When Emerging Markets Become “Submerging” Markets

News

|

Posted 26/09/2018

|

9670

Esteemed analyst Egon Von Greyerz of Matterhorn Asset Management recently penned an article titled “A Submerging Global Economy”. Part of that article struck a chord with us as it speaks to gold’s role in protecting your wealth in all manner of situations. We write often of its role as an uncorrelated investment that shines when financial markets crash. However we rarely talk about gold’s role when currencies fail or drop dramatically. We are all guilty of complacency in this the ‘Lucky Country’ believing we are somehow immune from that. We spoke most recently to this last week in terms of our own exposure. However that aside, we are still an active, inextricably linked participant in this interconnected global economy, completely exposed to the debt pile behind it. So let’s throw to Egon and see how bad it is elsewhere right as we speak and how gold is protecting those smart enough to buy it beforehand.

“Many emerging markets are now turning to submerging markets as country after country is experiencing falling economies, currencies and stock markets.

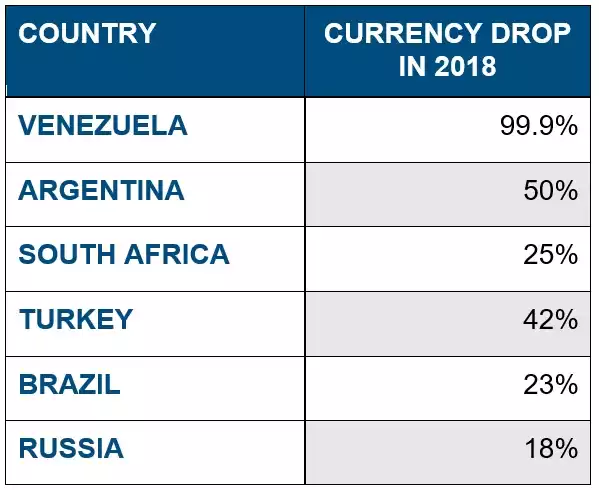

The currency is often the best indication of a country’s economic health. Just look at these six currencies submerging into obscurity:

CURRENCY CONTAGION IS SPREADING

But these are just some of the worst ones. The currency collapse is spreading like wild fire. High inflation and hyperinflation is hitting country after country. Here are some more countries with collapsing currencies in 2018: Sudan -61%, Angola -39%, Liberia -18% and India -12%. The list goes on. There are at least another 15 countries whose currencies have lost 10% or more against the dollar in 2018.

GLOBAL STOCK DOWNTURN STARTING

Many major stock markets around the world are also telling us that the global economy is now starting a secular bear market. China is down 25% in 2018, Brazil – 20%, Turkey -23%, Italy -16%, Spain -15%, Germany -10%, UK – 10%. The Emerging Market ETF is down 20%.

The BRIC countries – Brazil, Russia, India and China encompass 40% of the world’s population and has a GDP of $20 trillion. Therefore, the weakness that these economies are showing is an ominous sign for what is to come. Their downturn so far is obviously not on the scale of Venezuela or Argentina but it is an indication of how the world economy is starting to fray at the edges.

EMERGING DOLLAR DEBT DISASTER

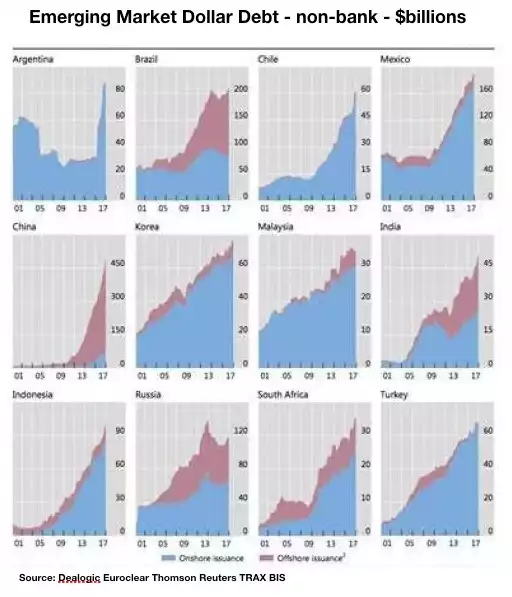

An economic downturn would not be so serious if the world wasn’t indebted up to the hilt. Western economies have debts that they can never repay but it is even worse for submerging markets since their growth has been financed to a large extent with US dollar debt.

Submerging market debt was $8 trillion in 2000 and is now approaching $50 trillion.

