When the US AND China Sneeze…

News

|

Posted 24/08/2015

|

4791

On Friday we touched on the effect of Quantitative Easing (money printing) on US shares. Last week Vern Gowdie of The Daily Reckoning wrote a great article on the effect of all this central bank stimulus around the world as they desperately try to prop up financial markets. We’ve posted Vern’s article here for you to read but in essence what he is saying is that markets, natural markets, always win. The unprecedented central bank/government stimulus and intervention we have seen, particularly since the GFC is just potentially temporarily skewed ‘nature’ and is setting us up for a far bigger fall.

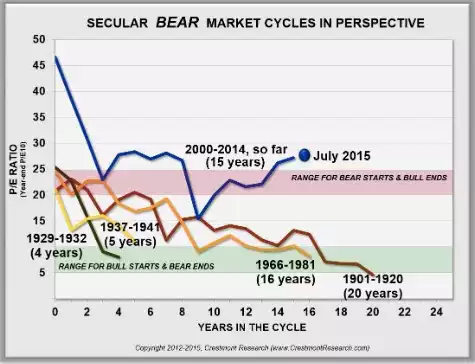

Consider the graph below that illustrates over the last century or so the market phenomenon of secular bull and bear markets. Bull markets take Price/Earnings ratios of shares up to unrealistic heights. Bear markets bring them back down to good value levels, and so repeats. They are secular as they are long term and include ups and downs along the way. But notice this current one. Look what the various programs of QE and zero interest rates did post GFC. But what we are potentially seeing this last week is this starting to unwind. The US is part of the global system (espec China) and their practices may be coming home to roost. The problem is the fall is from still heady P/E heights.

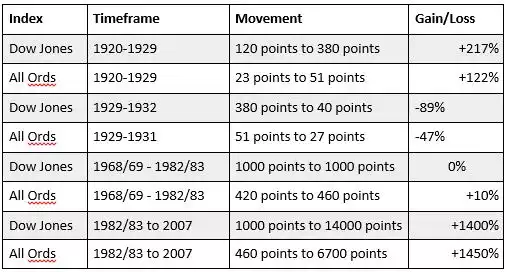

And for those who think ‘it’s different here in Australia’ the adage “The US sneezes and we catch a cold” is based on pretty clear evidence depicted in the table below.

We relatively cruised through the GFC courtesy of China and a solid domestic balance sheet. This time around China’s slowdown may well be the catalyst, won’t have the same appetite for our resources and we are (like everyone else) well and truly in the red with our country’s debt.

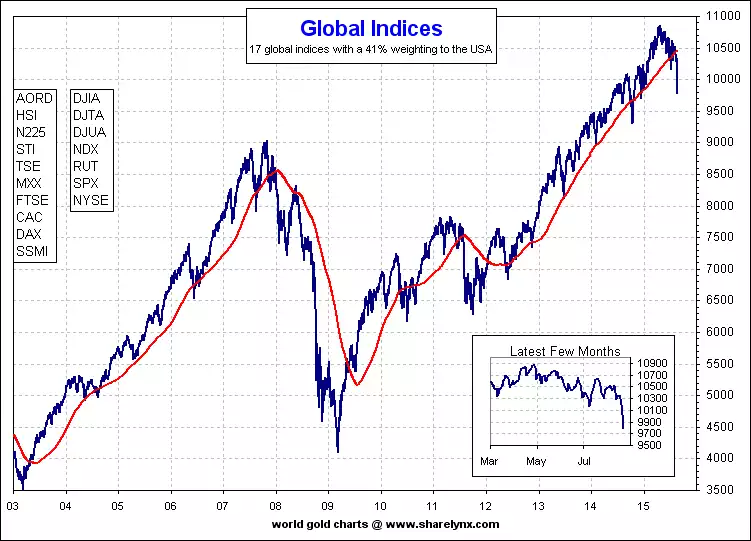

This is far beyond a Wall Street crash, this is a global crash. The graph below depict the global basket of sharemarkets and they have well and truly smashed through the 200 day moving average (red line).