After 40 Years, It’s Time for a New Solution

News

|

Posted 07/03/2018

|

12222

Ripple (XRP) is a digital asset with characteristics that set it apart from others in the cryptocurrency space. After a number of recent developments, we thought it would be worthwhile revisiting the Ripple value proposition.

Firstly, a bit of background. SWIFT (Society for Worldwide Interbank Financial Telecommunications) has dominated the entire financial marketplace for approximately 40 years. Since the 1970s, SWIFT has provided the only global solution to facilitate cross-border payments. Over this time, however, very little has changed in terms of the underlying technology and they have failed to keep pace with advancements, rendering their current solution slow and expensive.

In recent times, and with the emergence of the blockchain phenomenon, a new company has created a cross-border payment platform that is not only fast, but cheap. Ripple, based in San Francisco, utilises an innovative ledger protocol, similar to blockchain, with its own digital asset XRP to facilitate a near-instant transaction at a fraction of the cost of the old SWIFT model. They are able to achieve this by implementing their xCurrent solution which is then improved upon by xRapid.

Ripple describes xCurrent as “an enterprise software solution that enables banks to instantly settle cross-border payments with end-to-end tracking. Using xCurrent, banks message each other in real-time to confirm payment details prior to initiating the transaction and to confirm delivery once it settles. It includes a Rulebook developed in partnership with the RippleNet Advisory Board that ensures operational consistency and legal clarity for every transaction.”

In other words, xCurrent is the “new and improved” SWIFT. Our interest, however, lies in Ripple’s digital asset XRP. So where does XRP fit?

International payments require pre-funded local currency accounts stored at each correspondent bank around the world. This, as you can imagine, is very expensive and inefficient as banks need to tie up valuable capital and liquidity. After implementation of xCurrent, the next step in liquidity and cost savings for financial institutions and banks is xRapid. xRapid utilises Ripple’s digital asset XRP to reduce fees for cross-border payments and improves liquidity by removing the need for pre-funded accounts.

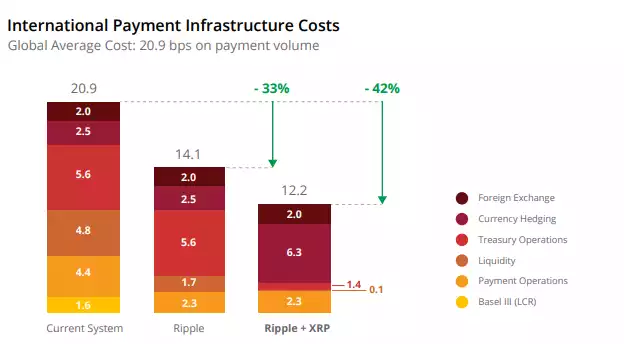

The chart below indicates that the first step banks take with xCurrent has the potential to save them in the order of 33%, when compared to existing practices. Additional cost savings are possible when banks implement XRP and xRapid. Usage of XRP is projected to save banks from 42% to 60% (high and low volatility, respectively).

https://ripple.com/files/xrp_cost_model_paper.pdf

The cost saving benefits have proven to be very appealing for a number of financial institutions who have been actively seeking partnerships to take advantage. Significant joint announcements have been made on a regular basis over the past few months. As recently as March 1st, Cambridge Global Payments — a subsidiary of FLEETCOR Technologies and a leading global provider of commercial payment solutions — has launched a pilot program to use XRP in cross-border payment flows through xRapid.

To give some perspective, Cambridge currently has over 13,000 institutional clients around the world and handles $20 billion in international transactions annually. Incorporating XRP in those flows will provide their clients with a cross-border payments experience that is significantly faster, cheaper and more transparent.

Additionally, five other major financial institutions have also publicly announced that they are piloting xRapid, including Cuallix, MoneyGram, IDT Corporation, Mercury FX and Western Union. These are not small players. For context, Western Union has over half a million locations throughout the world where customers can send and collect their funds, and transaction volumes in the order of $80B USD moved between customers per year.

Currently the digital asset market is flooded with cryptocurrencies with no apparent real-world use case. Ripple is diligently working towards their goals and executing on their business plans to solve a real-world problem of cross-border payments which hasn’t been updated for the last 40 years. No one knows the full extent of the role that XRP will play in the future of cross-border payments, but if Ripple keeps making such significant progress then the future for the XRP digital asset looks bright.