AUD kisses 80c – What comes next?

News

|

Posted 25/02/2021

|

5788

Last night saw a rebound on Wall Street despite falls on opening after the Fed doubled down on its dovish jawboning. That saw a reprieve in bond yields, shares up, gold down and further strengthening in silver and platinum on the reflation trade. It also of course saw the USD down and the AUD firming to kiss 80c taking away some of those USD gains in silver and platinum and worsening the fall in gold. Despite the fall, gold regained to finish above the USD1800 mark which was very encouraging.

Doubling down on yesterday, the Fed chair reiterated the US economy is a long way off stating “There is a long way to go to maximum employment.” and despite all the obvious risks of overshoot, that inflation is a long way off, to wit - “We live in a time where there is significant disinflationary pressures around the world and where essentially all major advanced economy’s central banks have struggled to get to 2%. We believe we can do it, we believe we will do it. It may take more than three years but we’ll update -- every quarter we update that assessment and we’ll see how that goes.”

In our usual bad news is good news financial markets response, shares of course surged on the news. Let’s not worry about what this means to fundamentals, what it MEANS is more free money from the Fed. Giddyup! What could possibly go wrong….

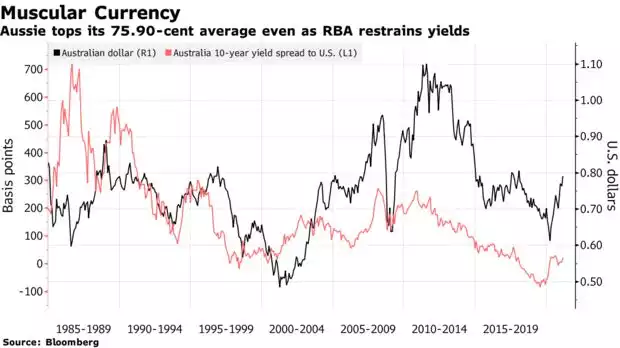

But coming back to that AUD breaching 80c… That hasn’t happened since 2018 and then only fleetingly. We have to go back to the post GFC period up to the end of 2014 on the journey that took it up to $1.10 and back to below 70c for any sustained price above 80c.

In the source article for the above chart in Bloomberg, Westpac’s Sean Callow said “The conversation around the Aussie changes when you leave the 70s. The RBA might be dismayed by the break of 0.80 but given the commodity price backing is so strong, they should take some comfort that the A$ doesn’t seem overvalued. It’s a headwind, but they saw worse in 2011-12.”

MacroBusiness’s Chief Strategist David Llewellyn-Smith begs to differ with this ‘she’ll be right’ attitude of Callow’s.

“The RBA has been very explicit about why it has renovated its entire monetary policy framework. Its inflation goals have fallen short for a decade. One major reason why was monetary policy was too tight leading to an overly high Australian dollar.”

In reference to the Bloomberg comments he says:

“This is the wrong way to think about it. The RBA will not take comfort from a failed past. An Australian dollar above 80 cents today bears no relation to it doing so in 2011/12.

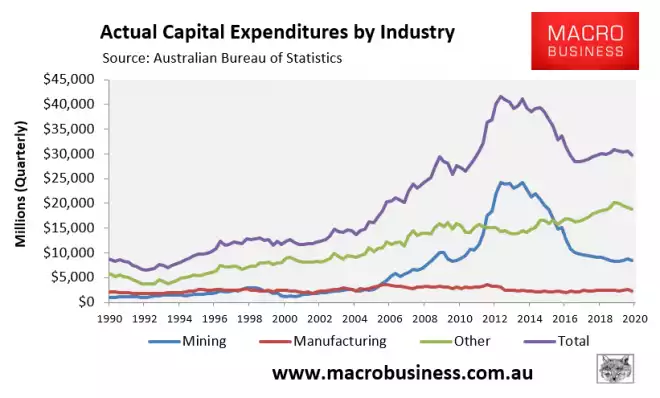

High commodity prices typically lift Australian activity via three channels: higher wages from investment, lower taxes from bigger budget receipts, and stock market gains. All three were going gangbusters in 2011/12. Only the last is intact now.

The mining investment boom is bust and is not coming back so there is no transmission to wages and demand:

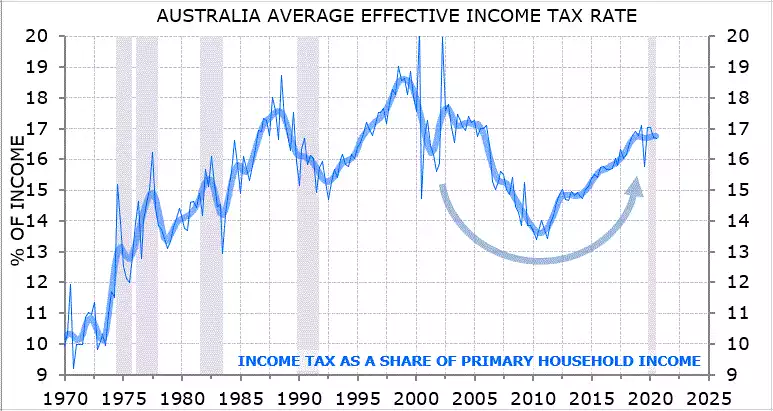

In 2011/12, tax rates were much lower. Today they are rising with further fiscal consolidation ahead. Via Minack and Associates:

The stock market returns are still looking good but the growth over a decade is pretty lousy and it was always the smallest of the three channels:

As well, in 2010/11, the RBA had numerous drivers running in the economy with house prices also hot. Today, that is all that it has. And it has macroprudential policy tools today that it did not have in 2011/12 so it will be very comfortable that it can tighten on that sector without rate hikes if need be.

