Worst since 1987 Black Monday – No bullets left

News

|

Posted 13/03/2020

|

30496

Wall Street crashed almost 10% overnight and the ASX down nearly 7.5% yesterday, both the biggest falls since 1987’s Black Monday. And again the liquidity squeeze was across the board with everything bar the USD dropping. Only gold had a relatively minor drop but the half commodities like silver and platinum saw greater drops. The AUD reached the lower 64’s and increasing predictions this morning of an imminent fall to 61c. After the Bank of England followed the Fed’s lead with a 0.5% rate cut the Fed then last night substantially upped their notQE Repo operations to $1 trillion. Per Bloomberg:

“The Federal Reserve offered a huge injection of liquidity to the Treasury market Thursday to counter signs of market dysfunction as investors panic over the spreading coronavirus.

The New York Fed, which conducts market operations on behalf of the U.S. central bank, said in a statement that it is aiming trillions of dollars in temporary loans at the banking system in coming weeks to relieve strains as investors sell government bonds to raise cash. It will also purchase a broader range of government securities than just short-term Treasury bills to make sure the liquidity gets into the cracks appearing.

The dramatic expansion comes amid widespread financial-market turmoil, which led to a seizing-up of the Treasury market Wednesday. The steps were taken at the direction of Fed Chair Jerome Powell, in consultation with his colleagues on the central bank’s rate-setting Federal Open Market Committee, to stem what it called “temporary disruptions.”

The moves were reminiscent of the Fed’s quantitative easing program, known as QE, during the financial crisis of 2008.”

But of course we can’t call it QE…. Shares initially rallied strongly on the news but then realised what it really meant (things are broken) and crashed from there.

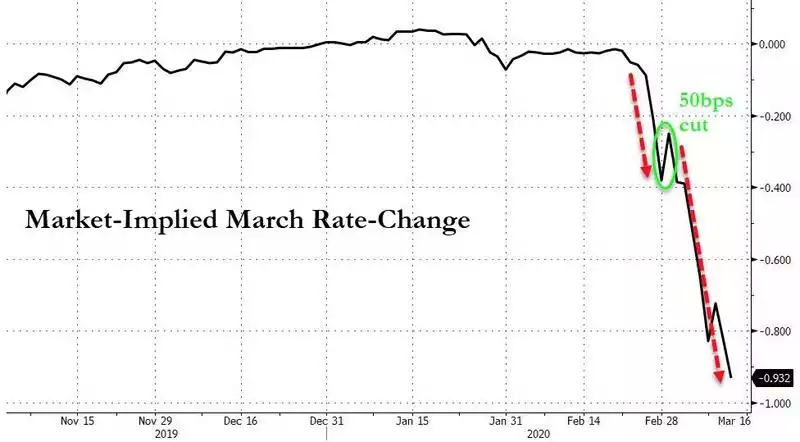

In additional to this liquidity injection the market is now pricing in nearly a full 1% rate cut by the Fed next week taking them to zero.

And herein lies the problem we have repeatedly warned about. They are starting from such a low base they have nowhere to go. The US will do everything they can to avoid negative interest rates (not a good look when you are the reserve currency). Prior to the GFC the interest rates of the major developed nation central banks stood at 4.15% giving them room to cut as they did collectively to zero and beyond (negative yielding sovereign debt breached $15trillion last night). As at 2 March as COVID-19 started to be taken seriously they were at just 0.6%. That has been reduced to just 0.425% since. We aren’t even officially in recession yet… All US Treasuries (short to long term) are under 1% for the first time ever. Not only does that highlight the seriousness of the situation, it also highlights the direction of safe haven investment will likely turn to gold as bonds have little way to go from here when the money eventually rotates back out of USD into these assets.

One of the most respected macro analysts and investors is Raoul Pal of Real Vision. He has been calling this bond rally for some time and profited nicely from that call. He is now saying phase 2 will be gold. In what we consider a must watch/listen interview, Alex Saunders of Nuggets News talks to Pal about this virus and where it will lead us and the oil war as well. Spoiler alert – he’s calling this the largest financial event of our lifetime. You can watch the YouTube here or podcasts on the various podcast channels. It is an hour long but gives one of the best summaries you will come across.

Finally, and in addition to our promise of ‘short and sharp’ reads, we’d suggest you take the time to go on to read the following excellent overview by Anthony “Pomp” Pompliano founder of capital management firm Morgan Creek. Its largely talking to Bitcoin but you can interchange Bitcoin with gold as it is the same story. Certainly worth the read.

“To investors,

We are watching history unfold. There will be books written about the events that are transpiring in financial markets right now. Every day feels like a month. Fear and panic are dominating the minds of most people. As I wrote earlier this week though, like most things in life — this too shall pass.

