Australia’s Slippery Slope to Negative Rates & QE

News

|

Posted 23/08/2021

|

6674

Last week we saw the lowest unemployment print since December 2008 at just 4.6%. However it only snicked the beginning of the full NSW lockdowns and some of the Victorian. And so any view that somehow everything is awesome now needs some newer context. From Indeed:

“Sarah Hunter, from BIS Oxford Economics, said the July figures were a portent of a big rise in unemployment to come in next month's data, especially in Sydney.

"In a sign of what's to come in the August data, employment in NSW fell by 36,000, the underemployment rate spiked to 9.3 per cent and the participation rate also fell 1 percentage point to 64.9 per cent," she observed.

"The structure of the COVID disaster payments means that all of these trends will be even more pronounced in the August data; anyone claiming the payment who has not worked at all will be counted as unemployed (and likely not in the labour force, as they will not be actively looking for work), while workers who have had their hours cut will be classed as underemployed."”

Additionally last week we saw the latest Average Weekly Earnings figures from ABS and they printed a weak 1.4% annualised growth.

The combination of these 2 most recent barometers of the economy confirm that Australia is not fairing as well as many thought. Last week the ASX gave up over 2.2%, its worst weekly fall this year in a sign that maybe the penny has dropped. Coincidentally the last few weeks of trade at Ainslie have picked up dramatically. The TINA trade (There Is No Alternative) of buying shares has reached its logical limit and buying its anti correlated asset, precious metals, is making more sense. Particularly, say, if the RBA starting loosening not tightening… OR… if it tightened into weakness and crashed the whole show… (as is the US’s equivalent, the Fed maybe this week).

So where to from here? Macro Business’s funds’ Chief Strategist David Llewellyn-Smith penned the following article last week suggesting the only way from here is more QE or negative interest rates for Australia. Imagine the market reaction when that happens!

“RBA will need to go negative

The Australian economy is a simple machine that runs on two motors. The two engines are commodities and household debt. We might call these miners and banks. Or, iron ore and house prices.

The machine is fuelled by commodity income derived offshore. This is then leveraged up in global markets via bank borrowing. The debt is channelled into rising house prices that drive consumption.

At least, that’s how it used to work. Since the pandemic began, the machine has instead leveraged commodity income via bank borrowing from the Reserve Bank of Australia

Like a twin-engine aircraft, the Australian economy can soar when both of its engines roar in unison. The last year is an example.

It can also hold its altitude on only one engine. Like the post-GFC period when mining boomed and house prices fell. Or, the reverse, during the mining bust of 2015 when house prices launched.

But when both engines fail, a crash is imminent. This is where the Australian economy finds itself today.

The first jet to flame out is households. Delta lockdowns have hammered confidence and spending. Business is slowing fast and future investment plans are being shelved.

