World Tour – Debt and Stimulus

News

|

Posted 25/02/2015

|

6164

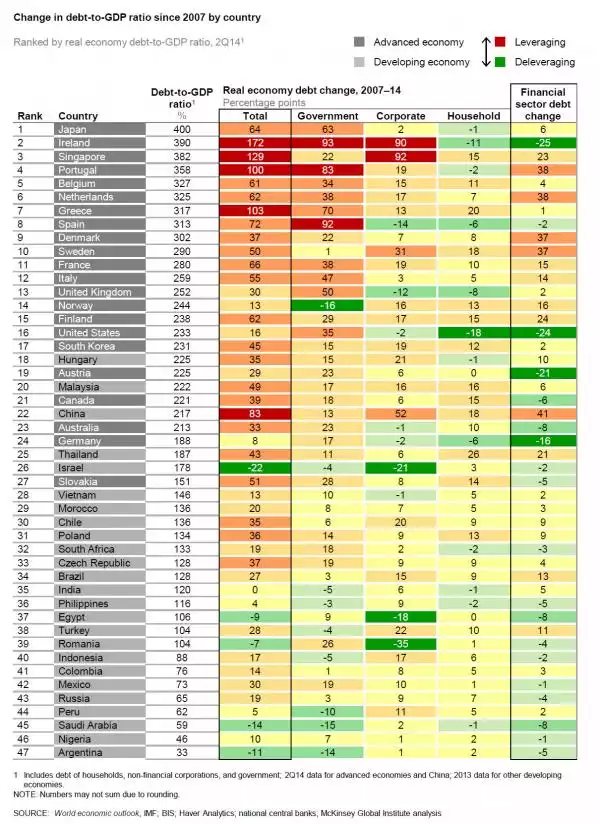

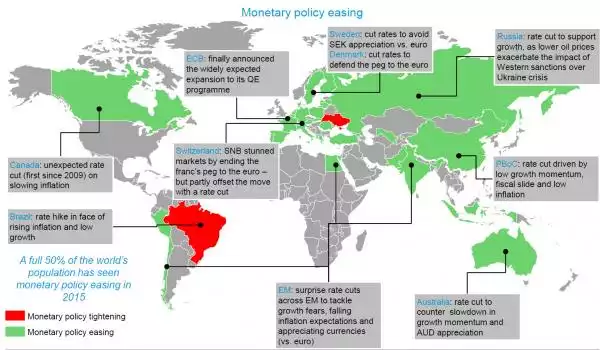

If you haven’t got it already, we think the world has a fatal debt problem. Why? Well, per the table below (courtesy of ZeroHedge), no less than 9 countries now have debt to GDP ratios over 300% (i.e their debt is 3 times their total annual output/ productivity) and 39% of countries are over the ‘danger line’ 100%. The table also shows how this has grown since just before the GFC. Note all the red (increases) in the Government column. This is the combination of debt from money printing and continual deficit spending to stimulate sick economies (and improve GDP’s which ironically can be bolstered by more debt, hiding real growth). If it isn’t printing money it is reducing rates (as we are now seeing in Australia) in an effort to stimulate growth and the only thing that will work away at this debt… inflation. But as we reported recently, it is mainly financial markets that are seeing that inflation – enriching the top 1% but not the broader population. The second picture below shows the interest rate stimulus attempts going on around the world, indeed 50% of the world is dropping rates – some into negative territory. The US has nowhere to go as it is near zero now, but just last night the Fed Chair reiterated they are not near raising theirs either. This from supposedly the economic saviour of the world… As we discussed recently this represents a possible opportunity for gold investors.