Before we get into my thoughts about where we are, here is what has happened in the last 24 hours or so:

The big news was that President Trump gave a national address last night related to COVID-19 and the subsequent economic / health impact. The key points of the speech were that travel from Europe to the US will be greatly hindered for the foreseeable future, the government is working on financial relief for small businesses and/or individuals affected by COVID-19’s economic slowdowns, and the IRS is likely to extend the tax reporting date for some.

The NBA season was suspended indefinitely after a member of the Utah Jazz team tested positive for COVID-19.

The Italian government “ordered all shops in the country to close except for grocery stores and pharmacies until March 25. Public transportation as well as financial and postal services will continue, but the country’s normally vibrant restaurants, cafes and bars will be shut. Factories can continue operating, but only with precautions.”

The S&P 500 dropped 7% on opening this morning and immediately triggered the circuit breakers, which puts a halt on trading for 15 minutes.

The Dow Jones Industrial Average is down approximately 8.5% this morning.

Bitcoin is down approximately 23% this morning.

Oil is down approximately 8% this morning.

Gold is down approximately 2.5% this morning.

This is just a small selection of the various developments. It can all be summed up with a simple framework:

COVID-19 has officially been labelled a pandemic by the World Health Organization. The necessary response requires social distancing and shutting down of large gatherings or various forms of economic activity.

The virus is grinding economies around the world to a halt.

The structural flaws in various markets are exposed when economies slow down, including too much leverage and lack of liquidity.

Unfortunately, we are watching a liquidity crisis play out in real-time. These liquidity issues are well understood structurally, but feel much worse than expected when they occur in reality. A liquidity crisis means that investors all rush to the exit doors at the same time, but there are so many more sellers than buyers that investors actually have a hard time offloading their assets for cash. Quite literally, investors begin aggressively lowering the price they are willing to accept for each asset in exchange for the cash which they are desperately seeking right now.

This is why you are seeing any asset with a liquid market tanking so hard right now. Additionally, the US treasury market (the most liquid market in the world) is experiencing incredible pain right now as well.

These two charts show that volatility is exploding and there is increasing levels of illiquidity in the UST market. If this is happening in the most liquid markets, you can imagine how bad this is becoming in less liquid markets.

Which brings me to assets like Bitcoin and gold. These assets have historically shown to be (a) non-correlated and (b) serve as safe haven assets. That all changes during a liquidity crisis though. In the short term, any asset that can be sold into a liquid market for cash is likely to be sold. Investors are incredibly insensitive to price. They need cash so badly that they will make traditionally irrational decisions in order to optimize for liquidity.

These sellers (and liquidity seekers) include retail investors, hedge funds, banks, and pretty much anyone else that has exposure to financial markets. This type of imbalance in buyers and sellers also explains why the Fed is stepping in to repo markets (overnight borrowing) with such significant size (recently increased to $175 billion). The statement that the Fed put out explains it well:

“Consistent with the FOMC directive to the Desk, these operations are intended to ensure that the supply of reserves remains ample and to mitigate the risk of money market pressures that could adversely affect policy implementation. They should help support smooth functioning of funding markets as market participants implement business resiliency plans in response to the coronavirus.”

If the Fed doesn’t step in, there is even larger liquidity issues. Before we get off on a tangent though, I want to get back to the sell off in safe haven assets. Remember, the short term optimization for investors is for liquidity. If an asset has a liquid market, the asset will be sold for cash. There is not an asset on the planet that is immune from this market dynamic.

During the 2008 global financial crisis, gold dropped in price by more than 30% leading into the depths of the real pain. This isn’t because gold is a bad store of value or that it had lost safe haven status after 5,000 years. It is because gold has a liquid market and investors needed liquidity over anything else.

Even though gold fell 30% during the 6 month liquidity crisis, the asset still went from approximately $650 in 2006 to over $1,800 in 2011. Why? Because people ran to gold when they feared that the United States would default on debt, that the US monetary policy measures were a bad idea, and/or that inflation was rising. Simply, gold served as a store of value and safe haven asset over the full timeline of the crisis, but it succumbed to the liquidity crisis during the worst 6 months.

This is what I believe is happening to Bitcoin right now. Bitcoin has a liquid market, so many people who are holding it will sell it for cash because they need liquidity. In fact, most of them have already sold the asset over the last week, which is why we have seen such a significant drop in Bitcoin’s price. The weak hands and/or those seeking liquidity have most likely acted already, so it is unlikely that we will see continued sell offs that cause massive price decreases from these levels. (approximately $6,000 price as of this writing).

This doesn’t guarantee that Bitcoin’s price won’t go lower for a short period of time, but it does mean that most of the people who want liquidity have likely already sold. This then brings us to the next stage in how this crisis probably plays out — holders of last resort and the safe haven status.

