When ‘Awesome’ Turns

News

|

Posted 17/10/2017

|

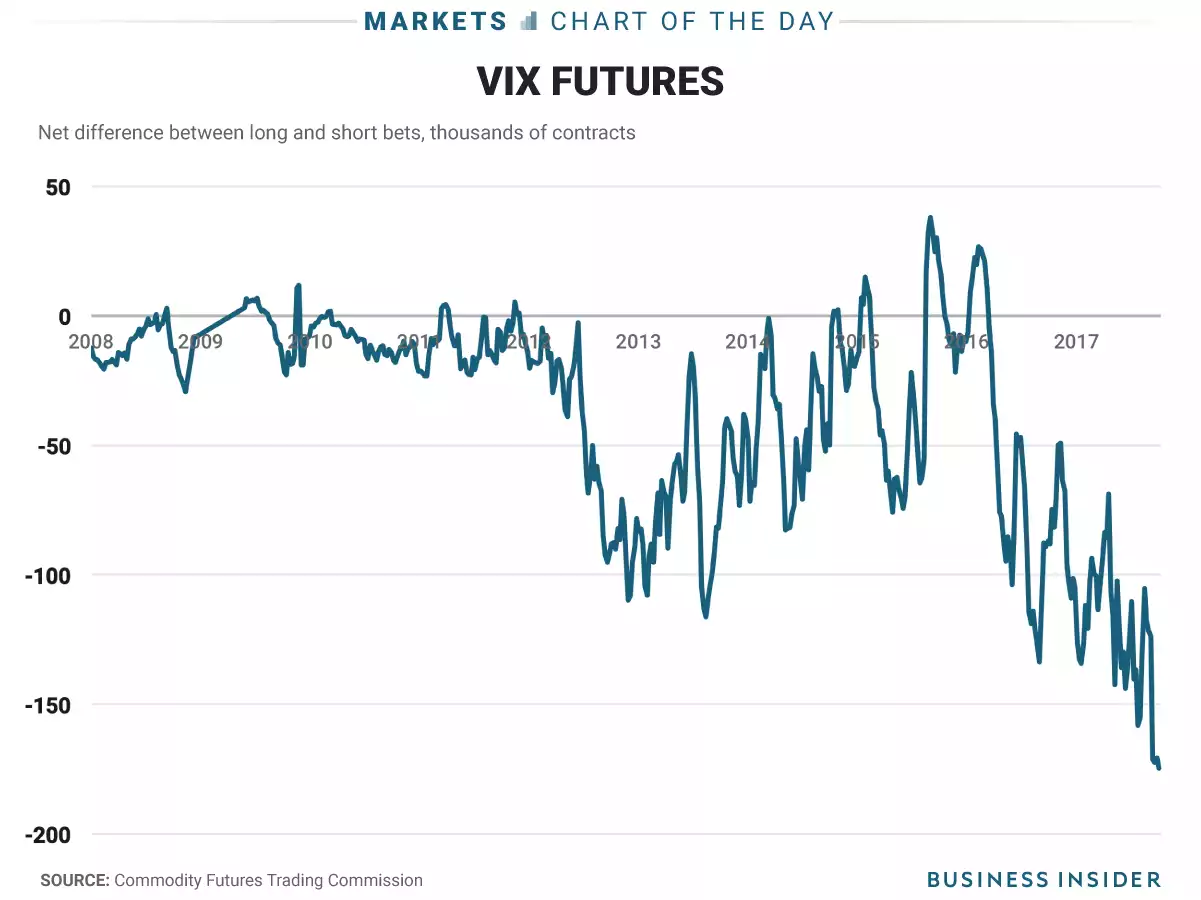

11341

Another night, another all-time high on Wall St... The lack of volatility in this market really has technical analysts scratching their heads. The VIX (volatility index) broke into single figures last night, just as it was in 2007 just before the GFC hit, and last week short bets on the VIX broke all time records. ‘Everything is awesome’, ‘let’s all pile into risk assets’ reign supreme until, well, it turns. The more extreme, the bigger the turn. Let’s have a look at a few charts doing the rounds overnight and see what picture they paint.

First, that record VIX short:

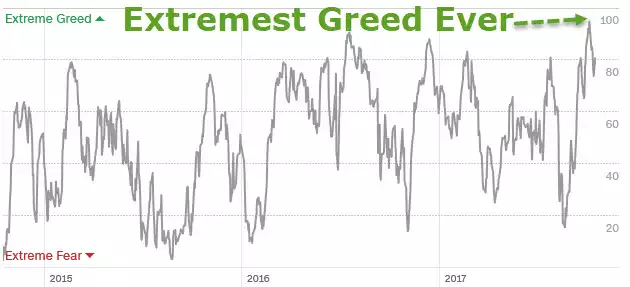

Gordon Gekko would love the following chart:

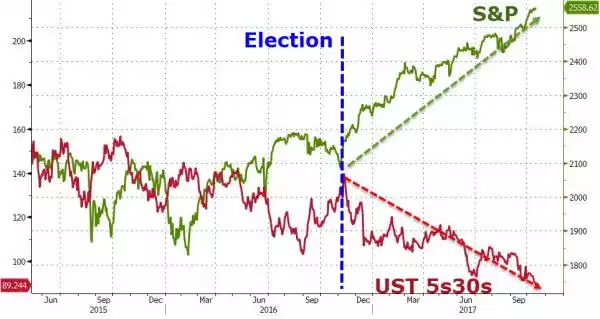

Late last year we explained why the flattening UST yield curve matters. (you can revisit that article here). Well that spread just hit recession (red band) alert levels, clearly there are a lot of people still not buying the ‘awesome’ message:

Or, to see this in context, let’s look at what has happened since Trump came to ‘drain the swamp’…

Or maybe for more context again…

History repeats, it just never tells you exactly when.