Why Gold, Silver & Bitcoin Jumped Last Night?

News

|

Posted 14/05/2019

|

9338

This might sound like it has an obvious answer when Wall St tanks and the headlines are all about the US – China Trade war escalating, but it is worth breaking it down to get a clearer picture of the many dynamics at play.

Firstly to recap, last night around $1 trillion ($1,000,000,000,000) was wiped off global sharemarkets with the MSCI World index off 2%, lead from the front by the US with the S&P500 down 2.4%, the NASDAQ down 3.4%. Conversely gold jumped around 2%, silver 1.5%, and bitcoin surging another 12%.

The principal reason? China have retaliated against Trump increasing tariffs with increased tariffs of their own against nearly 5000 US products and Trump has increased the pressure with the threat of the next $300b of 25% tariffs soon. German shares slid as they witness Trump following through with the $200b of tariff threats against China potentially signalling the same for $53b per year of Euro car and auto parts with a decision due in just 4 days time.

So apart from a simplistic ‘opposite to shares’ play into gold and silver let’s break down the tailwinds from this global saga.

Volatility

Gold and silver’s safe haven status means volatility is their friend. Last night the VIX jumped the most since October last year when sharemarkets last started to tank. Volatility is particularly instructive when you have a market so overvalued and based on little other than irrational exuberance. Volatility is directly related to faith and exuberance. When you are nervous about your position your finger tends to be ‘on the trigger’. A spike in volatility often sees the sell trigger pulled and proceeds to safety.

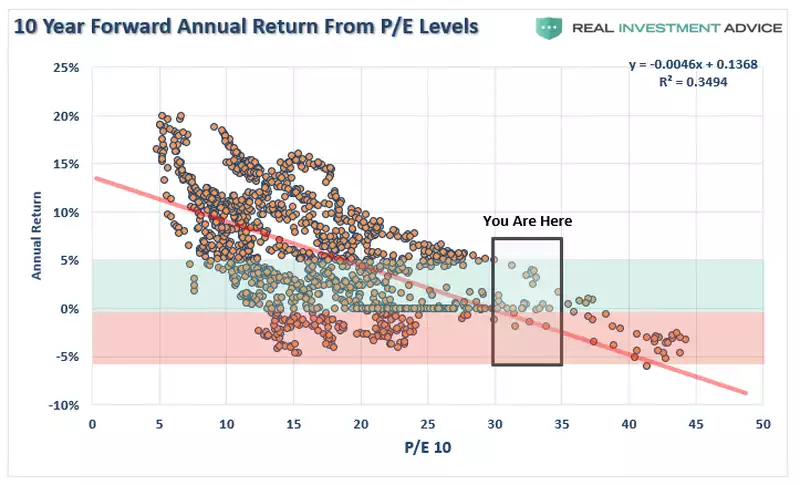

Value

US shares are currently at extremely elevated levels on any valuation measure. The most widely quoted and accepted measure of value is the CAPE (cyclically adjusted price-to-earnings ratio). Below is a plot of the 10 year forward annual return expected from the current CAPE of 30x. Pretty much nil. So at a time when it makes ‘nil’ sense to buy shares and interest rates are near zero for cash deposits, and you have the spectre of things going much worse given the level of ‘unprecedentedness’ in todays markets, well, you can well see why gold and silver look attractive all of a sudden. As Buffet says, “price is what you pay, value is what you get”.

Inflation

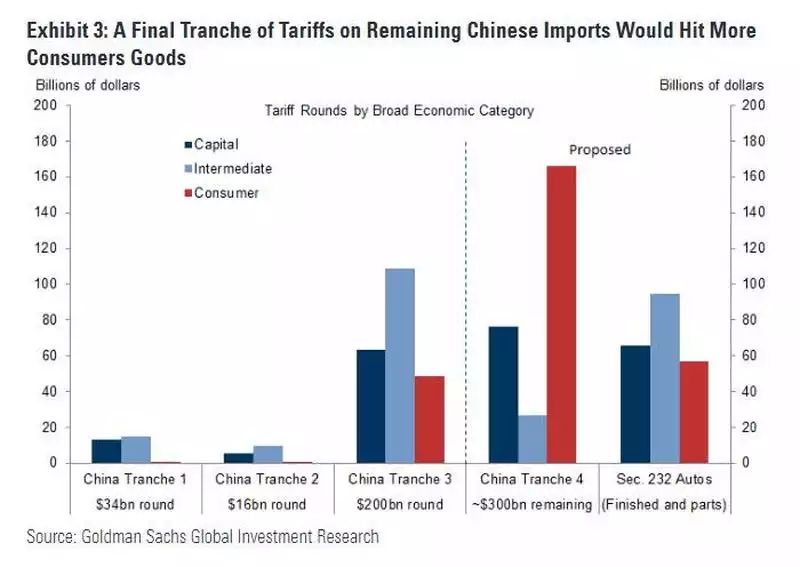

Historically, as the world’s pre-eminent non Fiat money, gold and silver LOVE inflation. They’ve been protecting people from inflation for 5000 years. So far the products Trump has tariffed aren’t highly inflationary consumables. However the list of the next $300b most definitely are and it prompted Goldman Sachs to warn of the very likelihood of higher inflation should he add 25% to them all.

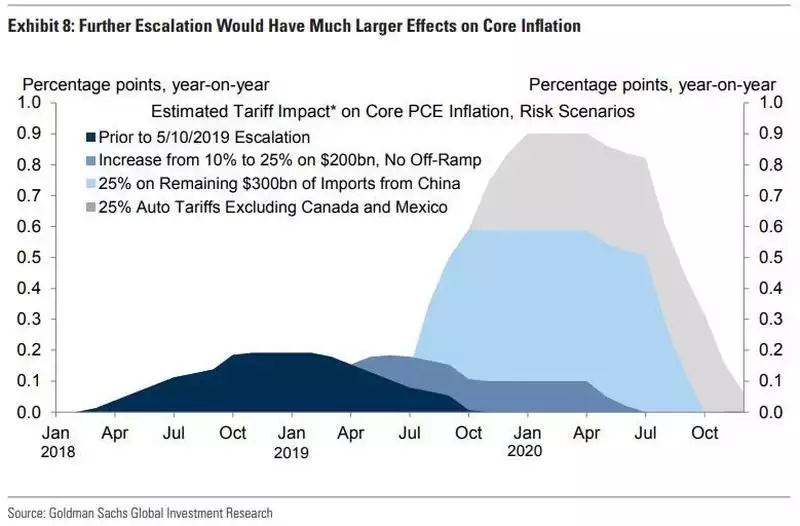

Translating to inflation forecasts as follows:

Real Interest Rates

The US market has priced in 41bp rate cuts from the Fed this year. A lower Fed rate less increased inflation puts you firmly in negative REAL interest rates territory. Last night, amid plummeting yields, the US Treasuries yield curve inverted again. The writing is most clearly on the wall.

An interesting correlation and potential explanation for the commencement of this Bitcoin rally could well be the devaluation of the Chinese currency. When the US smacks you with 25% tariffs, you simply devalue your currency to take up that slack. If you are Chinese that’s not great…. Unless you pile into an alternative, decentralised, secure, peer to peer currency…. Check out the correlation…

If you think this trade war is going away any time soon we beg to differ. If you missed it, we urge you to read our article with Jim Rickard’s insightful summation of this. You can read that here.

For some further insight, just check out the various headlines below: