Why the Fed’s Trapped & Crash Inevitable

News

|

Posted 23/09/2016

|

6406

We came across an excellent article this morning outlining just how trapped the US Fed (and by inevitable flow-on.. the world) is with it’s easy money policy gone too far. We will endeavour to get it up on our site shortly but if there are 2 graphs and accompanying quotes to take away its these.

“A ‘Liquidity Trap’ is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels.

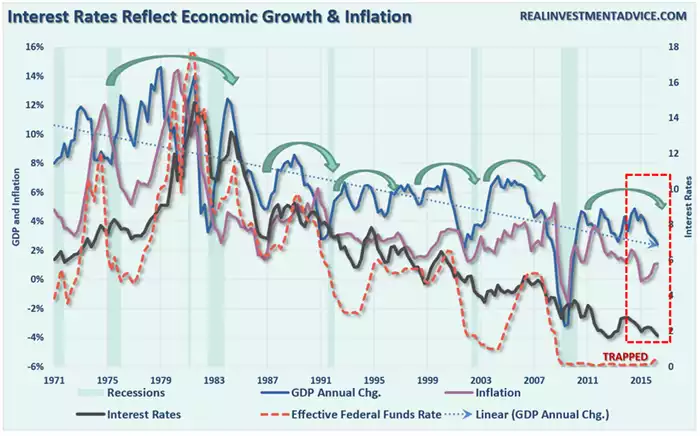

The problem for the Federal Reserve is that getting caught in a liquidity trap was not an unforeseen outcome of monetary policy, but rather an inevitable conclusion. As shown in the chart below the more active the Fed has become with monetary policy, the lower the eventual rates of GDP, inflation, and interest rates has become. As stated, the current low levels of inflation, interest rates, and economic growth are the result of more than 30-years of misguided monetary policies that have led to a continued misallocation of capital.”

They quote the Wall Street Journal article we discussed in last week’s Weekly Wrap regarding the Bank for International Settlement view:

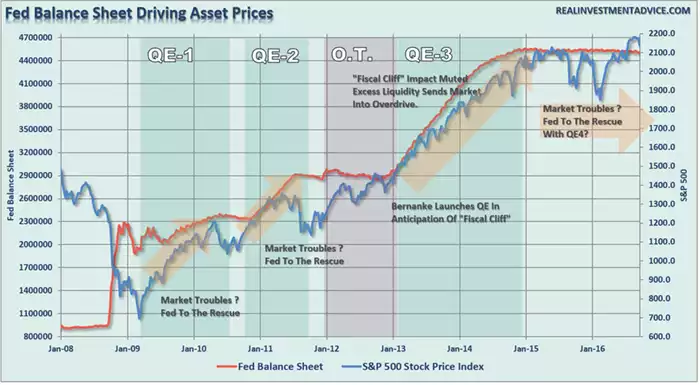

“The BIS has for years warned that the global economy is too dependent on its central banks, whose money-printing power allows for a rapid response to crises. The result is that central bank money boosts asset prices even if underlying economic conditions haven’t changed.”

Enter exhibit B

“Of course, this was ALWAYS the intention of these monetary interventions. As Ben Bernanke suggested in 2010 as he launched the second round of Quantitative Easing, the goal of the program was to lift asset prices to spur consumer confidence thereby lifting economic growth. The problem was the lifting of asset prices acted as a massive wealth transfer from the middle class to the top-10% providing little catalyst for a broad-based economic recovery. [and fuelling the social discontent playing out in the likes of Brexit, Trump and our very own Senate]

Unwittingly, the Fed has now become co-dependent on the markets. If they move to tighten monetary policy, the market sells-off impacting consumer confidence and pushes economic growth rates lower. With economic growth already running below 2%, there is very little leeway for the Fed to make a policy error at this juncture.

Therefore, the Fed remains trapped between keeping the financial markets happy and trying to resolve their monetary dilemma. The problem is that eventually something has to give and it will likely not be the outcome the Fed continues to hope for.”

“In fact, there have been absolutely ZERO times in history that the Federal Reserve has begun an interest-rate hiking campaign that has not eventually led to a negative outcome.”

“While raising rates would likely accelerate a potential recession, and a significant market correction, from the Fed’s perspective it might be the “lesser of two evils.””

“For Janet Yellen, the “window” to lift interest rates appears to have closed which could potentially be a policy nightmare for the Fed, the economy and you.”

Keep an eye out for the full article as it gives an easy to understand, graphically well presented account of why this is going to end very badly for financial markets and why you want your “insurance” in place…