Why This Is Just Like Dot.com & GFC

News

|

Posted 29/06/2017

|

7522

The psychology of markets is a fascinating phenomenon and as we are seeing now, more deterministic of pricing than fundamentals. We have quoted previously Warren Buffets famous observation that “Price is what you pay. Value is what you get.”

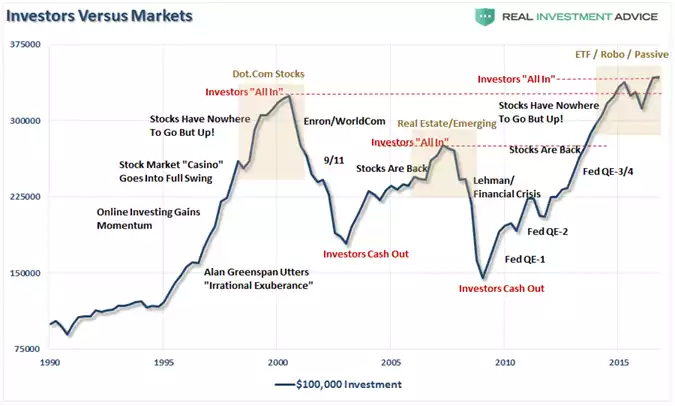

Lance Roberts of Real Investment Advice recently penned an article titled “Signs Of Excess: Crowding & Innovation” where he talks of investors’ emotions or greed and fear driving the invention, and their adoption, of new ways or products to get rich quick, outside of traditional sound financial advice. The charts below map out the last 2 crashes and the one yet to happen. Each, he argues, was driven by a mix of new promises that didn’t turn out so well…

We share a link to this article below but simplistically:

The dot.com bubble – this bull market was initially driven by mutual funds replacing stock brokers. Mutual funds got addicted to the fees and would never consider selling. We then had on line trading when every investor became an expert. No need for an advisor and just “point and click your way to wealth”. Don’t forget too that the dot.com internet phenomenon was considered a new paradigm and so “its different this time”… nope.

Next was the GFC – clearly the internet didn’t make life in shares ‘different’ and many lost 80% in that crash. So let’s pile into the safe haven of real estate… what could possibly go wrong? As we all know the new ‘products’ driving the bubble to 2007 were the commencement of ETF’s and no end of real estate vehicles made to ride that real estate wave including REIT’s and of course the now famous (subprime) mortgage backed securities. Again, ETF’s and Property don’t need those ‘expensive’ advisors to pick shares for you and property ‘never goes down’. Needless to say this period saw gold and silver enjoy one of their biggest bull markets as enough people saw through the scam.

Now it’s the Everything Bubble – spurred along by QE (Quantitative Easing) and ZIRP (zero interest rate policy) the market was flushed with freshly printed cash and forced into yielding assets as the bank and bonds no longer gave you a return. ETF’s became prolific and Passive Investments platforms (just blindly trading indices via a managed fund) and so called Robo Advisors got the public away from the now detested Wall Street / financial advisor types who walked away scot free after the GFC where they left the mum and dads holding the bag before the crash.

It’s never different this time. Click HERE for the full article.