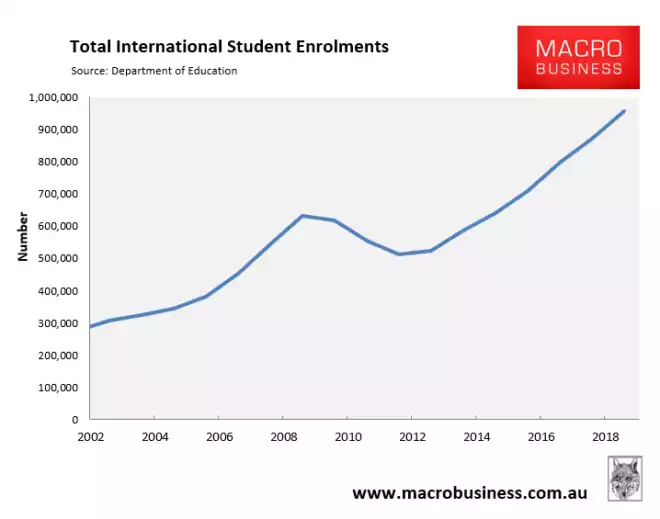

Finally, in 2011/12, Australia was still hell-bent on selling everything not tied down to a developing China. Today we confront some degree of decoupling from the Chinese economy, including very probably the international student trade which played a key role in delivering growth after 2011/12. 80 cents is the killer point for that sector’s competitiveness:

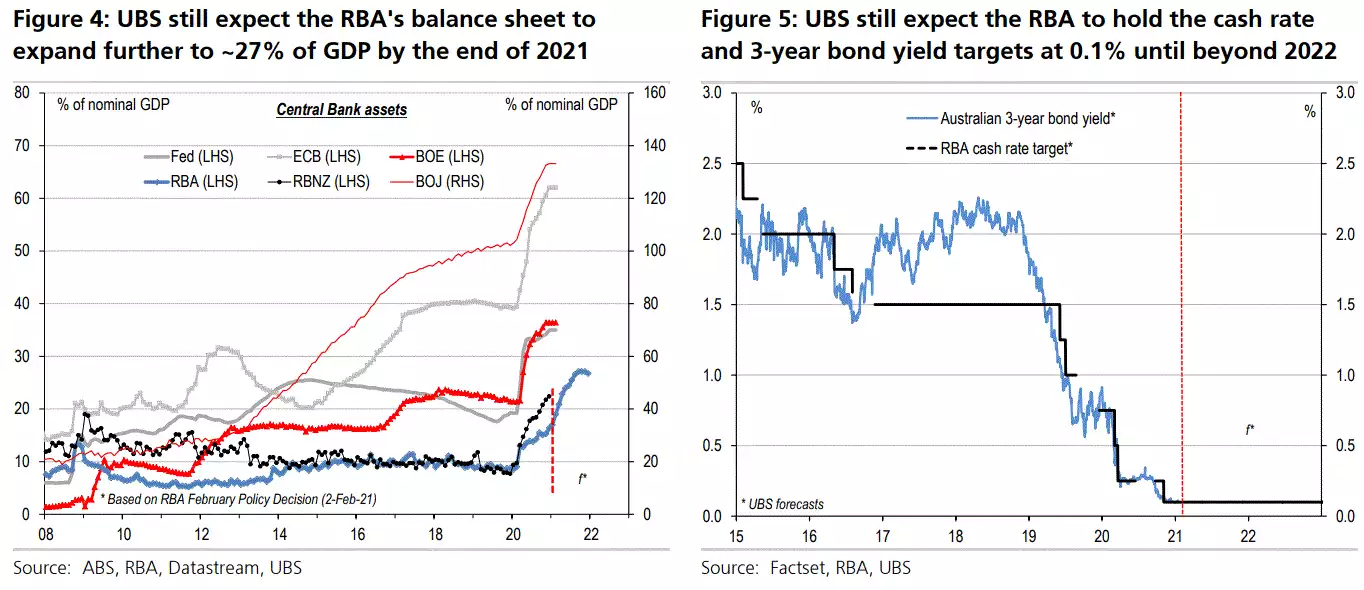

In short, the RBA will be very unhappy with an Australian dollar above 80 cents regardless of the high terms of trade. The bank has renovated its reaction function for all of the above reasons and it will be triggered if it needs to be. There is still oodles of scope for the RBA to expand QE:

In short, regardless of high terms of trade, the Australian dollar above 80 cents will smash Australian inflation and the RBA won’t get angry with AUD bulls, it will get even.”

We wrote about the inevitable continuation of QE in Australia recently here. We agree with Llewellyn-Smith’s points that the rising AUD will only add pressure for more and more QE locally as we compete with all that QE coming from the Fed, ECB, BoJ, BoE and of course China’s PBOC and various other state sponsored credit levers at their disposal.

That QE means pressure on lowering the AUD and consequently increasing the price of bullion in local terms, more debasement of that same currency in real terms, and the inevitable turn to inflation, possibly uncontrolled as a result. Make no mistake, QE is alive and well in Australia and looking likely to only continue and expand.