Why Tonight Matters – “AIT” & Down the Jackson Hole We Go

News

|

Posted 27/08/2020

|

12086

Tonight the US Fed Chairman will address a virtual gathering of Central Bankers at the Jackson Hole conference. He has flagged enough of what’s to come to have economists all frothy with expectation to wit the CNBC headline “Powell set to deliver ‘profoundly consequential’ speech, changing how the Fed views inflation”. So what is the expectation and why is it ‘profoundly consequential’?

Like our RBA the Fed has a mandate around maintaining both inflation and employment at acceptable rates. Historically that has largely been around ensuring neither run too hot. i.e. tightening monetary policy (raising rates and containing new money supply) to slow things down. The GFC saw an unprecedented and globally coordinated central bank response of the opposite amid crashing inflation and surging unemployment. Zero and negative rates became the norm and unprecedented money printing under the newly coined (pardon the pun) name of Quantitative Easing being unleashed. But it hasn’t worked. The problem now of course is we have a new recession upon us when they didn’t even fix the result of the last. And so the US now has official numbers of 0.8% inflation and over 10% unemployment (official, but much worse in reality).

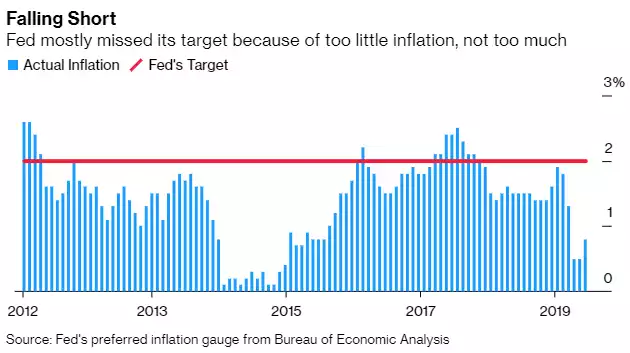

Whilst inflation was always hard to get after the GFC, the narrative was always about not having too much easy monetary policy in fear of it getting out of control and overshooting their 2% target. What makes the pre-talk of this year’s Jackson Hole conference so important is the message they are prepared to further ease and more importantly let inflation overshoot before tightening. Below is a chart (courtesy of Bloomberg) of US inflation over the last decade.

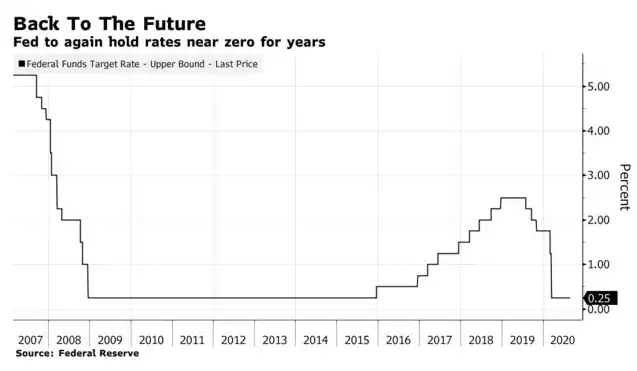

When you overlay that with US interest rates you can see they got excited in 2017 when they saw inflation crack through the 2% and straight away started raising rates in fear of losing control.

As we know now, the amount of debt in the system and the utter reliance on a central bank easy money support narrative for shares came home to bite. After raising rates to just 2.5% and a program of Quantitative Tightening (not Easing) the sharemarket tanked at the end of 2018 and as you can see above, the Fed had to lower rates and stop the QT program. This was not new. Each time they stopped QE1, 2, 3 the market corrected. This was not a sharemarket on fundamentals, it was one on stimulus. But always in the background was a Fed signalling it wouldn’t let inflation get out of control. And that is what makes tonight so important. They have already signalled they will let it run hotter for longer before tightening. They need inflation to erode all this debt, but they can’t raise rates and increase the service cost on all that same debt. Quite the dilemma…

Historically 4% was considered a ‘neutral’ interest rate. In 2018, 2.5% nearly crashed financial markets. The problem is where do you go when you’re already near zero? Negative?

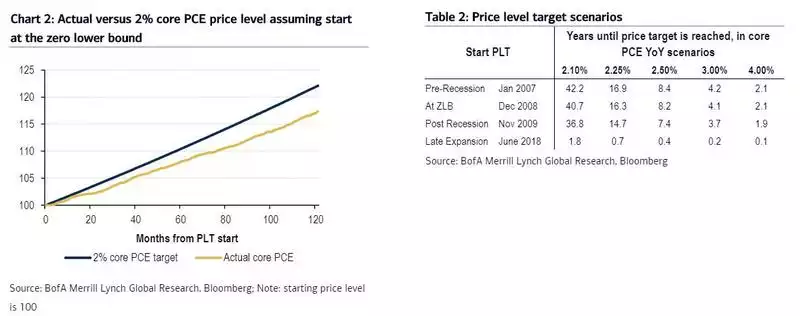

What many economists are expecting tonight is the Fed to adopt ‘Average Inflation Targeting’ or AIT. Whilst that might sound innocuous, what it means is they will let inflation run hotter than they like to essentially ‘make up’ for the lost sub 2% years. The issue with that is how hot to let it get to let the average catch up. Bank of America Merrill Lynch modelled this with alarming results.

“If price level targeting was implemented when we hit the zero lower bound in late 2008, and we assume the price level was 100 at that time, the price level now would be 117 versus a target 2% yoy price level of 122 (Chart 2). At this point, it would take 42 years to reach the price level target if core PCE remained at 2.1% yoy, or just 2 years if core PCE rocketed to 4.0% yoy. While these scenarios are extreme, they demonstrate the large variation in Fed policy regimes that could result from adoption of price targeting.”

42 years of zero interest rates and QE is probably a little long and maybe has other unintended consequences… (cue sarcasm). So you can see the temptation, or indeed the need, to run much hotter to achieve a result in an ordinary period of time. Just imagine the social and economic fallout of 4% inflation if they want to do this in 2 years…

We say social too as remember the Fed have a dual mandate that sees ‘full employment’ too. That is set to change too. From Bloomberg:

“The Fed is also expected to codify a change in its approach toward achieving full employment. In the past, officials shied away from pushing joblessness below what was considered its long-run natural rate out of concern that would lead to too rapid inflation.

Now, the emphasis is on the benefits of a strong labour market for the economy and society. “They’re not going to act to cool off the labour market unless it’s generating unwanted inflation,” said Nomura Chief U.S. Economist Lewis Alexander. “That’s essentially walking away from the concept that there is a natural rate that it is irresponsible to push beyond.”

Powell has said he’d like to see the jobs market return to its pre-Covid-19 state, when unemployment stood at a half-century low of 3.5%. It’s now 10.2%.

Blinder said it will take years to do that. “I hope it won’t be decades,” the Princeton University professor added.

The bottom line for policy: a prolonged period of rock-bottom interest rates.

“I’d be very surprised if it’s less than three years,” said David Wilcox, a former Fed official now with the Peterson Institute for International Economics. “I could see it being as much as six or seven years if the damage from the crisis proves to be much more long lasting.””

Gold thrives in negative real rate territory. What the Fed is contemplating, and tonight should confirm, is that we will be in negative real rate territory for several years from now. And constantly lurking will be the inflation genie getting out of control… “Weimar Republic 2.0”, “Venezuela 2.0”, “Zimbabwe 2.0”, etc etc