ATH v “Blood in the streets”

News

|

Posted 06/12/2017

|

8233

Following on from yesterday’s article where the BIS called current markets ‘frothy’ we thought it time to revisit the latest charts illustrating exactly where we are at courtesy of dshort.

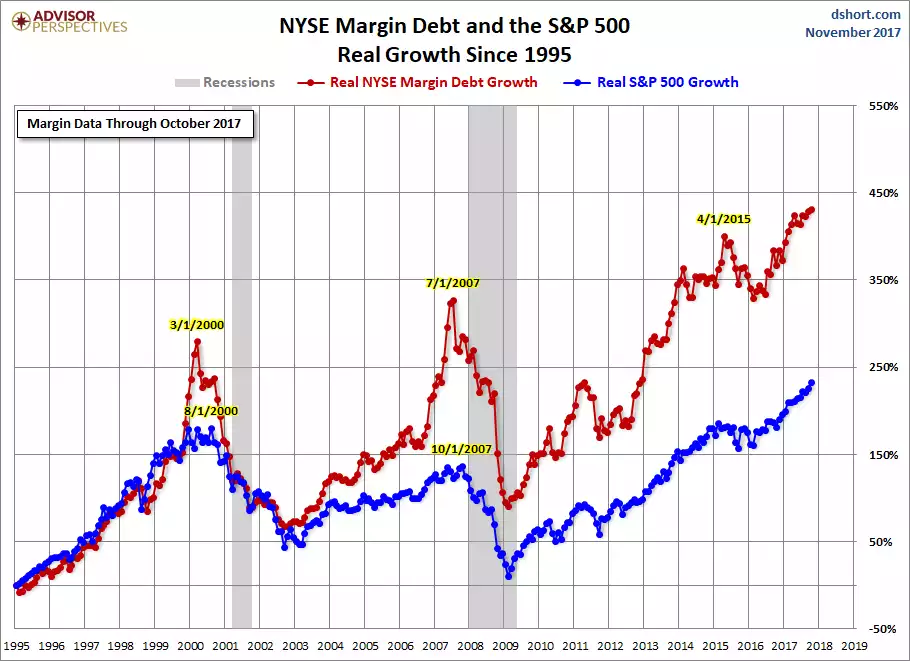

First, BIS warned of markets acting like central banks were easing not tightening. One insight to that is the amount of money the punters are borrowing to buy shares. The following chart shows that in real (inflation adjusted) terms and you can see it’s not been higher than now. Trading jargon calls that an ATH – all time high…. That’s something we are seeing nearly daily in financial markets.

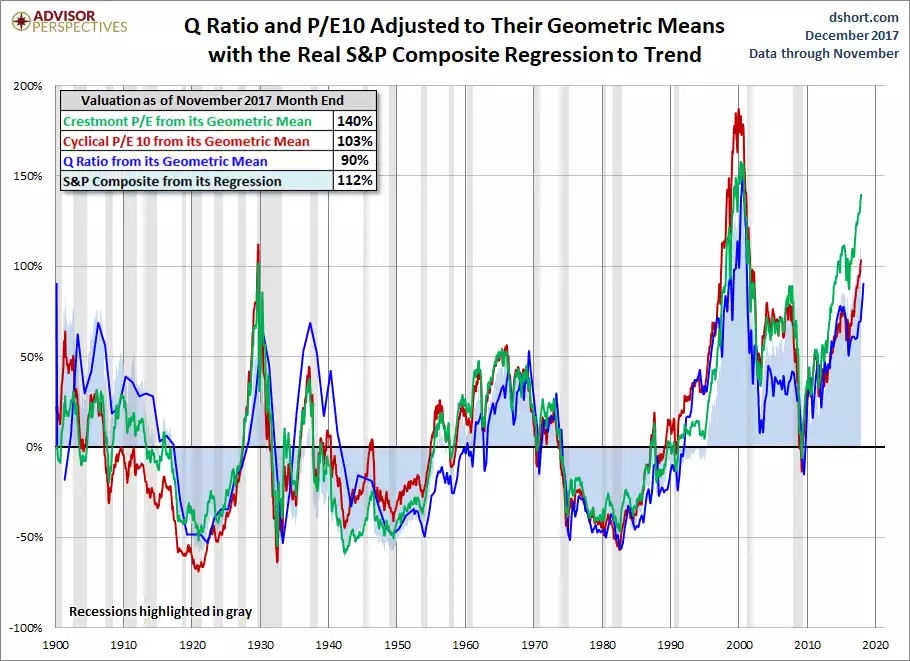

The following graph shows 4 different types of valuation measures against geometric means (not arithmetic given the very different numeric ranges for each):

- The Crestmont Research P/E Ratio

- The cyclical P/E ratio using the trailing 10-year earnings as the divisor

- The Q Ratio, which is the total price of the market divided by its replacement cost

- The relationship of the S&P Composite price to a regression trendline

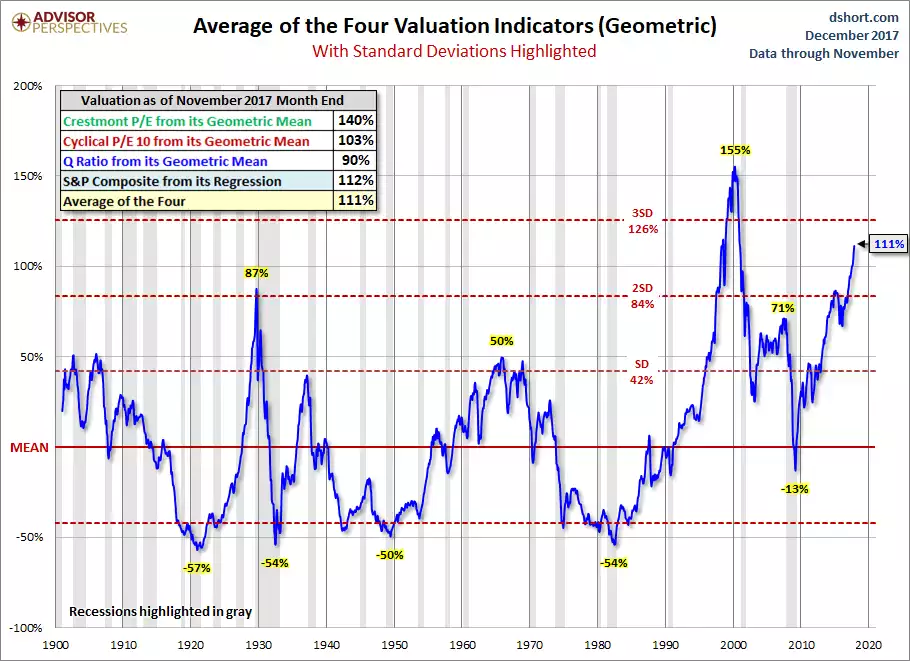

Now averaging them together with standard deviations above and below the mean:

So not quite ATH yet, but closing in on the dot.com bubble that saw 80% losses on the ‘pop’.

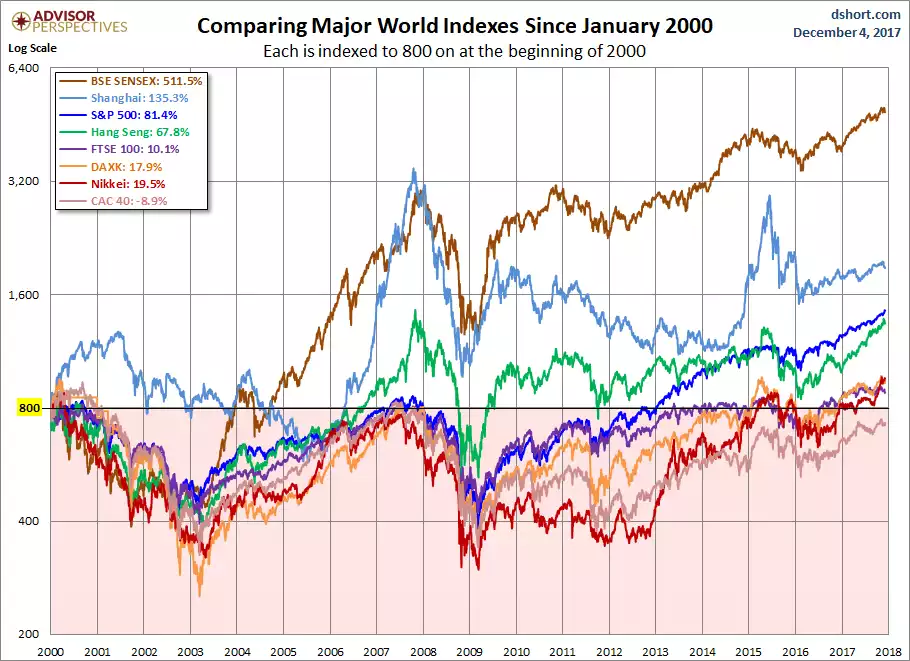

And now for a trip around the world since 2000 (Sensex is India).

Bitcoin had another strong night and is now up 1161% in AUD for this year alone. We explained on Monday why, for now, that needs to be looked at differently to equities and precious metals gains.

By comparison, gold and silver both got heavily sold off last night, albeit triggered by one almighty COMEX gold futures hit of $1.5b of notional (not real) gold sold instantly, which then saw stop losses likely triggered and further capitulation forcing it down below its 200 day moving average. When you look at this against the backdrop of Perth Mint just reporting silver sales plunging 45% in November and gold down 46%, and then look at the ‘frothy’ equities markets you may be reminded of Baron Rothschild’s famous quote:

“The time to buy is when there’s blood in the streets”