Why Gold Fell This Morning

News

|

Posted 04/05/2017

|

5644

You likely woke this morning to the gold and silver prices falling. Why? Last night the US Fed met and released their statement. Whilst they held rates unchanged this month at 1.0%, the minutes showed a decidedly more ‘hawkish’ (intent to tighten monetary policy / raise rates) stance and the odds of a June hike jumped to 90%. The Fed expect to hike 2 more times this year whilst the market is pricing in 1.

As usual, on any hawkish Fed commentary, gold and silver fell (less so in AUD as the AUD fell too) which is becoming more and more counterintuitive as, on each rate hike, gold and silver have gone on to rally!? Sell the rumour, buy the fact?... Or is it simply a matter of sell on traditional fears of rising rates being bad for gold (higher real rates), BUT then realise rising rates will likely be the very thing that brings down the debt based house of cards?

As you can see from the graph below (courtesy of Zerohedge), since the last hike gold rallied (like it did the last 3 times post GFC), shares went nowhere, and banks tumbled:

The Fed too seem to be working on the same ‘hope’ strategy as the market, as they described the awful 0.7% GDP print for the first quarter “as likely to be transitory”. The Fed haven’t hiked rates in a quarter that weak since 1980…

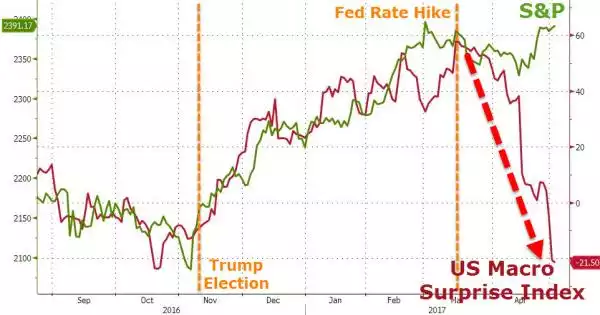

The Fed also seem to be ignoring the falls in the various hard (first) and now soft economic data prints over the last month too. Again courtesy of Zerohedge:

They also stated that inflation over the last 12 months has been “running close to the Committee’s 2% longer-run objective” however placed the caveat that "Excluding energy and food, consumer prices declined in March and inflation continued to run somewhat below 2 percent"… Hmmm. So after more than $4 trillion of printed money since the GFC not yet achieving 2% real inflation (but financial asset bubbles everywhere), they somehow think raising rates will help????