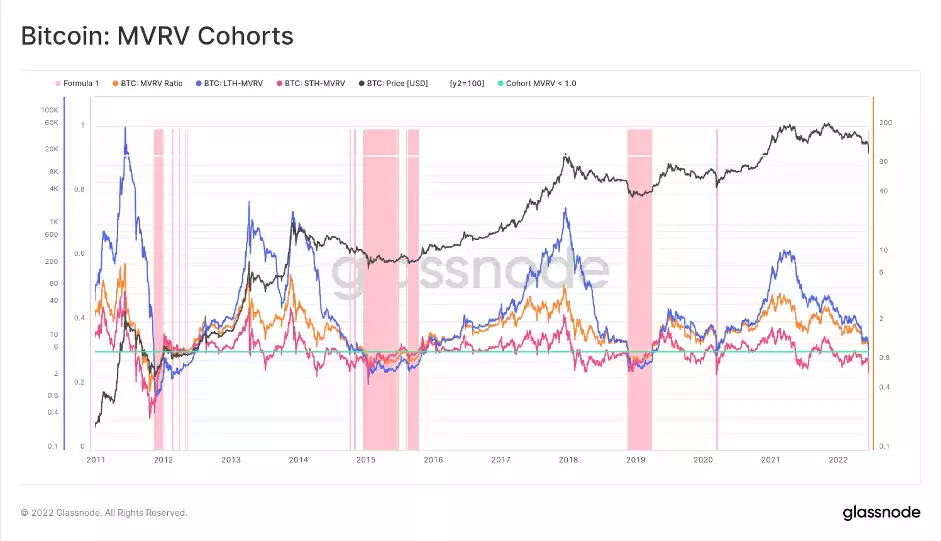

We can also investigate the profitability of specific investor cohorts relative to their realised price, which is the average price of all coins based on when they last moved on-chain. The chart below presents the MVRV Ratios (Market Value by Realised Value) for three Bitcoin cohorts (whole market, STHs and LTHs) which shows that all of them are now at a loss and holding coins below their cost basis on average.

Previous instances where all three cohorts are at an unrealised loss have coincided only with late-stage bear market capitulations, providing confluence with the above profitability metrics.

These maximum pain thresholds in supply can be investigated from different dimensions:

- Supply in Profit (blue) dropped to just 49.0% as the market traded down to $17.6k, putting more than half of the supply into an unrealised loss. Historical bear market floors have bottomed between 40% and 45% of supply in profit.

- Addresses in Profit (orange) assesses the profitability among individual wallets and returns similar results to supply in profit. This metric is now just 10% higher than its lowest level in the 2018-2019 bear market and COVID crash, indicating just marginally less pain than at those bottoms.

- LTH-Supply in Profit (red) monitors the profitability of long-term holders as a gauge of the severity of stress on Bitcoin's strongest-handed investors. At the moment, 35% of LTH-Supply is at a loss. This means this cohort is still shouldering less pain compared to past bear markets where LTHs held 42% to 51% of their supply in the loss.

There is an expected natural drift in the floor of these metrics as coins are lost and HODLed over time. As such, the sell-off over the weekend can be considered to have plunged profitability and investors into a historically meaningful degree of financial pain.

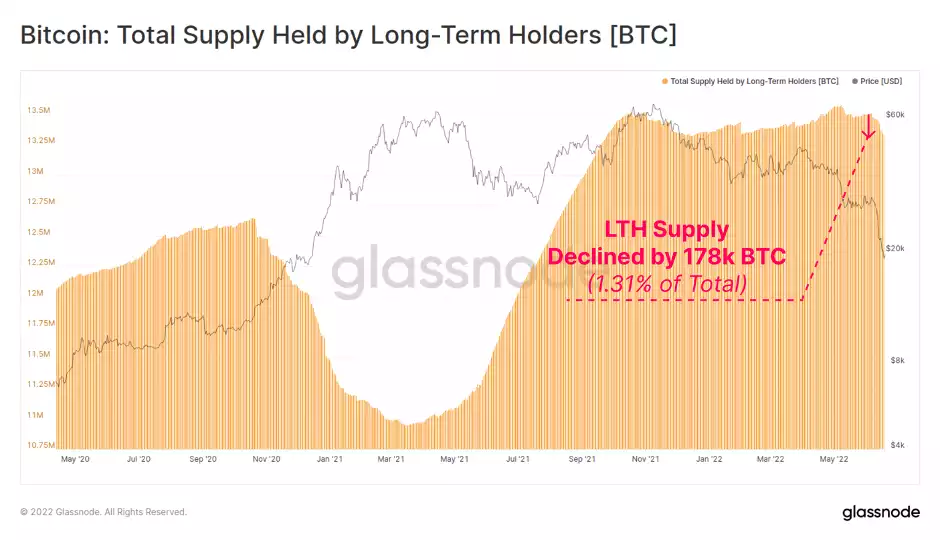

The falling dominoes of the current bear market are advancing to a new phase. Alongside miners, Long-Term Holders are now beginning to feel the pressure, forcing many of them to sell at an accelerating rate. Long-Term Holder Supply has declined by 178k BTC over the last week, equivalent to 1.31% of their total holdings.

Revived supply 1yr+ confirms that spending by older coins is taking place, accelerating to rates of 20k to 36k BTC per day. This reflects an influx of fear and panic within even Bitcoins' stronger hand cohort.

To summarise what we have witnessed this last week in crypto, the Bitcoin market has now experienced two distinct capitulation phases since the ATH in November 2021. The first phase was triggered by the Luna Foundation Guard force selling its 80k+ BTC, and the second this week via a massive industry-wide deleveraging, both on and off-chain.

Miners are now under significant financial stress, with BTC trading near the estimated cost of production, incomes well below their yearly average, and hash rate noticeably coming off ATHs. The aggregate market has realised over $7 Billion in losses this week, with Long-term Holders contributing some 178k BTC in additional sell-side.

Based on historical data, we are currently in the later phase of a bear market. Will you take advantage of it?