The dollar denominated part of this debt has grown exponentially and since most of these countries’ currencies are falling substantially against the dollar, they are likely to default on their debt in coming years. As the graphs show below, dollar denominated debts have gone up 5 to 10 times for most of these countries. The currency of virtually every country in the graph, is coming off rapidly and will continue to fall until it becomes practically worthless.

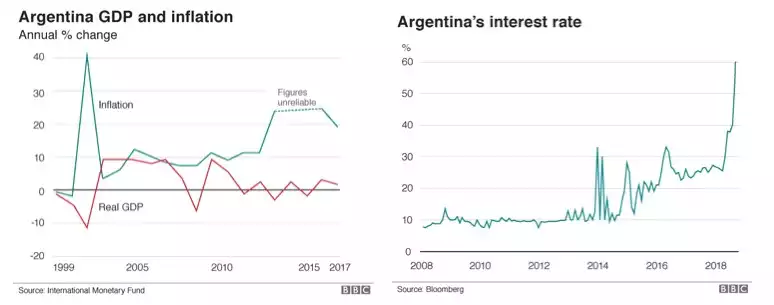

ARGENTINA 60% INTEREST RATE

If we have a quick look at Argentina, we can see the pattern that will hit not only emerging markets but also the West. With high inflation and the Peso collapsing 50% this year, Argentina has raised interest rates to 60%.

No country can cope with interest rates at 60%, especially not one with a heavy debt burden. So rates at that level is total lunacy and will quickly kill the patient if it continues.

The message cannot be clearer. Debt growing exponentially and totally out of proportion to the growth of GDP will eventually lead to a currency collapse and then default. The world could deal with Argentina defaulting. It has happened numerous times already. Same with the catastrophic Venezuelan economy. Although, there is a total collapse of both the economy and society, it will not in itself have global ramifications.

PROBLEMS IN PERIPHERY WILL SPREAD TO THE CENTRE

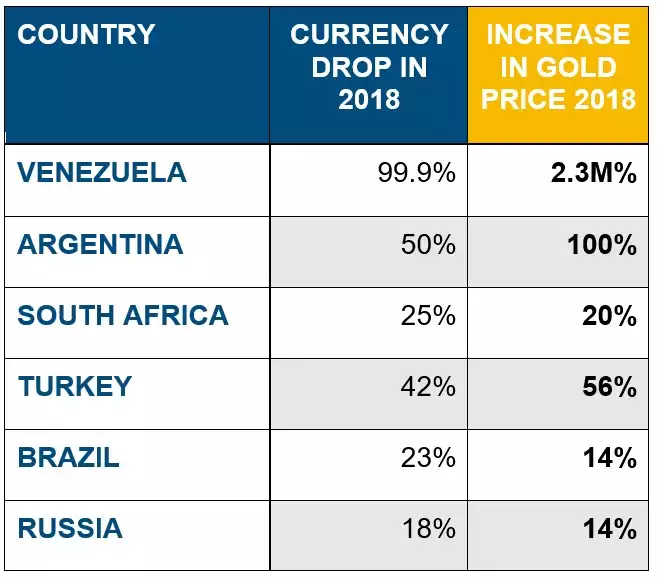

To understand what will happen next, let’s go back to the periphery to see what has hit some countries already. A drop in the currency is just one side of the equation. The other side is of course how gold reveals the mismanagement of the country and also protects against a total loss of wealth.

Venezuela is a clear basket case with the currency worthless. But with a gold price at 300 million Bolivars, any Venezuelan who owned a bit of gold from the beginning of this year or even better for a few years, would not be in the desperate situation that almost everyone is in currently.

The same with the other countries. By holding physical gold and some silver, you are not just insuring your wealth from the destruction of paper money but also from a potential bail-in or a collapse of the banking system.

We have a number of warning signs from around the world currently. The Dark Years have already started in the periphery and will move quickly to the centre. Some stock markets, like in the US, are still near their peak. Fundamentally the bubble markets can crash at any time.

The technical signals are now indicating that a crash is imminent. Same with gold and silver. They are poised for a resumption of the long term uptrend and a major move up.

These moves could happen any day. If they are delayed for a brief period, it would make no difference. The world economy will turn this autumn and the consequences will be horrific for the world.”

Most won’t anticipate Australia’s dollar plummeting to such an extent but many are calling a 50c AUD/USD. At 72.5c at the time of writing that would see your gold value increase by 45% in our local currency.