When QE is gone

News

|

Posted 31/07/2014

|

4850

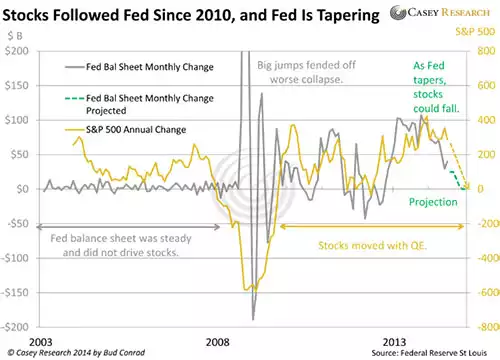

Last night the US Fed tapered another $10b off its monthly Quantitative Easing (QE) money printing program (and announced a 4% estimate of Q2 GDP!! – if you haven’t read yesterday’s missive on GDP you should to put that in context). QE is now down to ‘only’ $25b per month and on course for being phased out by October. So why aren’t stockmarkets crashing and interest rates rising? Casey Research penned a great article yesterday that simply says they went so hard with QE3 that there is some slack in the system – i.e. the Fed’s balance sheet grew much faster than US Gov debt but once this is ‘used up’ history would suggest we will see the sharemarket crash. The graph below tells the story..

Don’t forget too that we have a US Gov that hasn’t run a real budget surplus since 1969 and need to keep selling debt (US Treasuries/Bonds) to pay for this (and the interest on the $17.6t already accumulated). We also have a world getting increasingly frustrated by this and not buying that debt like they used to. So when the Fed stops buying it, who will? And if they let interest rates rise how will they pay their interest?

NOTE – if you haven’t spotted it, we have put up a new video on the home page of our website. It paints a very clear and compelling case for silver’s supply and demand dynamic. A must watch!