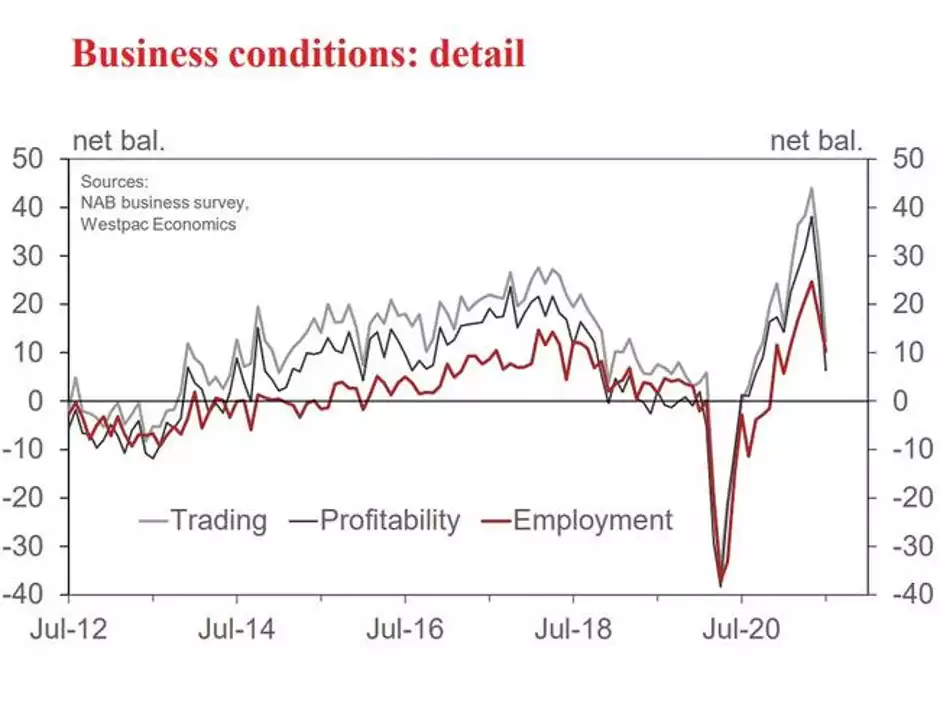

Trading, profitability and employment are all on a downward trajectory. Picture: SuppliedSource:Supplied

The lockdowns are likely to run until November, and even afterward there will be serious interstate restrictions, meaning no rebound of substance is possible.

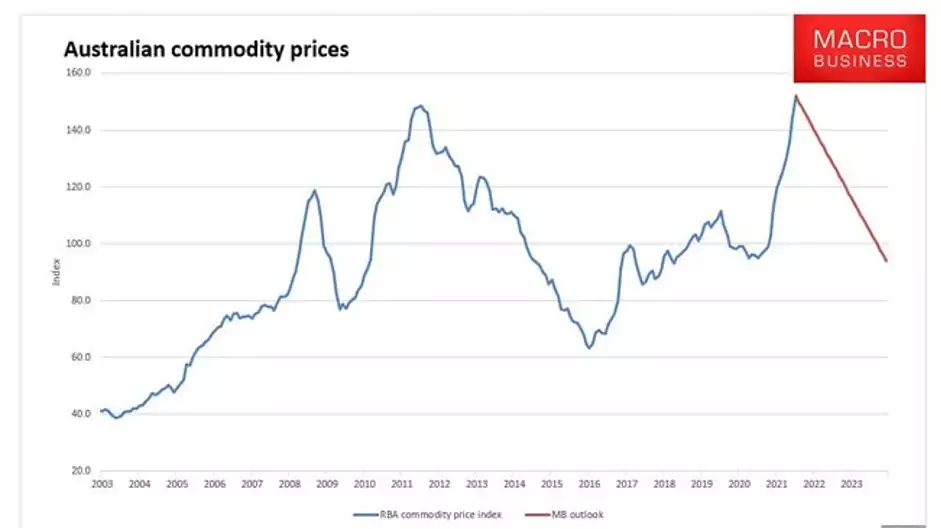

The second jet to flame out is our huge commodity price gains. China launched out of the Covid-19 lockdowns with huge commodity demand but is now slowing very fast. Iron ore is tumbling and coal is next:

As our two economic motors sputter, unemployment will begin to rise, wages will weaken and inflation will disappear.

How can Australia react?

Policymakers have two throttles to toggle in response.

First, governments can spend more – and they will. But, unlike 2020/21, as mining profits bust not boom this time, the tax take will get smashed so they’ll want to be more conservative.

The larger deficits will be more to absorb the falling revenues that come from the mining income crash. Actual spending increases will be much more difficult.

That will mean the second throttle, the RBA, will have to carry more of the load. Australia will need a lower currency to help offset collapsing export income so the RBA will be forced to increase its money printing and bond purchases as a matter of course.

More interesting is what it will do for domestic demand. The likelihood is that the mining income engine will be shut off throughout 2022. The RBA will therefore need to rev its other engine, the housing market.

But how can it do that when interest rates are already at effective zero and prices high?

It is possible. Either the RBA will have to cut its cash rate negative. Or, it will have to print more money for the banks offered up on negative yields.

The European Central Bank has been doing both of these things for many years. The European cash rate is -0.5 per cent and it provides money to banks to lend for as low as -1 per cent.

The RBA says it will never do these things. But it always says that.

When the master alarm goes off in its economic cockpit and the ominous voice declares “pull up terrain”, it will have no choice.”