There are a group of people, mostly individuals, who believe very strongly in the concept of sound money. These people have spent the time to educate themselves on the technical structure, monetary policy, and potential benefits of Bitcoin. They are convinced that Bitcoin’s sound money properties are superior to any other form of money. Regardless of price movements in the USD exchange value, the holders of last resort won’t sell their Bitcoin. They are strong hands. They can’t be shaken out of their belief. In fact, they are likely to be buying Bitcoin on these large price drops, rather than selling. They are exchanging USD for Bitcoin right now.

I am one of the strong hands and I exchanged more of my fiat currency into Bitcoin this morning.

Now the question shifts from “who is still holding Bitcoin?” to “what happens to Bitcoin over the next few months / years?” This is where I get really excited. I get excited because Bitcoin was built for this scenario. It is the hardest money the world has ever seen. It is provably scarce. It is difficult and expensive to produce. And the monetary policy is programatic and transparent. These things are important for any asset, but they become exponentially more important when we enter times like we are about to enter.

While the liquidity crisis is occurring in traditional markets and asset prices are in a free fall, the US government will feel the need to step in to save the average person. The legacy system is not built on free market capitalism, but rather a watered down version that relies on large, centralized institutions and governments to step in during times of uncertainty and fear. As we have discussed previously, central banks and governments have two tools at their disposal — interest rate cuts and quantitative easing.

We have seen the Federal Reserve cut rates consistently over the last year, including a recent 50 basis point emergency rate cut in the last two weeks. It wouldn’t surprise me to see further rate cuts in the next 6-8 weeks. My guess is that we will see rates at least hit 0.25%, with a high likelihood that they hit 0%. It is also possible that the United States will enter negative interest rate land, but there is a religious aspect to negative interest rates which suggests that they will do everything in their power to avoid negative rates.

So while rates are falling aggressively, the decision on when to shoot the other bullet (quantitative easing) becomes the focus. The Fed has already expanded their balance sheet by about $400 billion over the last few months, but they continue to say that it is not quantitative easing. Rather than argue semantics, it is important to understand that we have likely not seen anything like what they are going to have to do here.

My best guess is that we will see at least $1 trillion in total quantitative easing by the time this crisis is over. Anything less than that will probably not be enough to have the intended impact. Think about that for a second — $1,000,000,000,000+ in printing.

When the government prints this amount of money, they are injecting liquidity into the system, but they are also reminding people that the US dollar is not sound money. They are increasing the risk of high levels of inflation. And many will argue that the government is even illegally stealing the wealth of the bottom 50% of Americans when they print so much money.

The interest rate cuts and quantitative easing is market manipulation. They are trying to bail out the economy. When they do this, investors have historically weathered the liquidity crisis and then sought out (a) sound money and (b) safe haven assets. Both gold and Bitcoin should do incredibly well during this time period.

But Bitcoin has one other other aspect to it than gold — the upcoming supply shock (Bitcoin halving in May 2020). Right when Bitcoin is about to become super attractive to people because the US government / central bank begin incredible monetary stimulus efforts, the digital asset is going to see the incoming supply cut in half. One of the scarcest assets in the world is about to become even more scarce. (This would be the equivalent of investors seeking gold because of inflation, but half the gold mines in the world shutting down at the same time)

I say all this because it is important for people to understand what is happening in the short term (liquidity crisis), while still understanding the structural components that are at play in the long term (monetary stimulus simultaneous to Bitcoin halving).

I have been writing about this set up for almost a year now. It always had a 60-80% chance of happening in my mind. The big unknown was how long the bull market in traditional assets could last. The COVID-19 pandemic has accelerated the need for monetary stimulus, which is now going to fall within 60 days of the Bitcoin halving. My confidence level that we will see monetary stimulus around the same time as the Bitcoin halving is now well over 95%. You couldn’t have written a better script for the continued adoption of the decentralized digital currency.

The Bitcoin price is down over the last few weeks. This is what happens in a liquidity crisis. But understand what happens next in the sequence of a crisis. Monetary stimulus has to be relied on in order to stabilize traditional markets. This will greatly benefit Bitcoin and gold. Weak hands will sell during the liquidity crisis, which is simply a transfer of these safe haven assets to the strong hands. The holders of last resort.

Be safe out there. There is a lot of volatility. Sometimes it is best to just walk away from your computer and breathe. Other times it is important to read about what is happening to ensure you understand where we are in the timeline of these events.

This time is not different. Liquidity crises have happened before. They will happen again. Monetary stimulus has driven investors to safe haven assets with sound money properties before. They will do it again many more times in the future. Welcome to market cycles if you have not been here before.

History is transpiring right now. Liquidity has dried up. Those that remain unfazed by the short term pain are usually the ones who avoid making bad decisions. I can’t believe we are getting the opportunity to live through this period in time. Thankfully, we have a parachute with us this time around.”