Beyond Brexit – The Golden Cross

News

|

Posted 24/06/2016

|

5664

“Sell the rumour, buy the fact”. It’s an oft quoted investment paradigm. Since the expectations or “rumour” of the Remain camp winning today upon the unfortunate shooting of the UK MP, we have seen a continual sell down of gold and to a lesser extent silver on that expectation. Whilst some expect gold to take a hit on such a win, others think it may have been oversold already in this ‘rumour’ front-running sell off and we may actually see a jump on the ‘fact’ even if that fact is Remain. No one knows.

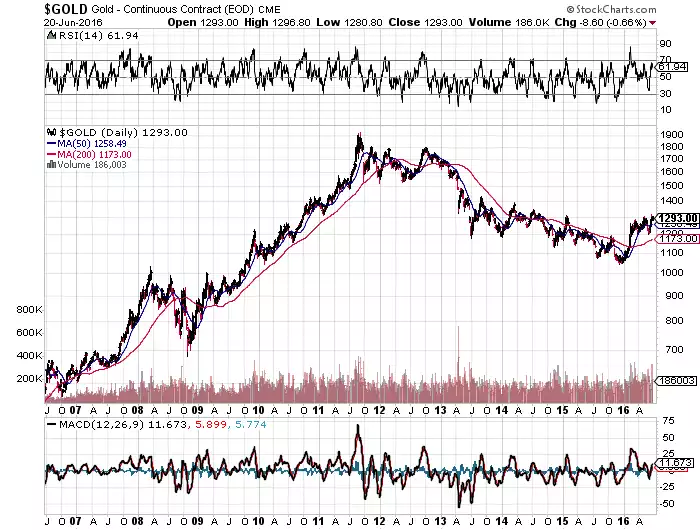

Amid these short term market influences it is often instructive to take a step back and look at the trend and the broader reasons for your investment. From a trend perspective the 10 year chart below shows we are still clearly in what many think is bull market territory. In February 2009 we saw what analysts call the ‘golden cross’ where the 50 day moving average crosses up through the 200 day moving average. That preceded the last bull run up to the ‘death cross’ in March 2013, which preceded the bear market since. In March this year we saw a ‘golden cross’ again which many think has set the scene for the next bull market. Despite the Brexit ups and downs that is still in tact.

Beyond the technicals there remain the core reasons for owning gold and silver that we write about daily. As we suggested in today’s Weekly Wrap podcast, if anything the panic over Brexit just highlights the underlying fragility of our global financial system and the need for gold and silver in your portfolio.